Answered step by step

Verified Expert Solution

Question

1 Approved Answer

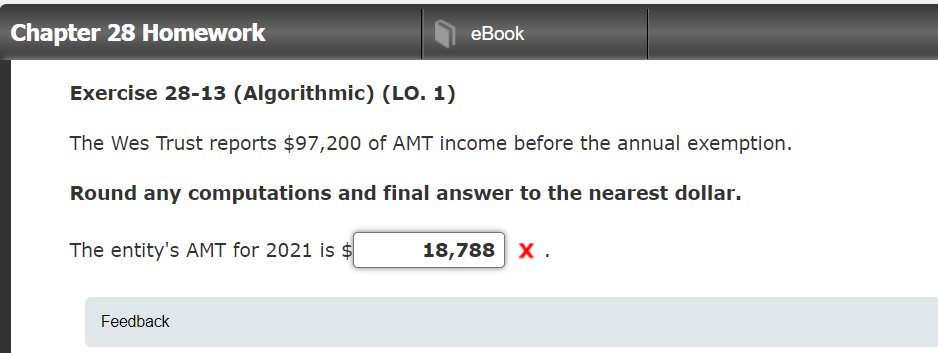

The 2021 numbers are below. Please show the calculation for phase out. Thank you! Chapter 28 Homework eBook Exercise 28-13 (Algorithmic) (LO. 1) The Wes

The 2021 numbers are below. Please show the calculation for phase out. Thank you!

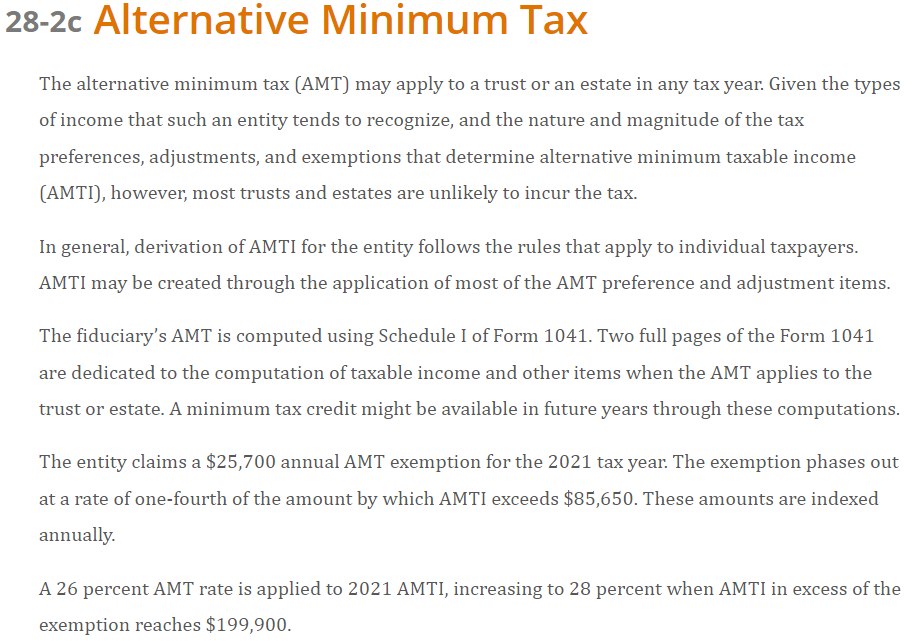

Chapter 28 Homework eBook Exercise 28-13 (Algorithmic) (LO. 1) The Wes Trust reports $97,200 of AMT income before the annual exemption. Round any computations and final answer to the nearest dollar. The entity's AMT for 2021 is $ 18,788 X. Feedback 28-2c Alternative Minimum Tax The alternative minimum tax (AMT) may apply to a trust or an estate in any tax year. Given the types of income that such an entity tends to recognize, and the nature and magnitude of the tax preferences, adjustments, and exemptions that determine alternative minimum taxable income (AMTI), however, most trusts and estates are unlikely to incur the tax. In general, derivation of AMTI for the entity follows the rules that apply to individual taxpayers. AMTI may be created through the application of most of the AMT preference and adjustment items. The fiduciary's AMT is computed using Schedule I of Form 1041. Two full pages of the Form 1041 are dedicated to the computation of taxable income and other items when the AMT applies to the trust or estate. A minimum tax credit might be available in future years through these computations. The entity claims a $25,700 annual AMT exemption for the 2021 tax year. The exemption phases out at a rate of one-fourth of the amount by which AMTI exceeds $85,650. These amounts are indexed annually. A 26 percent AMT rate is applied to 2021 AMTI, increasing to 28 percent when AMTI in excess of the exemption reaches $199,900

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started