Question

The 2020 comparative balance sheet and 2020 income statement of Maple Group Ltd, have just been prepare and presented to the owners by the companys

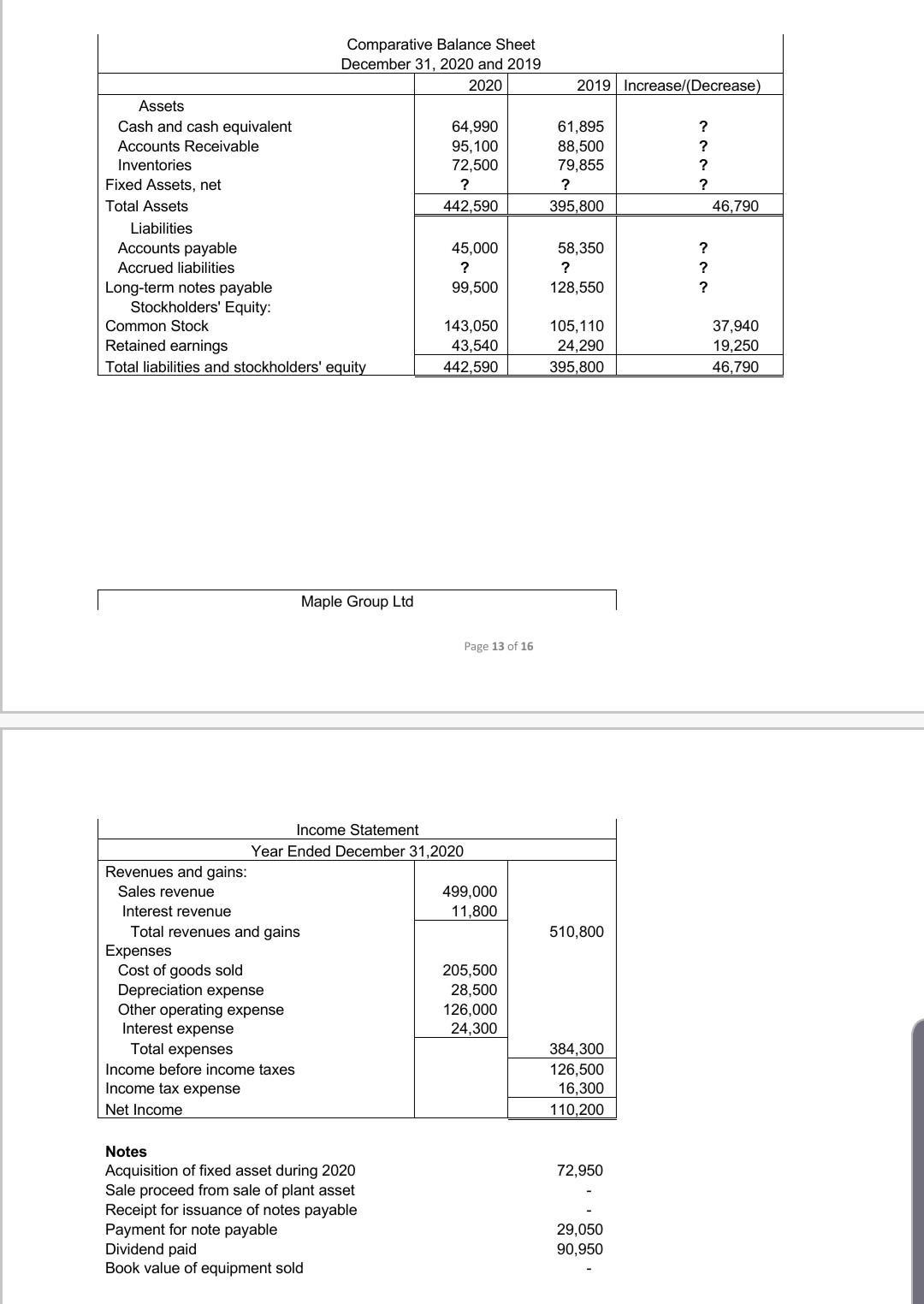

The 2020 comparative balance sheet and 2020 income statement of Maple Group Ltd, have just been prepare and presented to the owners by the company’s Accountant. Upon close examination of the financial information received, it was discovered that some figures in the balance sheet were erroneously omitted due to an oversight by the accountant who is not available to fix the problem due to his unavoidable absence from work. In addition, the owners were concerned about the movement in the company’s cash and cash equivalent given that the balance sheet does not show or explain the reason or reasons why there was an increase or decrease in this area. The company uses the indirect method to prepare the statement of cash flows and it is expected that this should be able to provide the needed clarity required by the owners.

The owners have asked you to assist with the needed clarification and have put forward the following financial information.

Requirements

1. How can the owners use the cash flow information or what can the statement of cash flows helps the owners to do?

2. Reconstruct the company’s comparative balance sheet for 2019/2020 and compute and show the missing figures to include the appropriate sign as a positive or negative figure.

3. Prepare a complete statement of cash flows for 2020 using the indirect method.

Comparative Balance Sheet December 31, 2020 and 2019 2020 64,990 95,100 72,500 ? 442,590 45,000 ? 99,500 143,050 43,540 442,590 Assets Cash and cash equivalent Accounts Receivable Inventories Fixed Assets, net Total Assets Liabilities Accounts payable Accrued liabilities Long-term notes payable Stockholders' Equity: Common Stock Retained earnings Total liabilities and stockholders' equity Expenses Maple Group Ltd Income Statement Year Ended December 31,2020 Revenues and gains: Sales revenue Interest revenue Total revenues and gains Cost of goods sold Depreciation expense Other operating expense Interest expense Total expenses Income before income taxes Income tax expense Net Income. Notes Acquisition of fixed asset during 2020 Sale proceed from sale of plant asset Receipt for issuance of notes payable Payment for note payable Dividend paid Book value of equipment sold Page 13 of 16 499,000 11,800 205,500 28,500 126,000 24,300 2019 Increase/(Decrease) 61,895 88,500 79,855 ? 395,800 58,350 ? 128,550 105,110 24,290 395,800 510,800 384,300 126,500 16,300 110,200 72,950 29,050 90,950 ~~~~ ? ? ? ? ? ? ? 46,790 37,940 19,250 46,790 Comparative Balance Sheet December 31, 2020 and 2019 2020 64,990 95,100 72,500 ? 442,590 45,000 ? 99,500 143,050 43,540 442,590 Assets Cash and cash equivalent Accounts Receivable Inventories Fixed Assets, net Total Assets Liabilities Accounts payable Accrued liabilities Long-term notes payable Stockholders' Equity: Common Stock Retained earnings Total liabilities and stockholders' equity Expenses Maple Group Ltd Income Statement Year Ended December 31,2020 Revenues and gains: Sales revenue Interest revenue Total revenues and gains Cost of goods sold Depreciation expense Other operating expense Interest expense Total expenses Income before income taxes Income tax expense Net Income. Notes Acquisition of fixed asset during 2020 Sale proceed from sale of plant asset Receipt for issuance of notes payable Payment for note payable Dividend paid Book value of equipment sold Page 13 of 16 499,000 11,800 205,500 28,500 126,000 24,300 2019 Increase/(Decrease) 61,895 88,500 79,855 ? 395,800 58,350 ? 128,550 105,110 24,290 395,800 510,800 384,300 126,500 16,300 110,200 72,950 29,050 90,950 ~~~~ ? ? ? ? ? ? ? 46,790 37,940 19,250 46,790 Comparative Balance Sheet December 31, 2020 and 2019 2020 64,990 95,100 72,500 ? 442,590 45,000 ? 99,500 143,050 43,540 442,590 Assets Cash and cash equivalent Accounts Receivable Inventories Fixed Assets, net Total Assets Liabilities Accounts payable Accrued liabilities Long-term notes payable Stockholders' Equity: Common Stock Retained earnings Total liabilities and stockholders' equity Expenses Maple Group Ltd Income Statement Year Ended December 31,2020 Revenues and gains: Sales revenue Interest revenue Total revenues and gains Cost of goods sold Depreciation expense Other operating expense Interest expense Total expenses Income before income taxes Income tax expense Net Income. Notes Acquisition of fixed asset during 2020 Sale proceed from sale of plant asset Receipt for issuance of notes payable Payment for note payable Dividend paid Book value of equipment sold Page 13 of 16 499,000 11,800 205,500 28,500 126,000 24,300 2019 Increase/(Decrease) 61,895 88,500 79,855 ? 395,800 58,350 ? 128,550 105,110 24,290 395,800 510,800 384,300 126,500 16,300 110,200 72,950 29,050 90,950 ~~~~ ? ? ? ? ? ? ? 46,790 37,940 19,250 46,790

Step by Step Solution

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

1 How can the proprietors use the money waft facts or what can the declaration of money flows helps ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started