Answered step by step

Verified Expert Solution

Question

1 Approved Answer

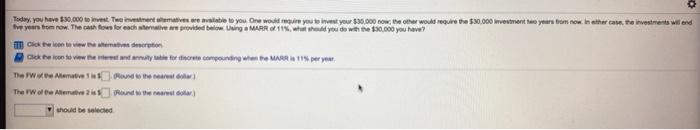

the $ 30,000 investment two years from now Today , you have $ 30,000 to invest . Two investment alternatives are available to you .

the $ 30,000 investment two years from now Today , you have $ 30,000 to invest . Two investment alternatives are available to you . One would require you to invest your $ 30,000 now , the other would free years from now . The cash flows for each alternative are provided below . Using a MARR of 11 % , what should you do with the $ 30,000 you have ?

Today, you have $30,000 to vest Tweets we table to you. One would require you to invest your $30.000 now, the other would require the $30.000 investment years from now. In the car, the investments wil end ve years from now. The shows for each were provided below. MARR 11 what hid you do we $30,000 you have Get the internet and annually the order con el MARR 115 peryem The Weed to the earth The Wote Allen2 should be selected The FW of the Alterative 1 is $ . ( Round to the nearest dollar . )

The FW of the Alternative 2 is $ ( Round to the nearest dolar )

which alternative should be selected .

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started