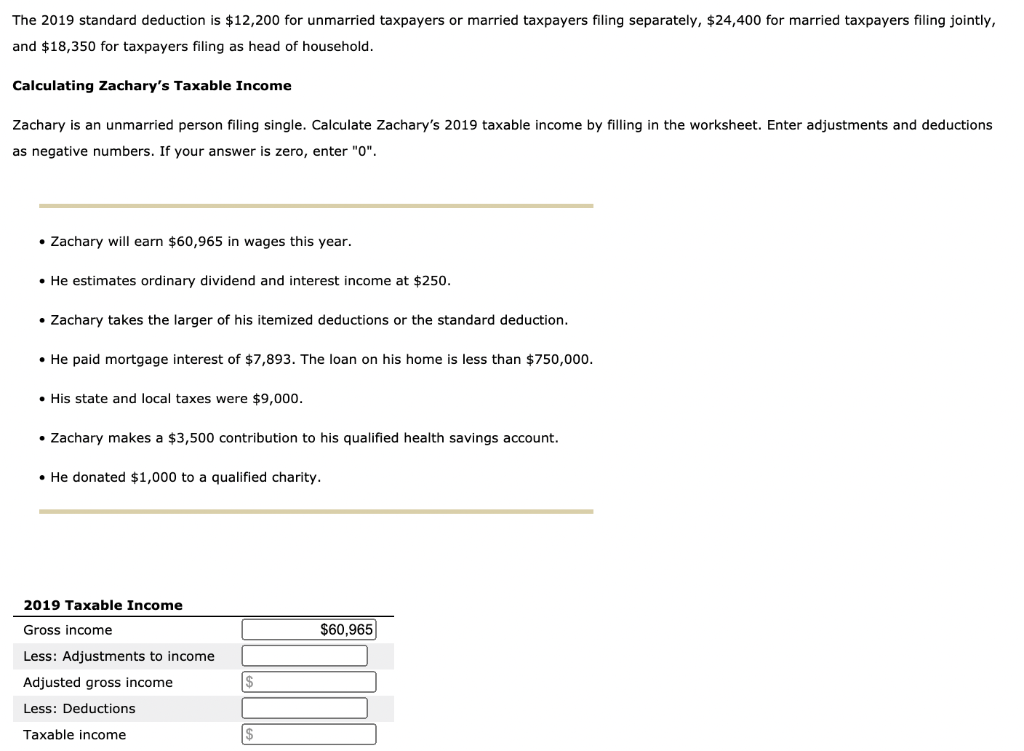

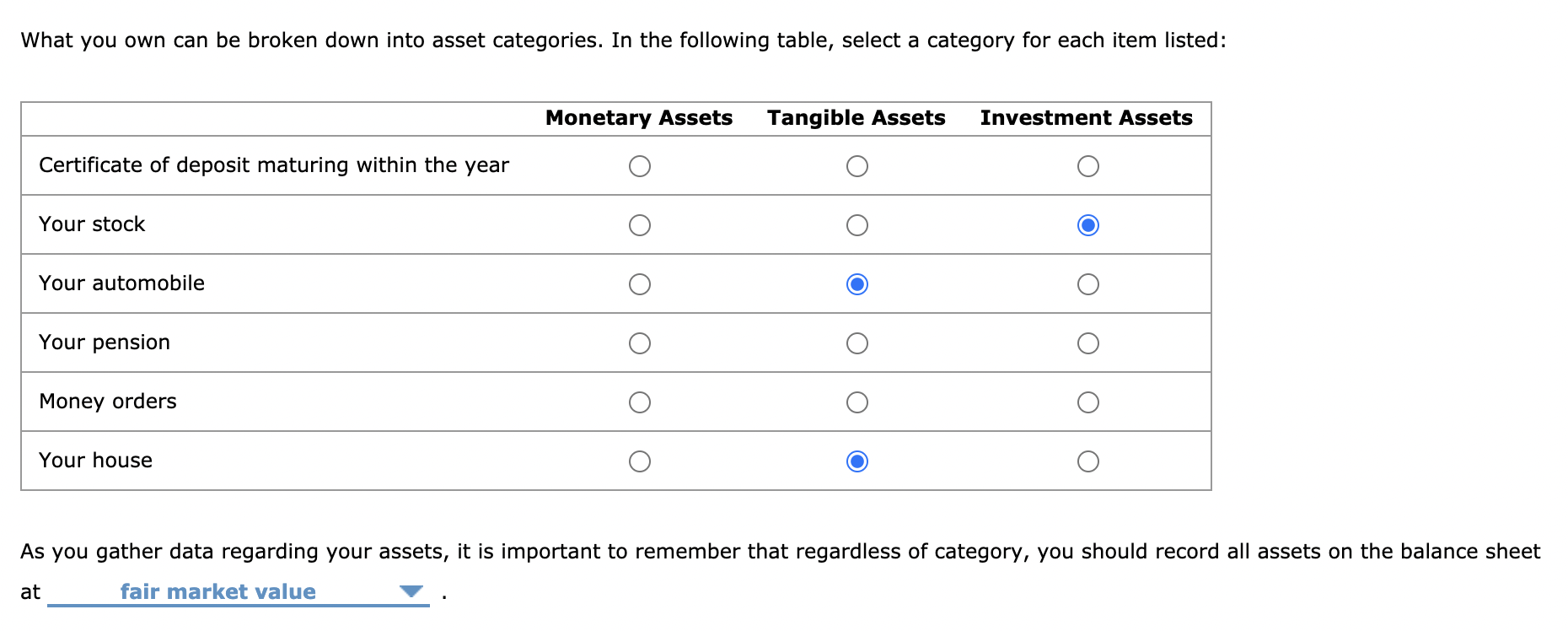

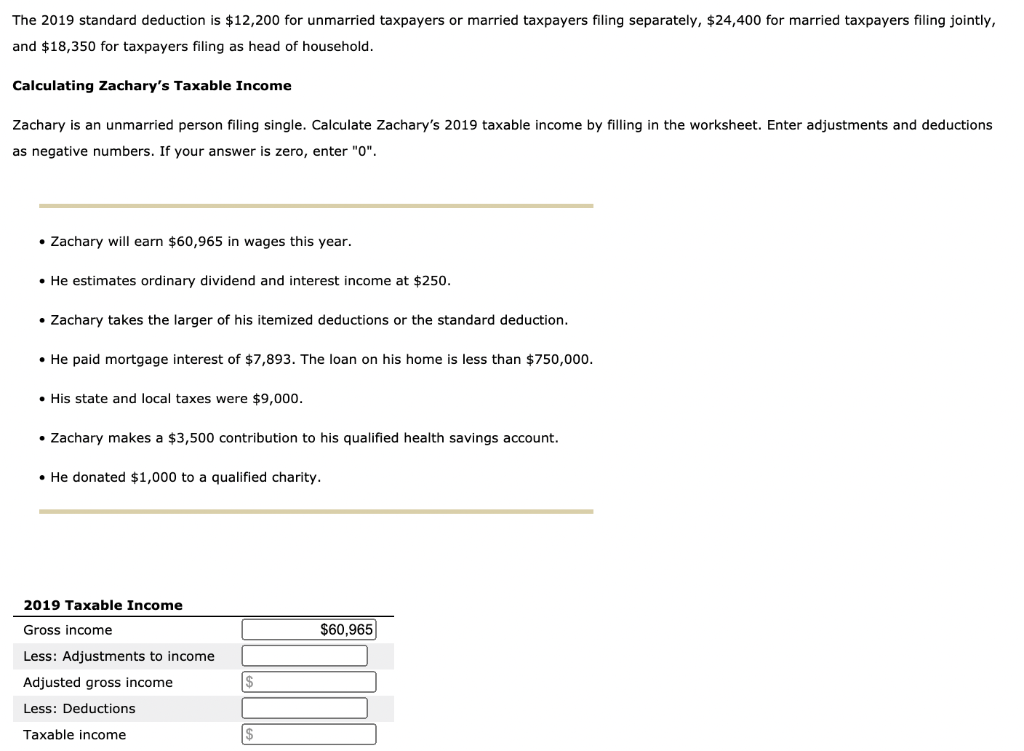

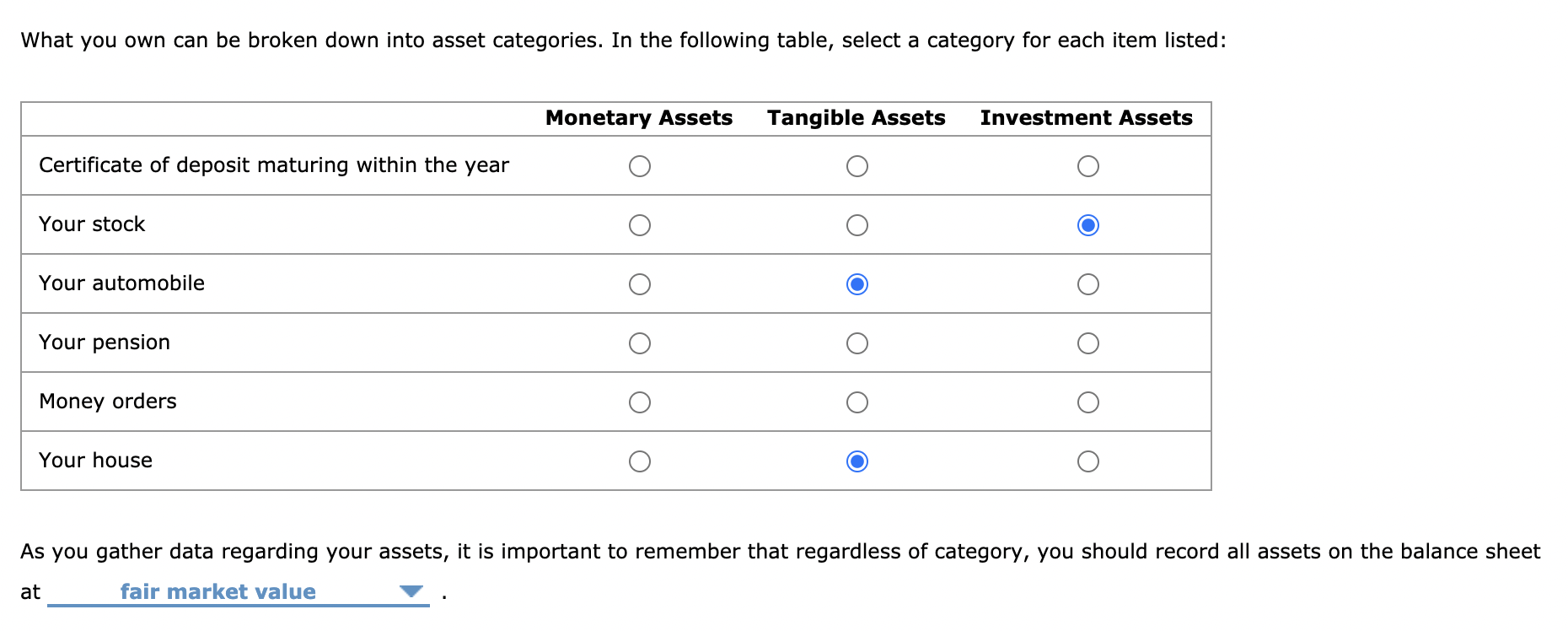

The 2019 standard deduction is $12,200 for unmarried taxpayers or married taxpayers filing separately, $24,400 for married taxpayers filing jointly, and $18,350 for taxpayers filing as head of household. Calculating Zachary's Taxable Income Zachary is an unmarried person filing single. Calculate Zachary's 2019 taxable income by filling in the worksheet. Enter adjustments and deductions as negative numbers. If your answer is zero, enter "O". Zachary will earn $60,965 in wages this year. He estimates ordinary dividend and interest income at $250. Zachary takes the larger of his itemized deductions or the standard deduction. He paid mortgage interest of $7,893. The loan on his home is less than $750,000. His state and local taxes were $9,000. Zachary makes a $3,500 contribution to his qualified health savings account. He donated $1,000 to a qualified charity. 2019 Taxable Income Gross income $60,965 Less: Adjustments to income Adjusted gross income Less: Deductions $ Taxable income What you own can be broken down into asset categories. In the following table, select a category for each item listed: Monetary Assets Tangible Assets Investment Assets Certificate of deposit maturing within the year Your stock Your automobile Your pension Money orders Your house As you gather data regarding your assets, it is important to remember that regardless of category, you should record all assets on the balance sheet at fair market value The 2019 standard deduction is $12,200 for unmarried taxpayers or married taxpayers filing separately, $24,400 for married taxpayers filing jointly, and $18,350 for taxpayers filing as head of household. Calculating Zachary's Taxable Income Zachary is an unmarried person filing single. Calculate Zachary's 2019 taxable income by filling in the worksheet. Enter adjustments and deductions as negative numbers. If your answer is zero, enter "O". Zachary will earn $60,965 in wages this year. He estimates ordinary dividend and interest income at $250. Zachary takes the larger of his itemized deductions or the standard deduction. He paid mortgage interest of $7,893. The loan on his home is less than $750,000. His state and local taxes were $9,000. Zachary makes a $3,500 contribution to his qualified health savings account. He donated $1,000 to a qualified charity. 2019 Taxable Income Gross income $60,965 Less: Adjustments to income Adjusted gross income Less: Deductions $ Taxable income What you own can be broken down into asset categories. In the following table, select a category for each item listed: Monetary Assets Tangible Assets Investment Assets Certificate of deposit maturing within the year Your stock Your automobile Your pension Money orders Your house As you gather data regarding your assets, it is important to remember that regardless of category, you should record all assets on the balance sheet at fair market value