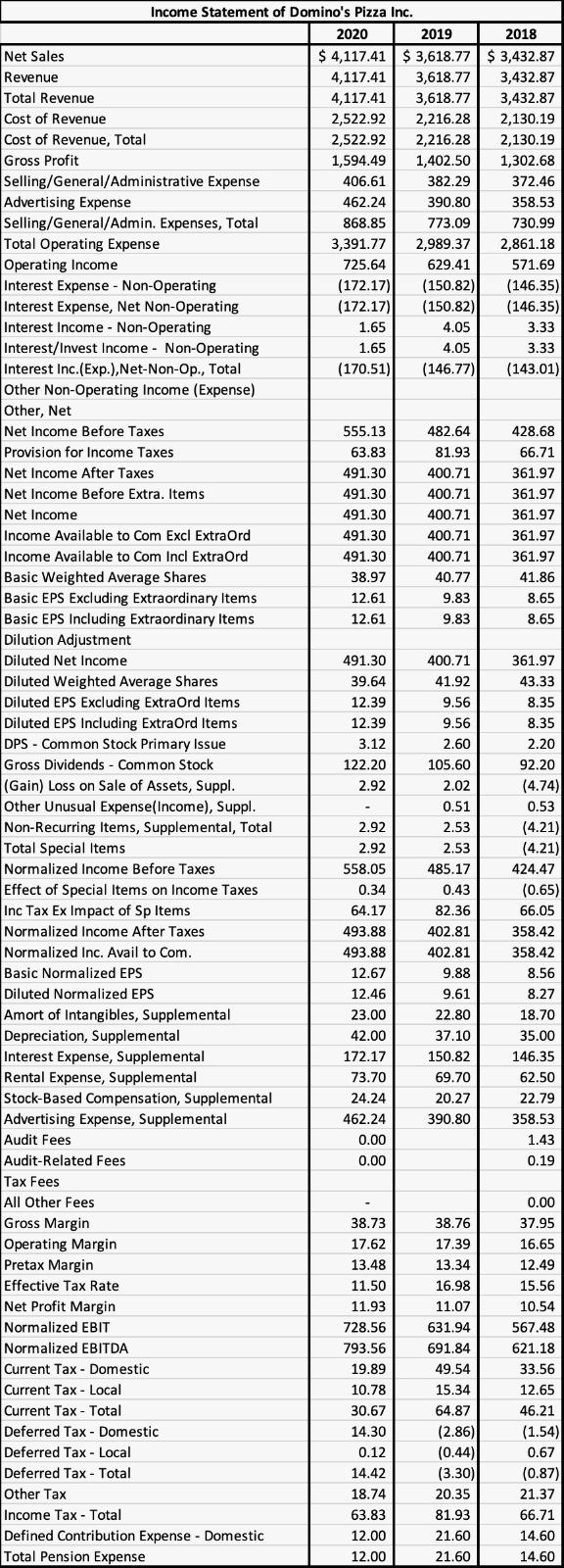

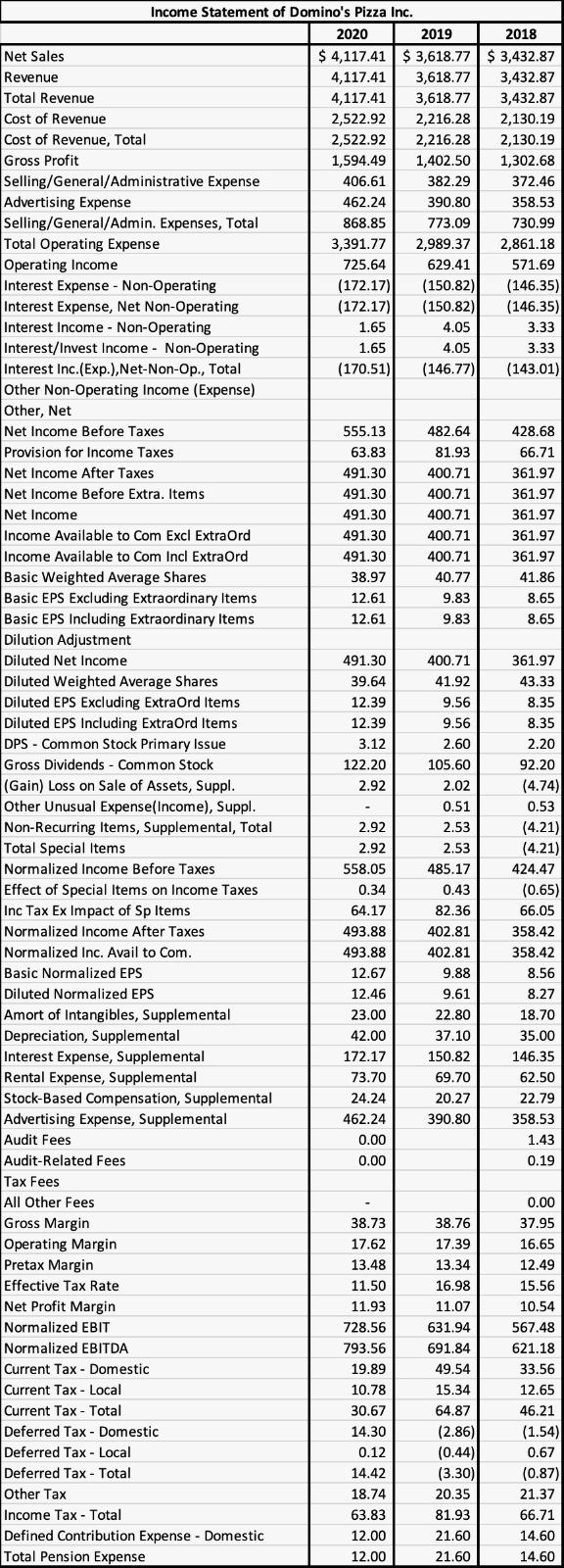

The 3 (2019, 2020, 2021) most current years income statement of the company Domino's Pizza Inc. (DPZ on NYSE)) on a table. The analysis must include horizontal and vertical changes for each line item for the 3 most current years. Please include formulas used.

Income Statement of Domino's Pizza Inc. 2020 2019 2018 Net Sales $ 4,117.41 $ 3,618.77 $ 3,432.87 Revenue 4,117.41 3,618.77 3,432.87 Total Revenue 4,117.41 3,618.77 3,432.87 Cost of Revenue 2,522.92 2,216.28 2,130.19 Cost of Revenue, Total 2,522.92 2,216.28 2,130.19 Gross Profit 1,594.49 1,402.50 1,302.68 Selling/General/Administrative Expense 406.61 382.29 372.46 Advertising Expense 462.24 390.80 358.53 Selling/General/Admin. Expenses, Total 868.85 773.09 730.99 Total Operating Expense 3,391.77 2,989.37 2,861.18 Operating Income 725.64 629.41 571.69 Interest Expense - Non-Operating (172.17) (150.82) (146.35) Interest Expense, Net Non-Operating (172.17) (150.82) (146.35) Interest Income - Non-Operating 1.65 4.05 3.33 Interest/Invest Income - Non-Operating 1.65 4.05 3.33 Interest Inc.(Exp.), Net-Non-Op., Total (170.51) (146.77) (143.01) Other Non-Operating Income (Expense) Other, Net Net Income Before Taxes 555.13 482.64 428.68 Provision for Income Taxes 63.83 81.93 66.71 Net Income After Taxes 491.30 400.71 361.97 Net Income Before Extra. Items 491.30 400.71 361.97 Net Income 491.30 400.71 361.97 Income Available to Com Excl Extra Ord 491.30 400.71 361.97 Income Available to Com Incl Extra Ord 491.30 400.71 361.97 Basic Weighted Average Shares 38.97 40.77 41.86 Basic EPS Excluding Extraordinary Items 12.61 9.83 8.65 Basic EPS Including Extraordinary Items 12.61 9.83 8.65 Dilution Adjustment Diluted Net Income 491.30 400.71 361.97 Diluted Weighted Average Shares 39.64 41.92 43.33 Diluted EPS Excluding Extraord Items 12.39 9.56 8.35 Diluted EPS Including Extraord Items 12.39 9.56 8.35 DPS - Common Stock Primary Issue 3.12 2.60 2.20 Gross Dividends - Common Stock 122.20 105.60 92.20 (Gain) Loss on Sale of Assets, Suppl. 2.92 2.02 (4.74) Other Unusual Expense(Income), Suppl. 0.51 0.53 Non-Recurring Items, Supplemental, Total 2.92 2.53 (4.21) Total Special Items 2.92 2.53 (4.21) Normalized Income Before Taxes 558.05 485.17 424.47 Effect of Special Items on Income Taxes 0.34 0.43 (0.65) Inc Tax Ex Impact of Sp Items 64.17 82.36 66.05 Normalized Income After Taxes 493.88 402.81 358.42 Normalized Inc. Avail to Com. 493.88 402.81 358.42 Basic Normalized EPS 12.67 9.88 8.56 Diluted Normalized EPS 12.46 9.61 8.27 Amort of Intangibles, Supplemental 23.00 22.80 18.70 Depreciation, Supplemental 42.00 37.10 35.00 Interest Expense, Supplemental 172.17 150.82 146.35 Rental Expense, Supplemental 73.70 69.70 62.50 Stock-Based Compensation, Supplemental 24.24 20.27 22.79 Advertising Expense, Supplemental 462.24 390.80 358.53 Audit Fees 0.00 1.43 Audit-Related Fees 0.00 0.19 Tax Fees All Other Fees 0.00 Gross Margin 38.73 38.76 37.95 Operating Margin 17.62 17.39 16.65 Pretax Margin 13.48 13.34 12.49 Effective Tax Rate 11.50 16.98 15.56 Net Profit Margin 11.93 11.07 10.54 Normalized EBIT 728.56 631.94 567.48 Normalized EBITDA 793.56 691.84 621.18 Current Tax - Domestic 19.89 49.54 33.56 Current Tax - Local 10.78 15.34 12.65 Current Tax - Total 30.67 64.87 46.21 Deferred Tax - Domestic 14.30 (2.86) (1.54) Deferred Tax - Local 0.12 (0.44) 0.67 Deferred Tax - Total 14.42 (3.30) (0.87) Other Tax 18.74 20.35 21.37 Income Tax - Total 63.83 81.93 66.71 Defined Contribution Expense - Domestic 12.00 21.60 14.60 Total Pension Expense 21.60 14.60 12.00