Question

The 3M Company is a global diversified technology company active in the following product markets: consumer and office; display and graphics; electronics and communications; health

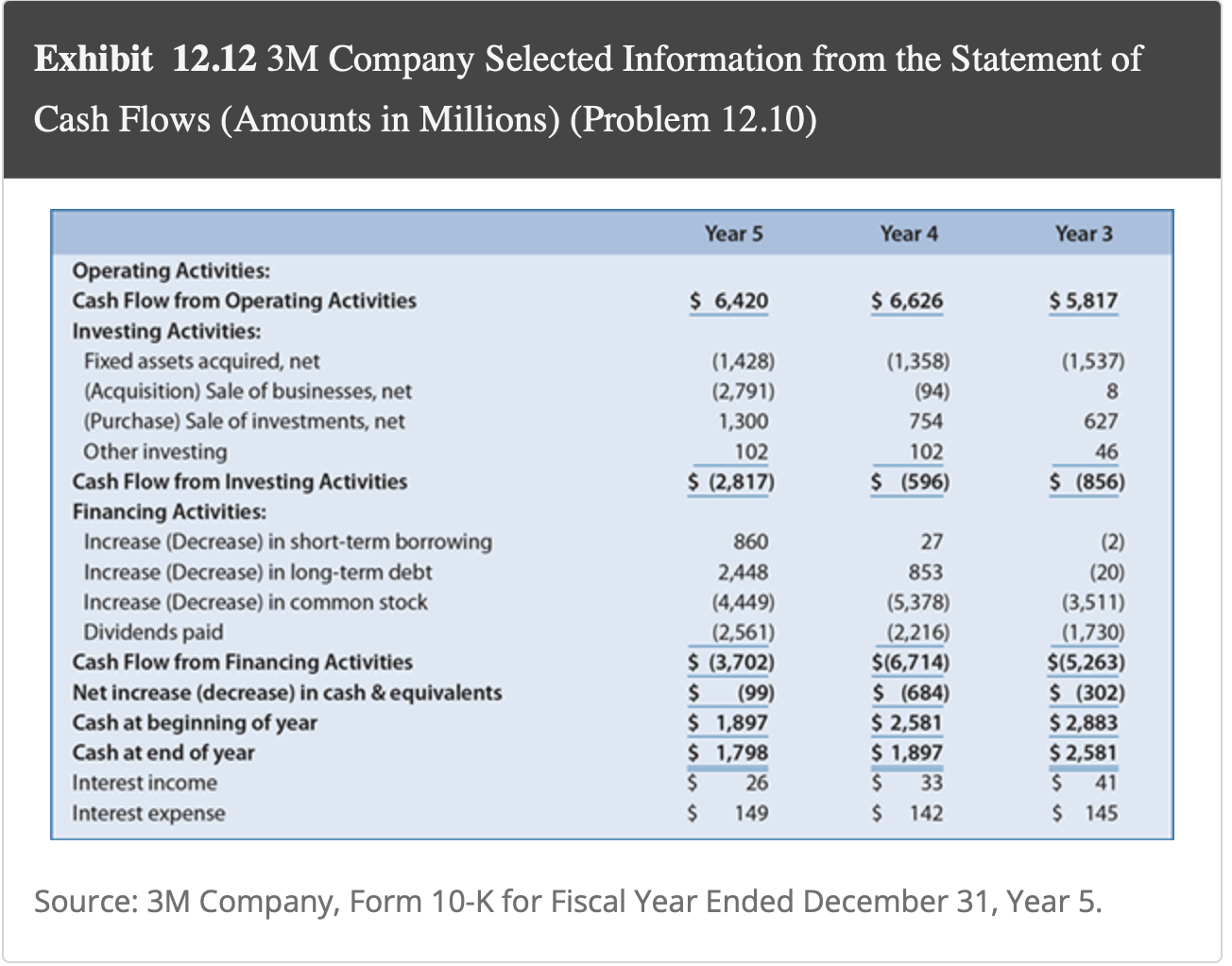

The 3M Company is a global diversified technology company active in the following product markets: consumer and office; display and graphics; electronics and communications; health care; industrial; safety, security, and protection services; and transportation. At the consumer level, 3M is probably most widely known for products such as Scotch Brand transparent tape and Post-it notes. Exhibit 12.12 presents information from the statement of cash flows and income statement for the 3M Company for Year 3, Year 4, and Year 5. During that period, 3M decreased cash and cash equivalents. The interest income reported by 3M pertains to interest earned on cash and marketable securities. 3M holds only small amounts of investments in marketable securities. 3Ms income tax rate is 35%.

Exhibit 12.12 3M Company Selected Information from the Statement of Cash Flows (Amounts in Millions) (Problem 12.10)

Required

a. Beginning with cash flows from operating activities, calculate the amount of free cash flows to all debt and equity capital stakeholders for 3M for Years 3, 4, and 5.

b. Beginning with cash flows from operating activities, calculate the amount of free cash flows 3M generated for common equity shareholders in Years 3, 4, and 5.

c. Reconcile the amounts of free cash flows 3M generated for common equity shareholders in Years 3, 4, and 5 from Requirement b with 3Ms uses of cash flows for equity shareholders, including share repurchases and dividend payments.

Exhibit 12.12 3M Company Selected Information from the Statement of Cash Flows (Amounts in Millions) (Problem 12.10) Source: 3M Company, Form 10-K for Fiscal Year Ended December 31, Year 5Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started