Answered step by step

Verified Expert Solution

Question

1 Approved Answer

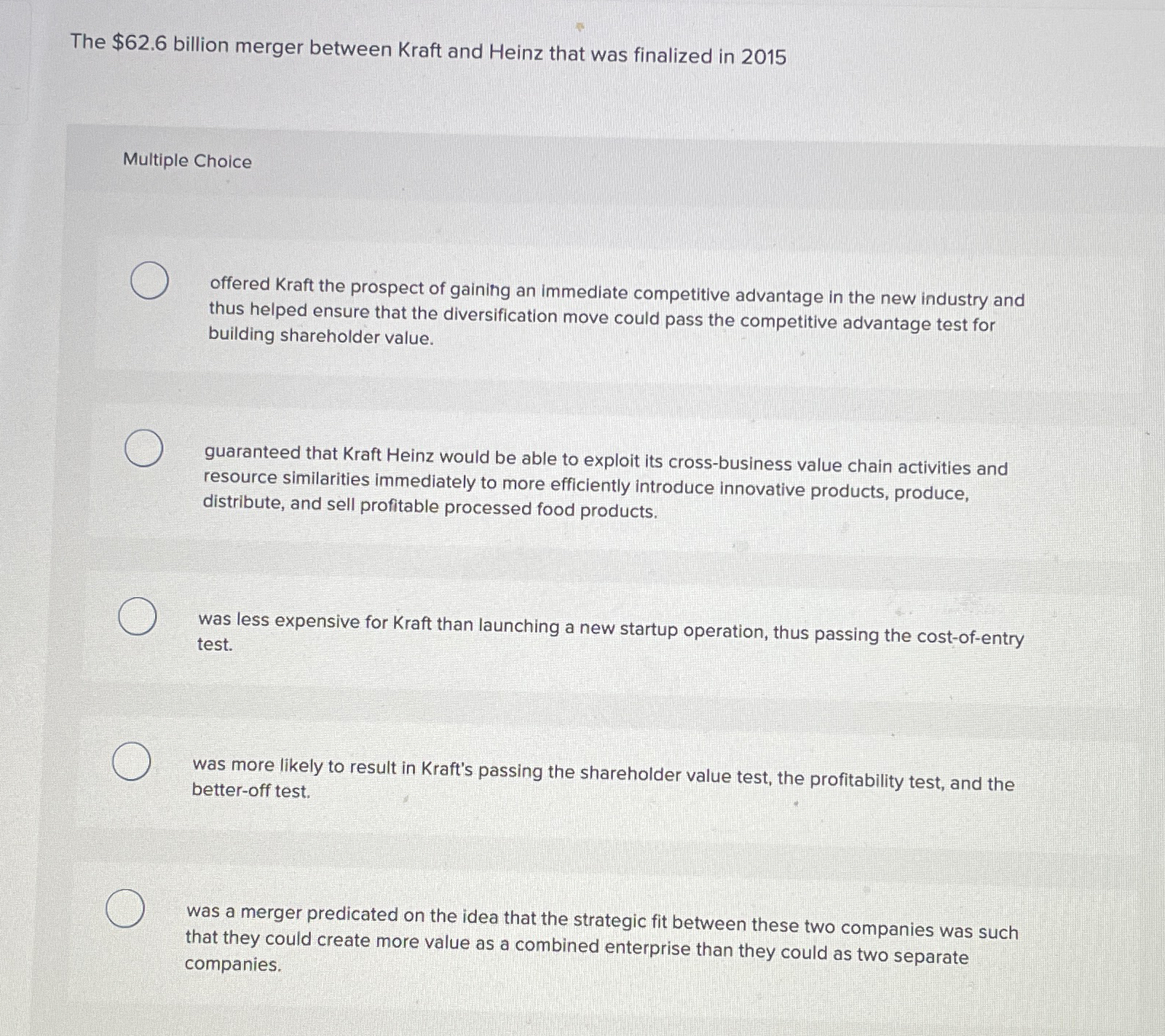

The $ 6 2 . 6 billion merger between Kraft and Heinz that was finalized in 2 0 1 5 Multiple Choice offered Kraft the

The $ billion merger between Kraft and Heinz that was finalized in

Multiple Choice

offered Kraft the prospect of gaining an immediate competitive advantage in the new industry and thus helped ensure that the diversification move could pass the competitive advantage test for building shareholder value.

guaranteed that Kraft Heinz would be able to exploit its crossbusiness value chain activities and resource similarities immediately to more efficiently introduce innovative products, produce, distribute, and sell profitable processed food products.

was less expensive for Kraft than launching a new startup operation, thus passing the costofentry test.

was more likely to result in Kraft's passing the shareholder value test, the profitability test, and the betteroff test.

was a merger predicated on the idea that the strategic fit between these two companies was such that they could create more value as a combined enterprise than they could as two separate companies.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started