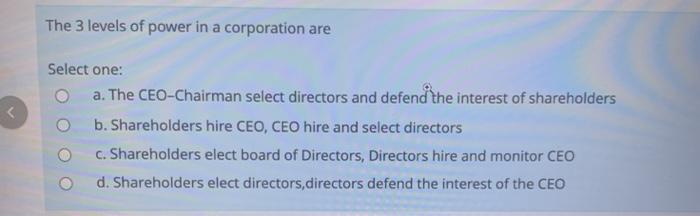

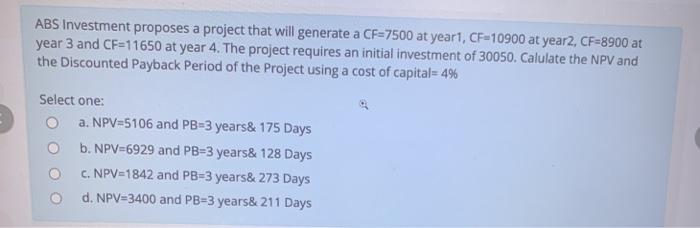

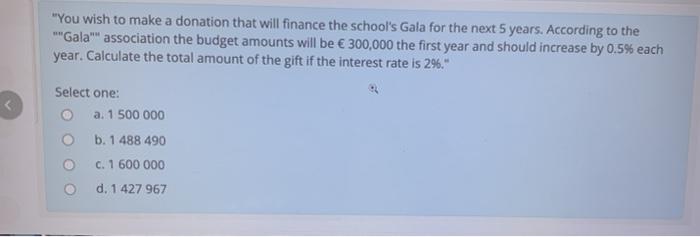

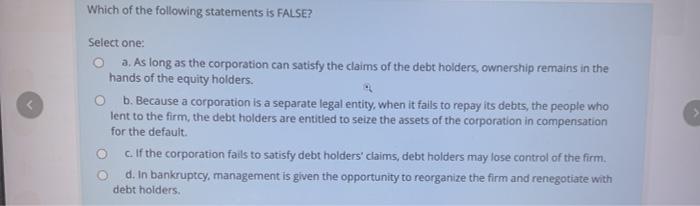

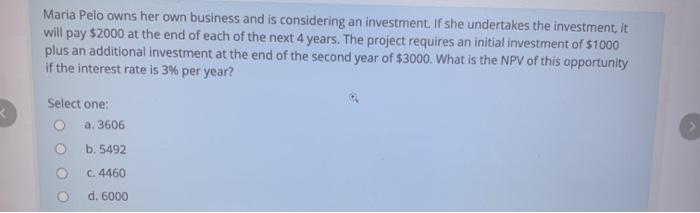

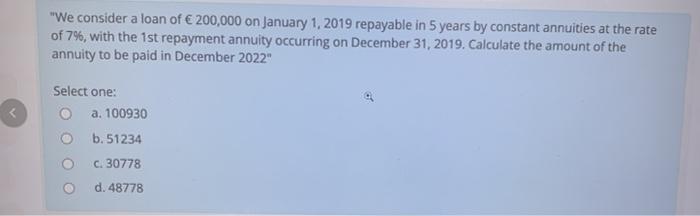

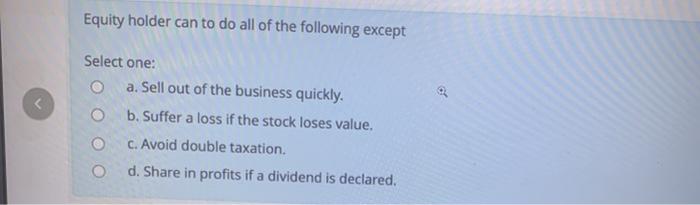

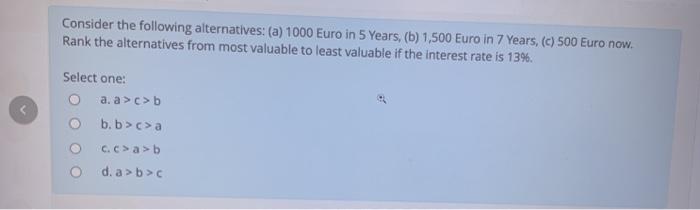

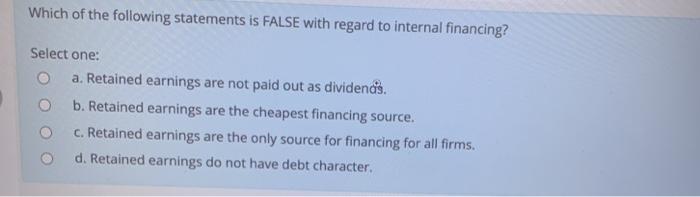

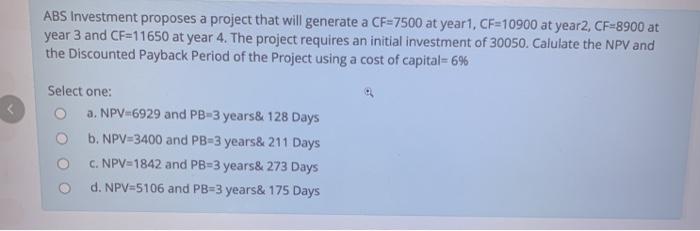

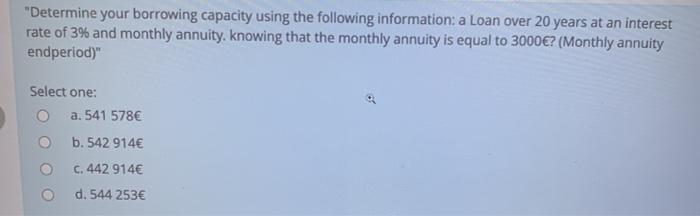

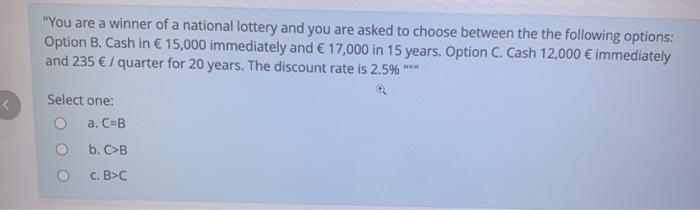

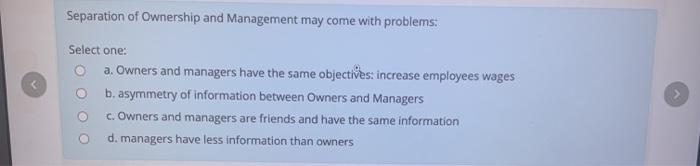

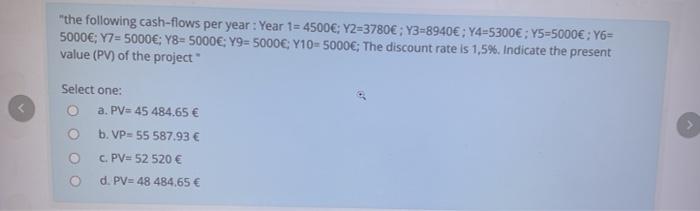

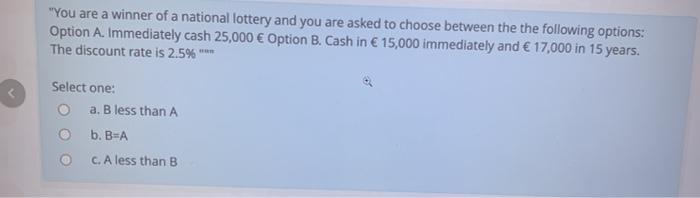

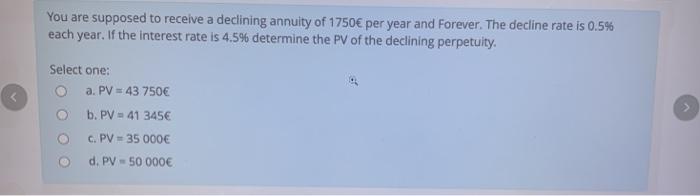

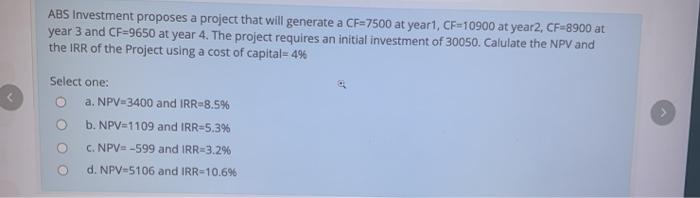

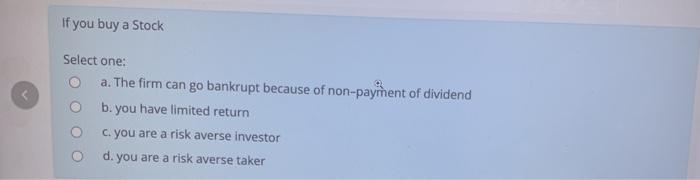

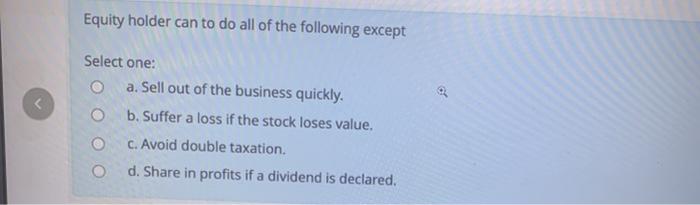

The 3 levels of power in a corporation are Select one: a. The CEO-Chairman select directors and defend the interest of shareholders b. Shareholders hire CEO, CEO hire and select directors c. Shareholders elect board of Directors, Directors hire and monitor CEO d. Shareholders elect directors, directors defend the interest of the CEO ABS Investment proposes a project that will generate a CF-7500 at year1, CF-10900 at year2, CF=8900 at year 3 and CF=11650 at year 4. The project requires an initial investment of 30050. Calulate the NPV and the Discounted Payback period of the Project using a cost of capital= 4% Select one: oa. NPV=5106 and PB-3 years& 175 Days b. NPV=6929 and PB-3 years& 128 Days C. NPV=1842 and PB=3 years& 273 Days O d. NPV=3400 and PB=3 years& 211 Days "You wish to make a donation that will finance the school's Gala for the next 5 years. According to the "Gala"" association the budget amounts will be 300,000 the first year and should increase by 0.5% each year. Calculate the total amount of the gift if the interest rate is 29." Select one: a. 1 500 000 b. 1 488 490 O C. 1 600 000 O d. 1 427 967 Which of the following statements is FALSE? Select one: oa. As long as the corporation can satisfy the claims of the debt holders, ownership remains in the hands of the equity holders. Ob. Because a corporation is a separate legal entity, when it fails to repay its debts, the people who lent to the firm, the debt holders are entitled to seize the assets of the corporation in compensation for the default. cIf the corporation fails to satisfy debt holders' claims, debt holders may lose control of the firm, d. In bankruptcy, management is given the opportunity to reorganize the firm and renegotiate with debt holders. Maria Pelo owns her own business and is considering an investment. If she undertakes the investment, it will pay $2000 at the end of each of the next 4 years. The project requires an initial investment of $1000 plus an additional investment at the end of the second year of $3000. What is the NPV of this opportunity if the interest rate is 3% per year? Select one: a. 3606 b. 5492 C. 4460 d. 6000 "We consider a loan of 200,000 on January 1, 2019 repayable in 5 years by constant annuities at the rate of 7%, with the 1st repayment annuity occurring on December 31, 2019. Calculate the amount of the annuity to be paid in December 2022" Select one: a. 100930 b. 51234 C. 30778 d. 48778 Equity holder can to do all of the following except Select one: O a. Sell out of the business quickly. O b. Suffer a loss if the stock loses value. O C. Avoid double taxation. O d. Share in profits if a dividend is declared. Consider the following alternatives: (a) 1000 Euro in 5 Years, (b) 1,500 Euro in 7 Years, (c) 500 Euro now. Rank the alternatives from most valuable to least valuable if the interest rate is 1396. Select one: a. a>c>b b.b>> C.Cab d. a > > Which of the following statements is FALSE with regard to internal financing? Select one: a. Retained earnings are not paid out as dividends. O b. Retained earnings are the cheapest financing source. c. Retained earnings are the only source for financing for all firms. d. Retained earnings do not have debt character. ABS Investment proposes a project that will generate a CF-7500 at year 1, CF=10900 at year2, CF-8900 at year 3 and CF=11650 at year 4. The project requires an initial investment of 30050. Calulate the NPV and the Discounted Payback period of the Project using a cost of capital= 6% Select one: a. NPV=6929 and PB-3 years& 128 Days b. NPV=3400 and PB=3 years& 211 Days C. NPV=1842 and PB-3 years& 273 Days d. NPV=5106 and PB=3 years& 175 Days "Determine your borrowing capacity using the following information: a Loan over 20 years at an interest rate of 3% and monthly annuity, knowing that the monthly annuity is equal to 3000? (Monthly annuity endperiod)" Select one: a. 541 578 b. 542 914 C. 442 914 d. 544 253 "You are a winner of a national lottery and you are asked to choose between the the following options: Option B. Cash in 15,000 immediately and 17,000 in 15 years. Option C. Cash 12,000 immediately and 235 / quarter for 20 years. The discount rate is 2.5% *** Select one: o a. C=B b. CB c. B>C Separation of Ownership and Management may come with problems. Select one: a. Owners and managers have the same objectives: increase employees wages b. asymmetry of information between Owners and Managers c. Owners and managers are friends and have the same information d. managers have less information than owners "the following cash-flows per year: Year 1 = 4500; Y2=3780 ; Y3=8940; Y4=5300; Y5=5000: Y6= 5000; Y7= 5000: Y8= 5000: Y9= 5000; Y10-5000; The discount rate is 1,5%. Indicate the present value (PV) of the project Select one: a. PV=45 484.65 b. VP= 55 587.93 c. PV= 52 520 d. PV=48 484,65 "You are a winner of a national lottery and you are asked to choose between the the following options: Option A. Immediately cash 25,000 Option B. Cash in 15,000 immediately and 17,000 in 15 years. The discount rate is 2.5% *** Select one: a. B less than A b. B-A C. A less than B You are supposed to receive a declining annuity of 1750 per year and forever. The decline rate is 0.5% each year. If the interest rate is 4.5% determine the PV of the declining perpetuity. Select one: a. PV = 43 750 b. PV - 41 345 C. PV 35 000 d. PV - 50 000 ABS Investment proposes a project that will generate a CF=7500 at yeart, CF=10900 at year2, CF=8900 at year 3 and CF=9650 at year 4. The project requires an initial investment of 30050. Calulate the NPV and the IRR of the Project using a cost of capital= 496