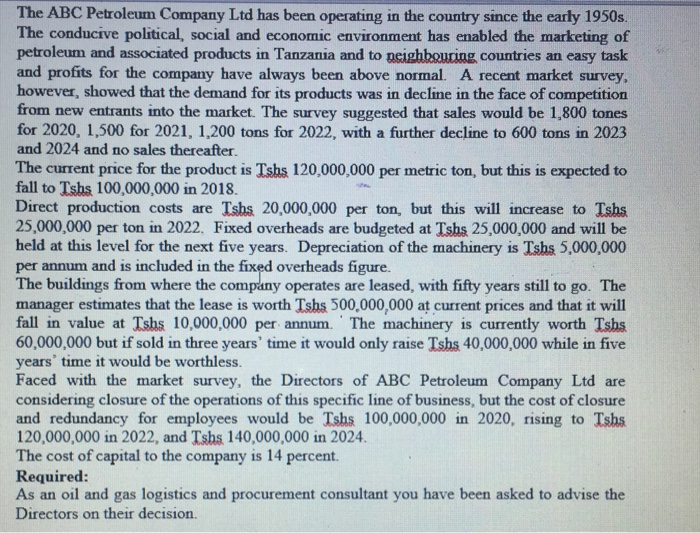

The ABC Petroleum Company Ltd has been operating in the country since the early 1950s. The conducive political, social and economic environment has enabled the marketing of petroleum and associated products in Tanzania and to neighbouring countries an easy task and profits for the company have always been above normal. A recent market survey. however, showed that the demand for its products was in decline in the face of competition from new entrants into the market. The survey suggested that sales would be 1,800 tones for 2020, 1,500 for 2021, 1,200 tons for 2022, with a further decline to 600 tons in 2023 and 2024 and no sales thereafter. The current price for the product is Tshs 120,000,000 per metric ton, but this is expected to fall to Tshs 100,000,000 in 2018. Direct production costs are Tshs 20,000,000 per ton, but this will increase to Tshs 25,000,000 per ton in 2022. Fixed overheads are budgeted at Tshs 25,000,000 and will be held at this level for the next five years. Depreciation of the machinery is Tshs 5,000,000 per annum and is included in the fixed overheads figure. The buildings from where the company operates are leased, with fifty years still to go. The manager estimates that the lease is worth Tshs 500,000,000 at current prices and that it will fall in value at Tshs 10,000,000 per annum. ' The machinery is currently worth Tshs. 60,000,000 but if sold in three years' time it would only raise Tshs 40,000,000 while in five years' time it would be worthless. Faced with the market survey, the Directors of ABC Petroleum Company Ltd are considering closure of the operations of this specific line of business, but the cost of closure and redundancy for employees would be Tshs 100,000,000 in 2020, rising to Tshs 120,000,000 in 2022, and Tshs 140,000,000 in 2024. The cost of capital to the company is 14 percent. Required: As an oil and gas logistics and procurement consultant you have been asked to advise the Directors on their decision. The ABC Petroleum Company Ltd has been operating in the country since the early 1950s. The conducive political, social and economic environment has enabled the marketing of petroleum and associated products in Tanzania and to neighbouring countries an easy task and profits for the company have always been above normal. A recent market survey. however, showed that the demand for its products was in decline in the face of competition from new entrants into the market. The survey suggested that sales would be 1,800 tones for 2020, 1,500 for 2021, 1,200 tons for 2022, with a further decline to 600 tons in 2023 and 2024 and no sales thereafter. The current price for the product is Tshs 120,000,000 per metric ton, but this is expected to fall to Tshs 100,000,000 in 2018. Direct production costs are Tshs 20,000,000 per ton, but this will increase to Tshs 25,000,000 per ton in 2022. Fixed overheads are budgeted at Tshs 25,000,000 and will be held at this level for the next five years. Depreciation of the machinery is Tshs 5,000,000 per annum and is included in the fixed overheads figure. The buildings from where the company operates are leased, with fifty years still to go. The manager estimates that the lease is worth Tshs 500,000,000 at current prices and that it will fall in value at Tshs 10,000,000 per annum. ' The machinery is currently worth Tshs. 60,000,000 but if sold in three years' time it would only raise Tshs 40,000,000 while in five years' time it would be worthless. Faced with the market survey, the Directors of ABC Petroleum Company Ltd are considering closure of the operations of this specific line of business, but the cost of closure and redundancy for employees would be Tshs 100,000,000 in 2020, rising to Tshs 120,000,000 in 2022, and Tshs 140,000,000 in 2024. The cost of capital to the company is 14 percent. Required: As an oil and gas logistics and procurement consultant you have been asked to advise the Directors on their decision