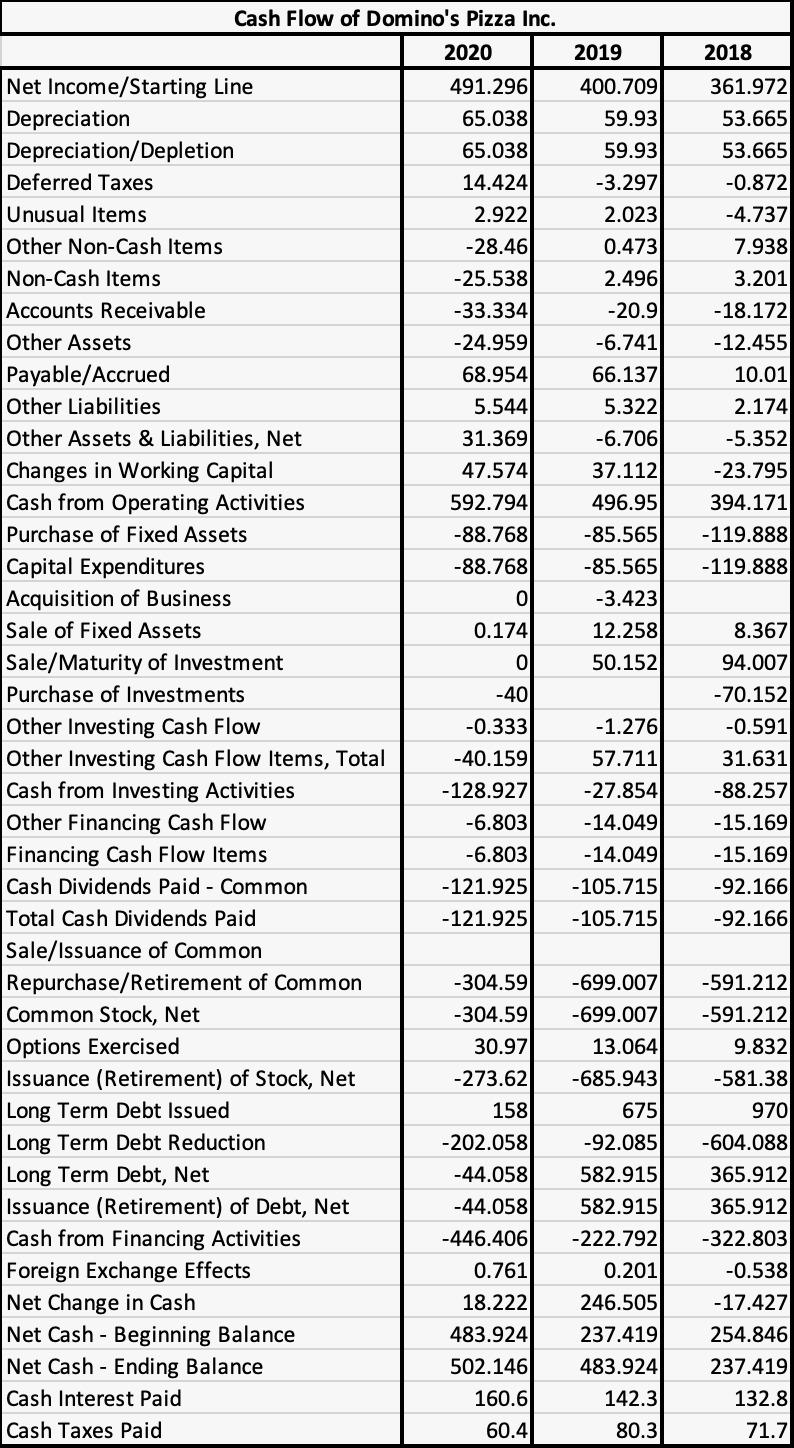

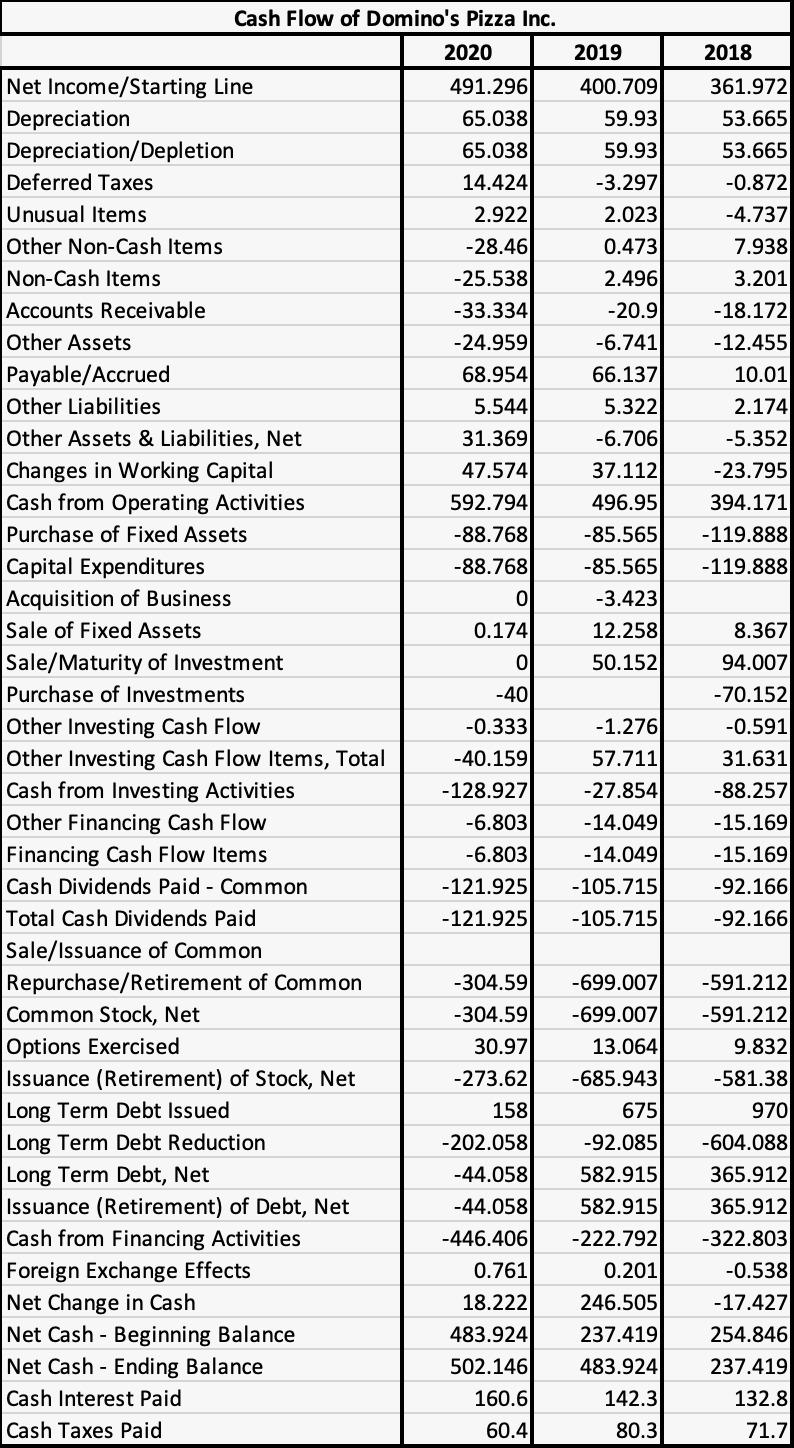

The 3 most current years (2019, 2020, 2021) Statement of Cash Flows of the company Domino's Pizza Inc. (DPZ on NYSE) on a table. The analysis must include horizontal and vertical changes for each line item for the 3 most current years. Please attached formulas used.

2018 2019 400.709 59.93 59.93 -3.297 2.023 0.473 2.496 -20.9 -6.741 66.137 5.322 -6.706 37.112 496.95 -85.565 -85.565 -3.423 12.258 50.152 361.972 53.665 53.665 -0.872 -4.737 7.938 3.201 -18.172 -12.455 10.01 2.174 -5.352 -23.795 394.171 -119.888 -119.888 Cash Flow of Domino's Pizza Inc. 2020 Net Income/Starting Line 491.296 Depreciation 65.038 Depreciation/Depletion 65.038 Deferred Taxes 14.424 Unusual Items 2.922 Other Non-Cash Items -28.46 Non-Cash Items -25.538 Accounts Receivable -33.334 Other Assets -24.959 Payable/Accrued 68.954 Other Liabilities 5.544 Other Assets & Liabilities, Net 31.369 Changes in Working Capital 47.574 Cash from Operating Activities 592.794 Purchase of Fixed Assets -88.768 Capital Expenditures -88.768 Acquisition of Business 0 Sale of Fixed Assets 0.174 Sale/Maturity of Investment 0 Purchase of Investments -40 Other Investing Cash Flow -0.333 Other Investing Cash Flow Items, Total -40.159 Cash from Investing Activities -128.927 Other Financing Cash Flow -6.803 Financing Cash Flow Items -6.803 Cash Dividends Paid - Common -121.925 Total Cash Dividends Paid -121.925 Sale/Issuance of Common Repurchase/Retirement of Common -304.59 Common Stock, Net -304.59 Options Exercised 30.97 Issuance (Retirement) of Stock, Net -273.62 Long Term Debt Issued 158 Long Term Debt Reduction -202.058 Long Term Debt, Net -44.058 Issuance (Retirement) of Debt, Net -44.058 Cash from Financing Activities -446.406 Foreign Exchange Effects 0.761 Net Change in Cash 18.222 Net Cash - Beginning Balance 483.924 Net Cash - Ending Balance 502.146 Cash Interest Paid 160.6 Cash Taxes Paid 60.4 -1.276 57.711 -27.854 - 14.049 - 14.049 -105.715 -105.715 8.367 94.007 -70.152 -0.591 31.631 -88.257 -15.169 -15.169 -92.166 -92.166 -699.007 -699.007 13.064 -685.943 675 -92.085 582.915 582.915 -222.792 0.201 246.505 237.419 483.924 142.3 80.3 -591.212 -591.212 9.832 -581.38 970 -604.088 365.912 365.912 -322.803 -0.538 -17.427 254.846 237.419 132.8 71.7 2018 2019 400.709 59.93 59.93 -3.297 2.023 0.473 2.496 -20.9 -6.741 66.137 5.322 -6.706 37.112 496.95 -85.565 -85.565 -3.423 12.258 50.152 361.972 53.665 53.665 -0.872 -4.737 7.938 3.201 -18.172 -12.455 10.01 2.174 -5.352 -23.795 394.171 -119.888 -119.888 Cash Flow of Domino's Pizza Inc. 2020 Net Income/Starting Line 491.296 Depreciation 65.038 Depreciation/Depletion 65.038 Deferred Taxes 14.424 Unusual Items 2.922 Other Non-Cash Items -28.46 Non-Cash Items -25.538 Accounts Receivable -33.334 Other Assets -24.959 Payable/Accrued 68.954 Other Liabilities 5.544 Other Assets & Liabilities, Net 31.369 Changes in Working Capital 47.574 Cash from Operating Activities 592.794 Purchase of Fixed Assets -88.768 Capital Expenditures -88.768 Acquisition of Business 0 Sale of Fixed Assets 0.174 Sale/Maturity of Investment 0 Purchase of Investments -40 Other Investing Cash Flow -0.333 Other Investing Cash Flow Items, Total -40.159 Cash from Investing Activities -128.927 Other Financing Cash Flow -6.803 Financing Cash Flow Items -6.803 Cash Dividends Paid - Common -121.925 Total Cash Dividends Paid -121.925 Sale/Issuance of Common Repurchase/Retirement of Common -304.59 Common Stock, Net -304.59 Options Exercised 30.97 Issuance (Retirement) of Stock, Net -273.62 Long Term Debt Issued 158 Long Term Debt Reduction -202.058 Long Term Debt, Net -44.058 Issuance (Retirement) of Debt, Net -44.058 Cash from Financing Activities -446.406 Foreign Exchange Effects 0.761 Net Change in Cash 18.222 Net Cash - Beginning Balance 483.924 Net Cash - Ending Balance 502.146 Cash Interest Paid 160.6 Cash Taxes Paid 60.4 -1.276 57.711 -27.854 - 14.049 - 14.049 -105.715 -105.715 8.367 94.007 -70.152 -0.591 31.631 -88.257 -15.169 -15.169 -92.166 -92.166 -699.007 -699.007 13.064 -685.943 675 -92.085 582.915 582.915 -222.792 0.201 246.505 237.419 483.924 142.3 80.3 -591.212 -591.212 9.832 -581.38 970 -604.088 365.912 365.912 -322.803 -0.538 -17.427 254.846 237.419 132.8 71.7