Answered step by step

Verified Expert Solution

Question

1 Approved Answer

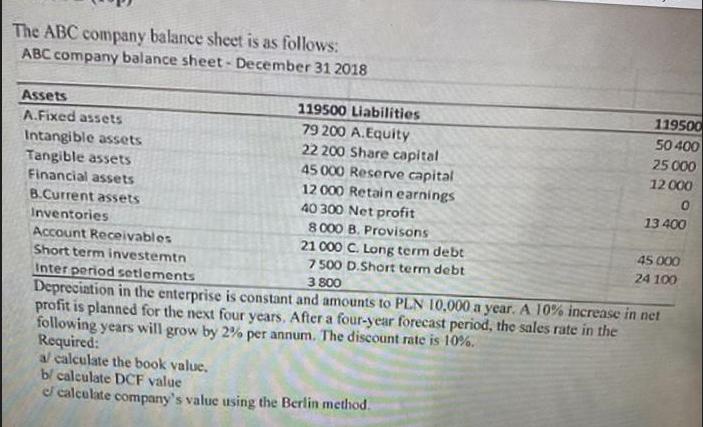

The ABC company balance sheet is as follows: ABC company balance sheet- December 31 2018 Assets A.Fixed assets Intangible assets Tangible assets Financial assets

The ABC company balance sheet is as follows: ABC company balance sheet- December 31 2018 Assets A.Fixed assets Intangible assets Tangible assets Financial assets B.Current assets Inventories Account Receivables Short term investemtn Inter period setlements 21 000 C. Long term debt 7 500 D.Short term debt 3 800 Depreciation in the enterprise is constant and amounts to PLN 10,000 a year. A 10% increase in net profit is planned for the next four years. After a four-year forecast period, the sales rate in the following years will grow by 2% per annum. The discount rate is 10%. Required: 119500 Liabilities 79 200 A.Equity 22 200 Share capital 45 000 Reserve capital 12 000 Retain earnings 40 300 Net profit 8000 B. Provisons al calculate the book value, b/ calculate DCF value e calculate company's value using the Berlin method. 119500 50 400 25 000 12 000 0 13 400 45 000 24 100

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER a Book Value Tangible Assets Intangible Assets Financial Assets Current Assets Liabil...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started