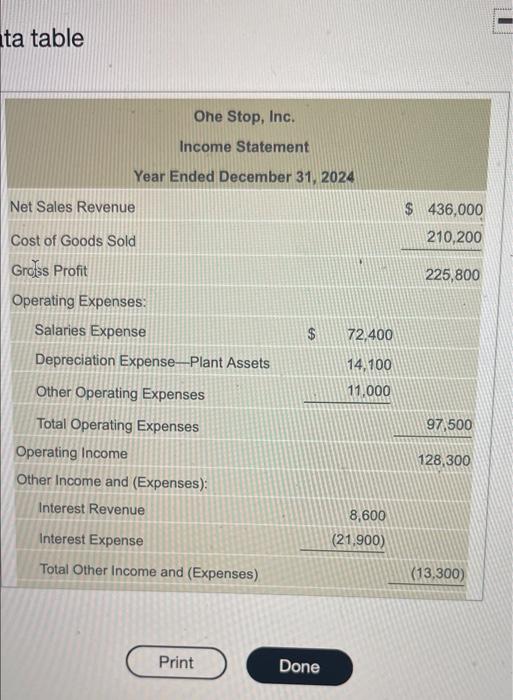

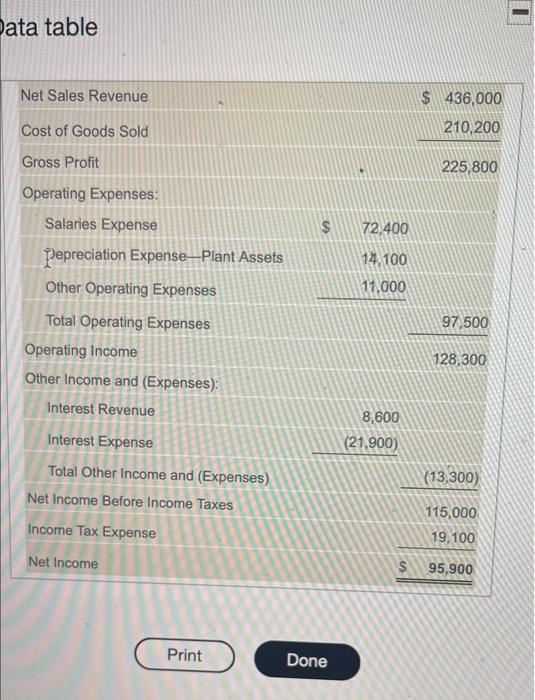

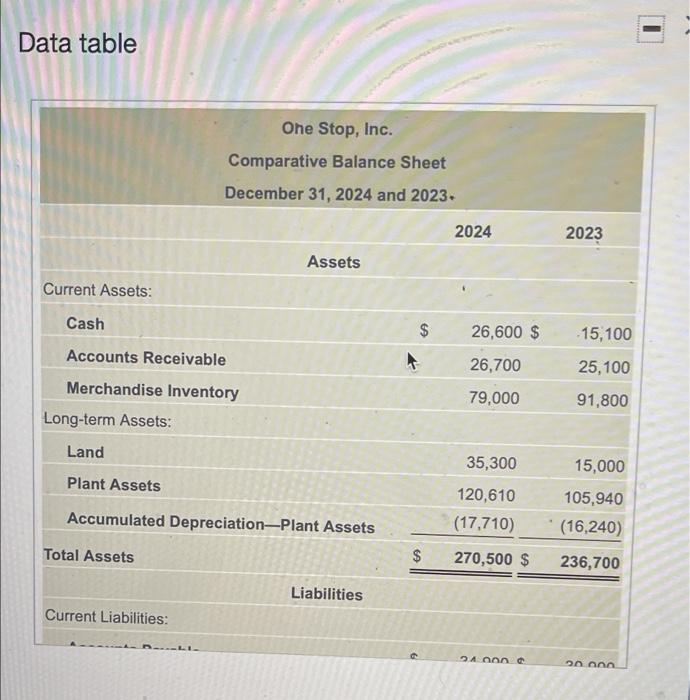

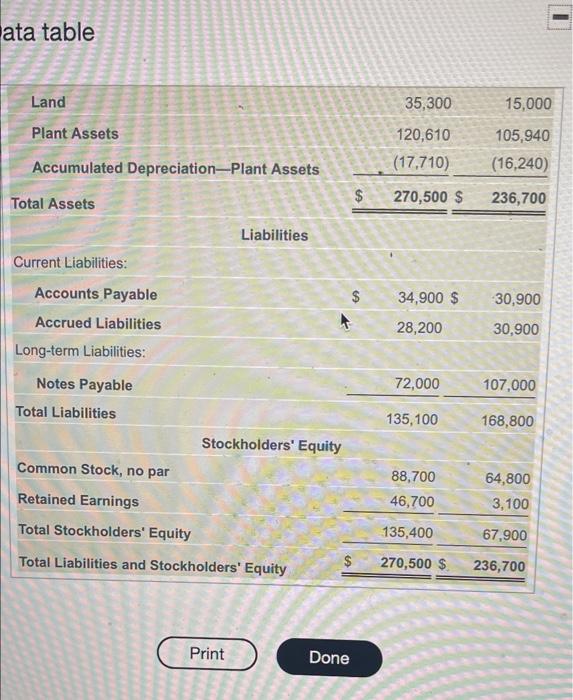

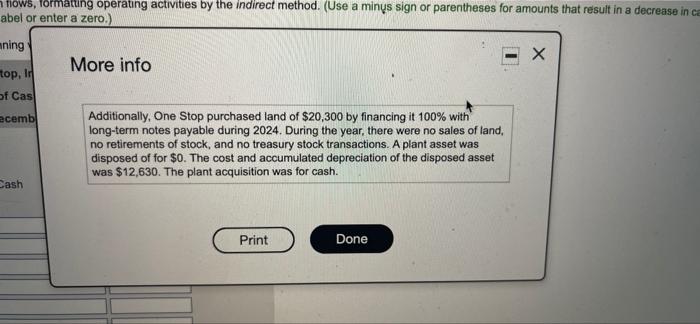

The 2024 incomment and comparative balance sheet of One Shop, Inc.fo The icon to view the income statement) lock the icon to view the comparative lance sheet) Ook woon to view to tination) Read the mourmandis Ruquireman 1, Prepare the 2024 intement of confom formatting operating activities by the indirect method (ie a non son or parenched for amounts at the cromenaan te bou a veden then we the box omoly, do not talabel or enter) Complete the statement one action at a time, bogining with the cash flows from operating activities One Stop, Inc Statement of Cash Flows Year Ended December 2014 Cash Flow from Operating Active Nel com Adjustments to reconcilio contato Net Cash Provided by (Used Operating the No Cash Provided by (Used Son Operating Actres Cash Flow from Invest Act ata table One Stop, Inc. Income Statement Year Ended December 31, 2024 Net Sales Revenue $ 436,000 210,200 Cost of Goods Sold 225,800 Gross Profit Operating Expenses: Salaries Expense Depreciation Expense_Plant Assets $ 72.400 14,100 Other Operating Expenses 11,000 97,500 Total Operating Expenses Operating Income Other Income and (Expenses): Interest Revenue 128,300 Interest Expense 8,600 (21,900) Total Other Income and (Expenses) (13,300) Print Done Data table Net Sales Revenue $ 436,000 Cost of Goods Sold 210,200 Gross Profit 225,800 $ 72,400 14,100 11,000 Operating Expenses: Salaries Expense Depreciation Expense-Plant Assets Other Operating Expenses Total Operating Expenses Operating Income Other Income and (Expenses): Interest Revenue 97,500 128,300 8,600 Interest Expense (21,900) (13,300) Total Other Income and (Expenses) Net Income Before Income Taxes Income Tax Expense 115,000 19, 100 Net Income $ 95,900 Print Done Data table One Stop, Inc. Comparative Balance Sheet December 31, 2024 and 2023. 2024 2023 Assets Current Assets: Cash 26,600 $ -15,100 Accounts Receivable 26,700 25,100 Merchandise Inventory Long-term Assets: 79,000 91,800 Land 35,300 15,000 Plant Assets Accumulated Depreciation-Plant Assets 120,610 (17,710) 105,940 (16,240) Total Assets $ 270,500 $ 236,700 Liabilities Current Liabilities: DOLI 2 Ann Dana ata table 35,300 15,000 Land Plant Assets Accumulated Depreciation-Plant Assets 120,610 (17,710) 105,940 (16,240) Total Assets $ 270,500 $ 236,700 Liabilities Current Liabilities: Accounts Payable $ 34,900 $ 30,900 28,200 Accrued Liabilities Long-term Liabilities: 30,900 Notes Payable 72,000 107,000 Total Liabilities 135, 100 168,800 Stockholders' Equity Common Stock, no par 88,700 46,700 Retained Earnings 64,800 3,100 Total Stockholders' Equity 135,400 67,900 Total Liabilities and Stockholders' Equity $ 270,500 $ 236,700 Print Done tows, formatung operating activities by the indirect method. (Use a minys sign or parentheses for amounts that result in a decrease in ce abel or enter a zero.) mning More info top, ld of Cas ecemb Additionally, One Stop purchased land of $20,300 by financing it 100% with long-term notes payable during 2024. During the year, there were no sales of land, no retirements of stock, and no treasury stock transactions. A plant asset was disposed of for $0. The cost and accumulated depreciation of the disposed asset was $12,630. The plant acquisition was for cash. Cash Print Done