Answered step by step

Verified Expert Solution

Question

1 Approved Answer

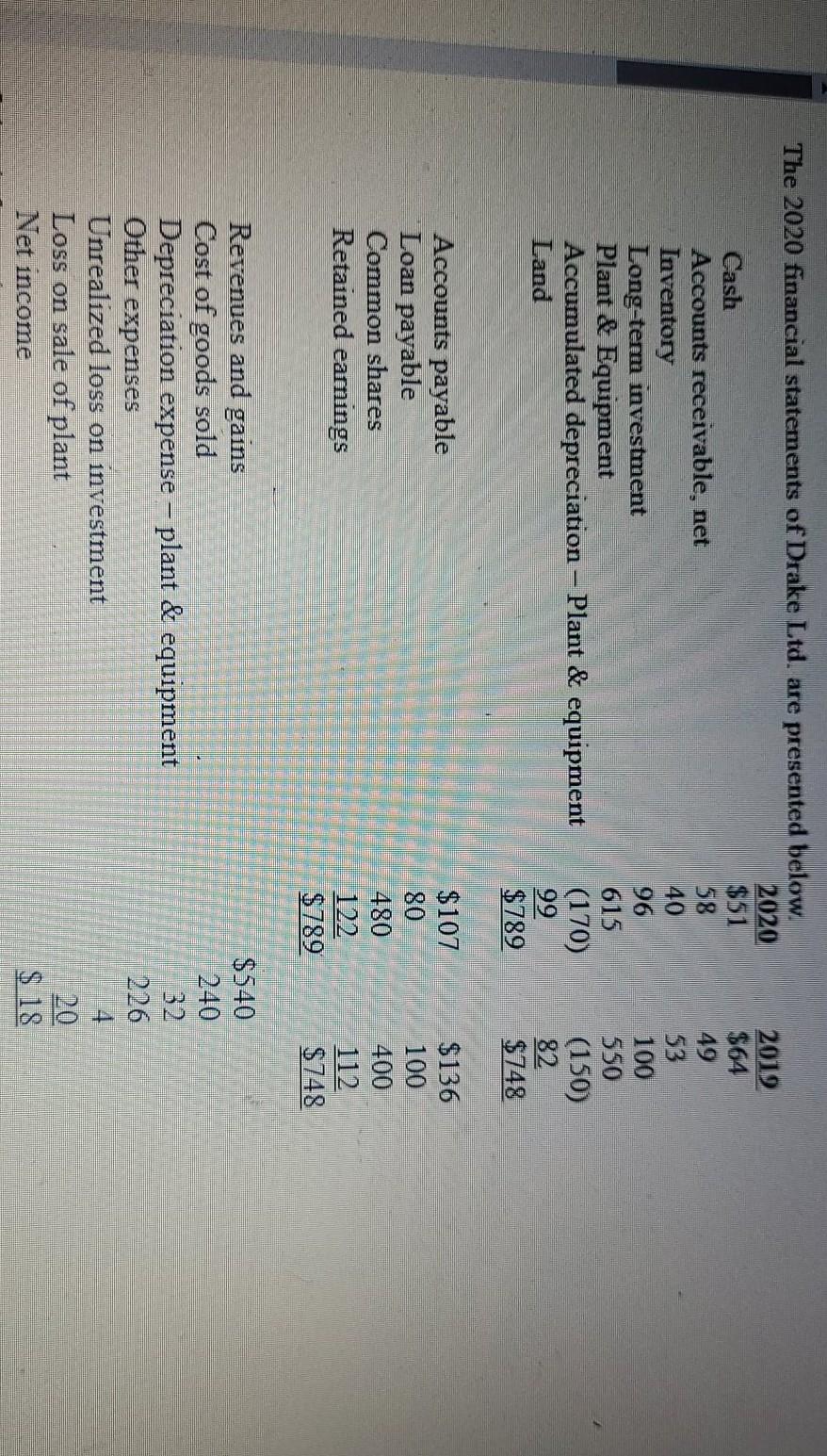

The 2020 financial statements of Drake Ltd. are presented below. 2020 Cash $51 Accounts receivable, net 58 Inventory 40 Long-term investment 96 Plant & Equipment

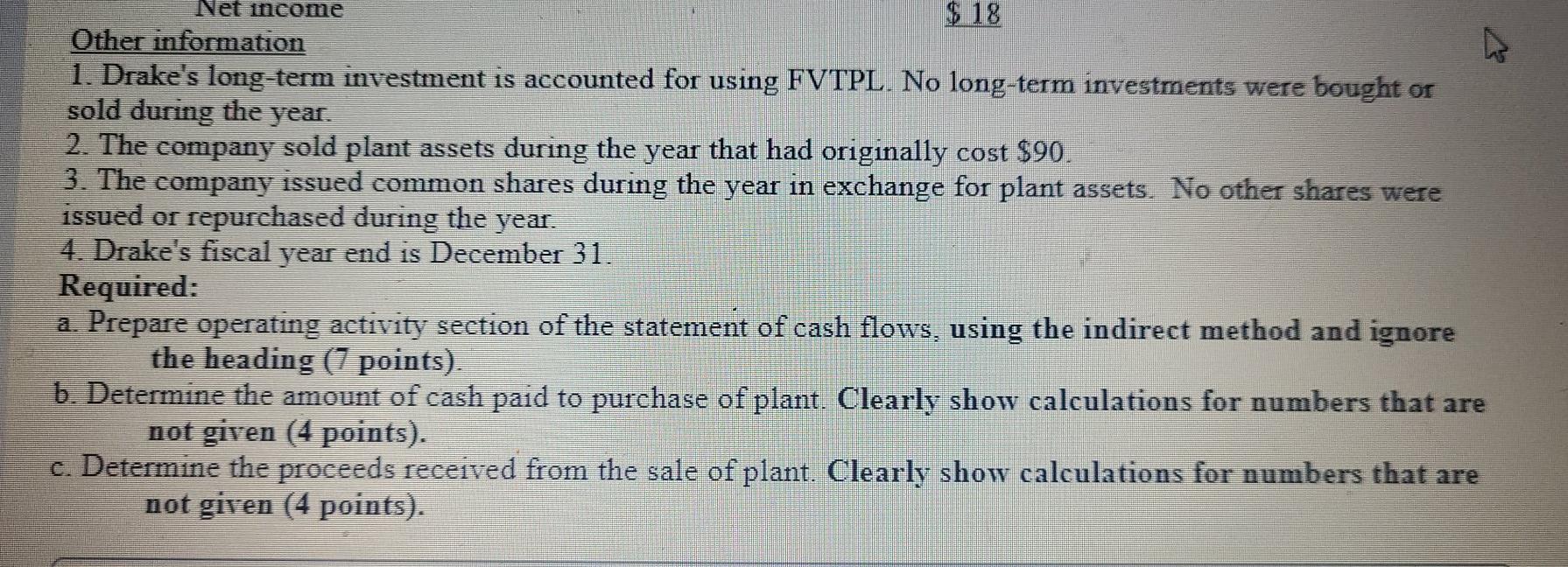

The 2020 financial statements of Drake Ltd. are presented below. 2020 Cash $51 Accounts receivable, net 58 Inventory 40 Long-term investment 96 Plant & Equipment 615 Accumulated depreciation - Plant & equipment (170) Land 99 $789 2019 $64 49 53 100 550 (150) 82 $748 Accounts payable Loan payable Common shares Retained earnings $107 80 480 122 $789 $136 100 400 112 $748 Revenues and gains Cost of goods sold Depreciation expense - plant & equipment Other expenses Unrealized loss on investment Loss on sale of plant Net income $540 240 32 226 4. 20 $ 18 Net income $ 18 Other information 1. Drake's long-term investment is accounted for using FVTPL. No long-term investments were bought or sold during the year. 2. The company sold plant assets during the year that had originally cost $90. 3. The company issued common shares during the year in exchange for plant assets. No other shares were issued or repurchased during the year. 4. Drake's fiscal year end is December 31. Required: a. Prepare operating activity section of the statement of cash flows, using the indirect method and ignore the heading (7 points). b. Determine the amount of cash paid to purchase of plant. Clearly show calculations for numbers that are not given (4 points). c. Determine the proceeds received from the sale of plant. Clearly show calculations for numbers that are not given (4 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started