Question

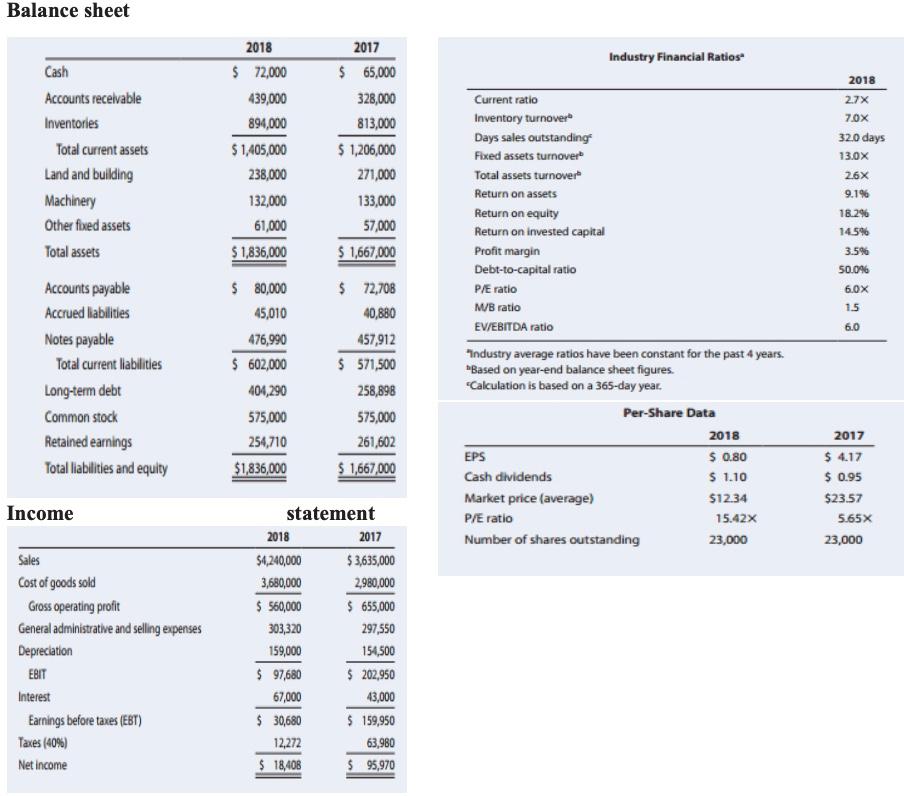

The ABC company 2017 and 2018 financial statements is provided below along with some industry average ratios. Note: Provide all the ratios possible under each

The ABC company 2017 and 2018 financial statements is provided below along with some industry average ratios.

Note: Provide all the ratios possible under each of the ratio categories and do not use the average method while calculating the ratios.

Requirement:

Assess ABCs liquidity position, asset management position, debt management position, and profitability ratios, and determine how they compare with peers and how its related position for all the ratios has changed over time. Also, calculate ABCs ROE as well as the industry average ROE, using the DuPont equation. From this analysis, how does ABCs financial position compare with the industry average numbers?

Balance sheet "Based on year-end balance sheet figures. "Calculation is based on a 365-day year. Balance sheet "Based on year-end balance sheet figures. "Calculation is based on a 365-day yearStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started