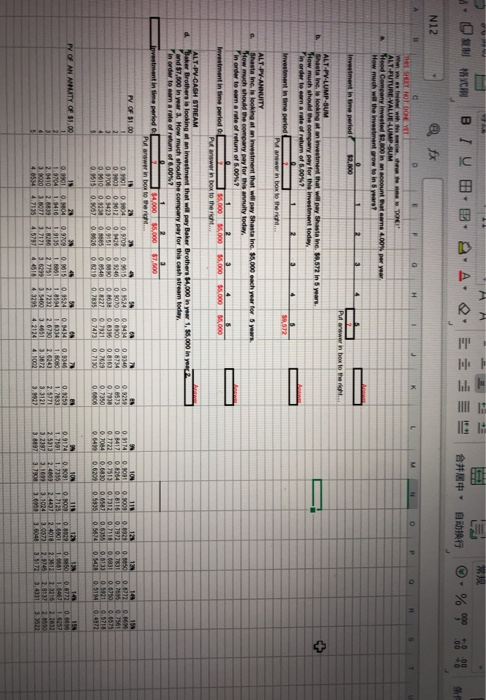

THE 21 BI UB E- % 900 N12 @fx H J K L M N O T E F G THS NOT DONCYCL When with him. DONE! ALT-FUTURE-VALUE-LUMP-SUM tood Company invested 2.800 in an account that owns 4.00 per year How much wel the investment grow to in 5 years? 2 3 Investment in time period 12,800 Puwwer in box to the ALT.PV-LUMP-SUM Shasta Ine. I looking at anvestment that will pay Shasta Inc. $9.572 in 5 years How much should the company for this investment today, in order to earn a rate of return of 6.00%7 3 Investment in time period Put answer in box to the 58,672 ALT-PV-ANNUITY Shasta Inc. is looking at an investment that will pay Shanta Inc. $5,000 each year for years. How much should the company pay for this annuity today in order to earn a rate of return of 5.00%? 5 Investment in time periodo $5,000 $5,000 $5,000 $6.000.000 Panswer box to the right ALT-PV-CASH STREAM Baker Brothers is looking at an investment that will pay Baker Brothers 1,000 in your 1.5,000 in yo2 and $7.500 in year 3. How much should the company pay for this cash stream today In order to earn a rate of return of 6.00%7 Investment in time periodo $4,000,000 Pulanger in box to the right P OF 31.00 0.0 0.2004 0.003 0.9012 0.9700 0.9423 0.100.13 0.8515 0.8052 0.9709 0.26 0.9151 0.6885 0.920 0.15 0.1524 0.9246 0.9020 OMO 0.1631 0.6540 0.8219 N 0.9340 0.000 0.8734 0.8380.8163 0.7321 0.769 0.74730.7180 09174 0 8417 01722 104 123 0.10.2009 0.921 O 8294 OBI 0.7972 0.7513 0.7312 0.7110 0.000 0.6587 0.6355 0.6200 0.5335 0.5474 0.7930 07359 0.6600 13 0 3450 0.82720 O. 0.7695 01901 33 0.00 9.6573 0.6133 0.5121 0 1 4 5 0.847 151 PY OF AN ANLITY OF 31.00 1 2 0. 108 0.9091 1.2355 0.9524 45 0.015 18061 2.7151 0.9804 1.9704 1. MI 2.9410 320203 DOT? 4.85344.7135 0.9709 9135 2.8200 3.7171 4.5787 7 0.9434 0.9340 1.6934 2.67302.6249 34051 3.3872 42124 4.1002 0.250 1.7833 2.5171 3.3121 3 1922 115 0 ko 1.2125 2.4497 3.1024 0.9174 1.7591 2.5313 3.2197 3.8897 1 0 1.8901 2.4018 307 3.6041 2.232 3.5400 0.5459 1.0001 23612 2. 115 2.3210 2.2002 2 8599 3.3522 4 5 3.100 3.79 4451