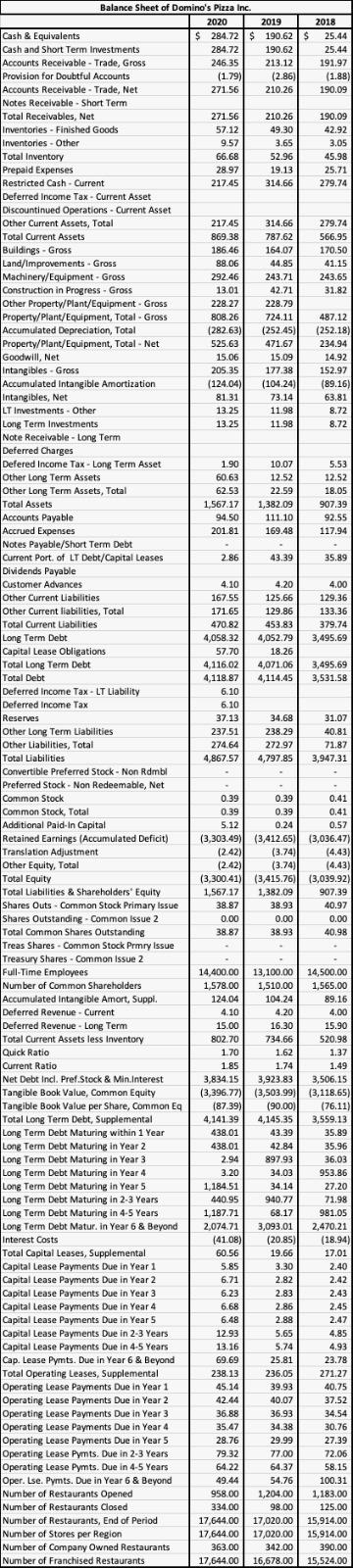

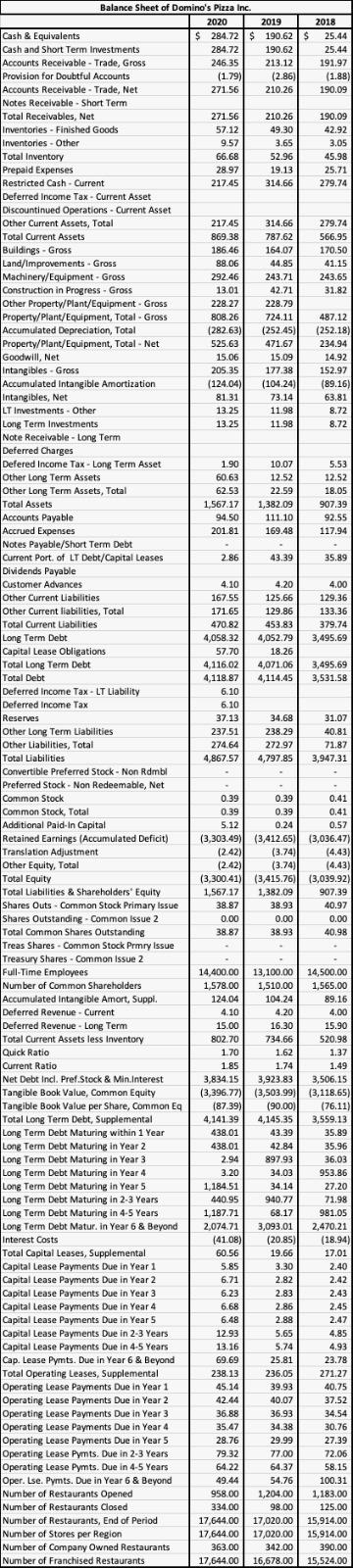

The 3 most current years (2019, 2020, 2021) balance sheet of the company Domino's Pizza Inc. (DPZ on NYSE)) on a table. The analysis must include horizontal and vertical changes for each line item for the 3 most current years. Please attach the formulas used.

Reserves Balance Sheet of Domino's Pizza Inc. 2020 2019 2018 Cash & Equivalents $ $ 284.72 $ 190.62 $ 25.44 Cash and Short Term Investments 284.72 190.62 25.44 Accounts Receivable - Trade, Gross 24635 213.12 191.97 Provision for Doubtful Accounts (1.79) (2.86 (1.88) Accounts Receivable - Trade, Net 271.56 210.26 190.09 Notes Receivable - Short Term Total Receivables, Net 271 56 210.26 190.09 Inventories - Finished Goods 57.12 49.30 42.92 Inventories - Other 9.57 3.65 3.05 Total Inventory 66.68 52.96 45.98 Prepaid Expenses 28.97 19.13 25.71 Restricted Cash - Current 217.45 314.66 279.74 Deferred Income Tax - Current Asset Discountinued Operations - Current Asset Other Current Assets, Total 217.45 314.66 279.74 Total Current Assets 869.38 787.62 566.95 Buildings - Gross 186.46 164.07 170.50 Land/Improvements - Gross 88.06 44.85 41.15 Machinery/Equipment. Gross 292.46 243.71 243.65 Construction in Progress - Gross 13.01 42.71 31.82 Other Property/Plant/Equipment - Gross 228.27 228.79 Property/Plant/Equipment, Total - Gross 808 26 724.11 487.12 Accumulated Depreciation, Total (282.63) (252.45) (252.18) Property/Plant/Equipment, Total - Net 525.63 471.67 234.94 Goodwill, Net 15.06 15.09 14.92 intangibles - Gross 205.35 177.38 152.97 Accumulated Intangible Amortization (124.04) (104.24) (89.16) Intangibles, Net 81.31 73.14 63.81 LT Investments - Other 13.25 11.98 8.72 Long Term Investments 13.25 11.98 8.72 Note Receivable - Long Term Deferred Charges Defered Income Tax - Long Term Asset 1.90 10.07 5.53 Other Long Term Assets 60.63 12.52 12.52 Other Long Term Assets, Total 62.53 22.59 18.05 Total Assets 1.567.17 1,382.09 907.39 Accounts Payable 94.50 111.10 92.55 Accrued Expenses 201.81 169.48 117.94 Notes Payable/Short Term Debt - Current Port of LT Debt/Capital Leases 2.86 43.39 35.89 Dividends Payable Customer Advances 4.10 4.20 4.00 Other Current Liabilities 167.55 125.66 129.36 Other Current liabilities, Total , 171.65 129.86 133.36 Total Current Liabilities 470.82 453.83 379.74 Long Term Debt 4,058.32 4,052.79 3,495.69 Capital Lease Obligations 57.70 18.26 Total Long Term Debt 4,116.02 4,071.06 3,495.69 Total Debt 4,118.87 4,114.45 3,531.58 Deferred Income Tax LT Liability 6.10 Deferred Income Tax 6.10 37.13 34.68 31.07 Other Long Term Liabilities 237.51 238.29 40,81 Other Liabilities, Total 274.64 272.97 71.87 Total Liabilities 4,867.57 4,797.85 3,947.31 Convertible Preferred Stock - Non Rombl Preferred Stock - Non Redeemable, Net . Common Stock 0.39 0.39 0.41 Common Stock, Total 0.39 0.39 0.41 Additional Paid In Capital - 5.12 0.24 0.57 Retained Earnings (Accumulated Deficit) (3,303.49) (3,412.65) (3,036.47) Translation Adjustment (2.42) (3.74 (4.43 Other Equity, Total (2.42) (3.74) (4.43) Total Equity (3,300.41) (3,415.76) (3,039.92) Total Liabilities & Shareholders' Equity 1,567.17 1,382.09 907.39 Shares Outs - Common Stock Primary Issue 38.87 38.93 40.97 Shares Outstanding - Common Issue 2 0.00 0.00 0.00 Total Common Shares Outstanding 38 87 38.93 40.98 Treas Shares - Common Stock Prmry Issue Treasury Shares - Common Issue 2 Full-Time Employees 14,400.00 13,100.00 14,500.00 Number of Common Shareholders 1578.00 1,510.00 1,565.00 Accumulated intangible Amort, Suppl. 124.04 104.24 89.16 Deferred Revenue - Current 4.10 4.20 4.00 Deferred Revenue . Long Term 15.00 16.30 15.90 Total Current Assets less Inventory 802.70 734.66 520.98 Quick Ratio 1.70 1.62 1.37 Current Ratio 1.85 1.74 1.49 Net Debt Incl. Pref.Stock & Min.Interest 3.834 15 3,923.83 3,506,15 Tangible Book Value, Common Equity (3,396.77) (3,503.99) (3,503.99) (3,118.65) Tangible Book Value per Share, Common Eq (87.39) (90.00) (76.11) Total Long Term Debt, Supplemental 4,141 39 4,145.35 3,559.13 Long Term Debt Maturing within 1 Year 438.01 43.39 35.89 Long Term Debt Maturing in Year 2 438.01 42.84 35.96 Long Term Debt Maturing in Year 3 2.94 897.93 36.03 Long Term Debt Maturing in Year 4 3.20 34.03 953.86 Long Term Debt Maturing in Year 5 1,184.51 34.14 27.20 Long Term Debt Maturing in 2-3 Years 440.95 940.77 71.98 Long Term Debt Maturing in 4-5 Years 1,187.71 68.17 981.05 Long Term Debt Matur, in Year 6 & Beyond 2,074.71 3,093.01 2,470.21 Interest Costs (41.08) (20.85) (18.94) Total Capital Leases, Supplemental 60.56 19.66 17.01 Capital Lease Payments Due in Year 1 5.85 3.30 2.40 Capital Lease Payments Due in Year 2 6.71 2.82 2.42 Capital Lease Payments Due in Year 3 6.23 2.83 2.43 Capital Lease Payments Due in Year 4 6.68 2.86 2.45 Capital Lease Payments Due in Year 5 6.48 2.88 2.47 Capital Lease Payments Due in 2-3 Years 12.93 5.65 4.85 Capital Lease Payments Due in 4-5 Years 13.16 5.74 4.93 Cap. Lease Pymts. Due in Year 6 & Beyond 69.69 25.81 23.78 Total Operating Leases, Supplemental 238.13 236.05 271.27 Operating Lease Payments Due in Year 1 45.14 39.93 40.75 Operating Lease Payments Due in Year 2 42.44 40.07 37.52 Operating Lease Payments Due in Year 3 36.88 36.93 34,54 Operating Lease Payments Due in Year 4 35.47 34.38 30.76 Operating Lease Payments Due in Year 5 28.76 29.99 27.39 Operating Lease Pymts. Due in 2-3 Years 79.32 77.00 72.06 Operating Lease Pymts. Due in 4-5 Years 64.22 64.37 58.15 Oper. Lse. Pymts. Due in Year 6 & Beyond 49.44 54.76 100.31 Number of Restaurants opened 958.00 1,204.00 1,183.00 Number of Restaurants Closed 334.00 98.00 125.00 Number of Restaurants, End of Period 17,644.00 17,020.00 15,914.00 Number of Stores per Region 17,644.00 17,020.00 15,914,00 Number of Company Owned Restaurants 363.00 342.00 390.00 Number of Franchised Restaurants 17,644.00 16,678.00 15,524.00