Answered step by step

Verified Expert Solution

Question

1 Approved Answer

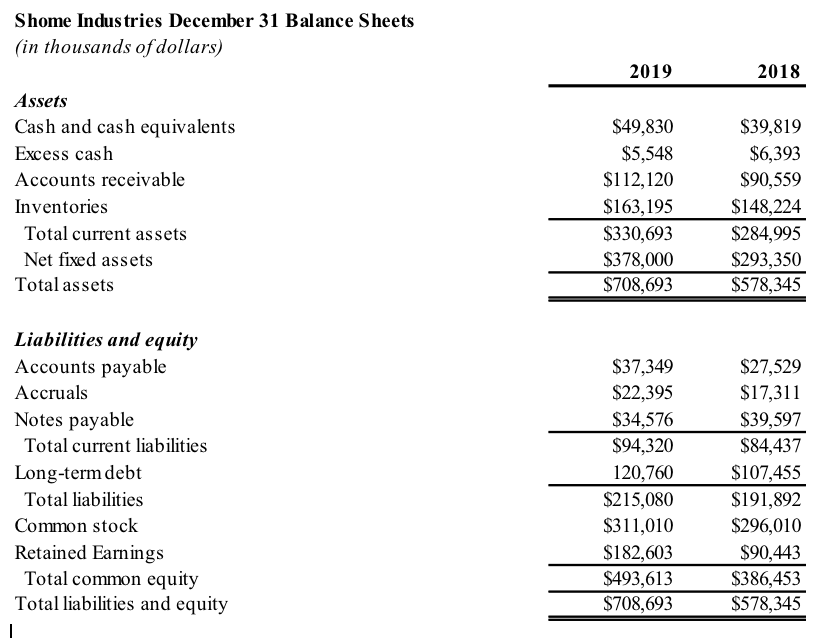

The 2019 and 2018 balance sheets for Shome Industries are provided below. The companys sales for 2019 were $1,500 million, and EBITDA was 25% of

- The 2019 and 2018 balance sheets for Shome Industries are provided below. The companys sales for 2019 were $1,500 million, and EBITDA was 25% of sales. Furthermore, depreciation amounted to 10% of net fixed assets, interest expense was $30 million, the corporate tax rate was 25%, and Shome pays out 60% of its net income as dividends.

Shome had 8 million shares outstanding in 2019, the 12/31/19 stock price was $90 per share, and its after-tax cost of capital was 15%. Based upon this information, answer the following seven questions.

A. Set up the companys 2019 Statement of Stockholders Equity.

Shome Industries December 31 Balance Sheets (in thousands of dollars) 2019 2018 Assets Cash and cash equivalents Excess cash Accounts receivable Inventories Total current assets Net fixed assets Total assets $49,830 $5,548 $112, 120 $163,195 $330,693 $378,000 $708,693 $39,819 $6,393 $90,559 $148,224 $284,995 $293,350 $578,345 Liabilities and equity Accounts payable Accruals Notes payable Total current liabilities Long-term debt Total liabilities Common stock Retained Earnings Total common equity Total liabilities and equity $37,349 $22,395 $34,576 $94,320 120,760 $215,080 $311,010 $182,603 $493,613 $708,693 $27,529 $17,311 $39,597 $84,437 $107,455 $191,892 $296,010 $90,443 $386,453 $578,345Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started