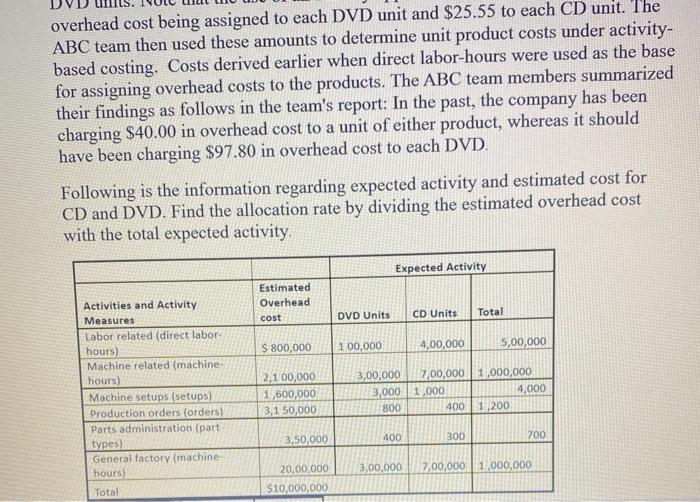

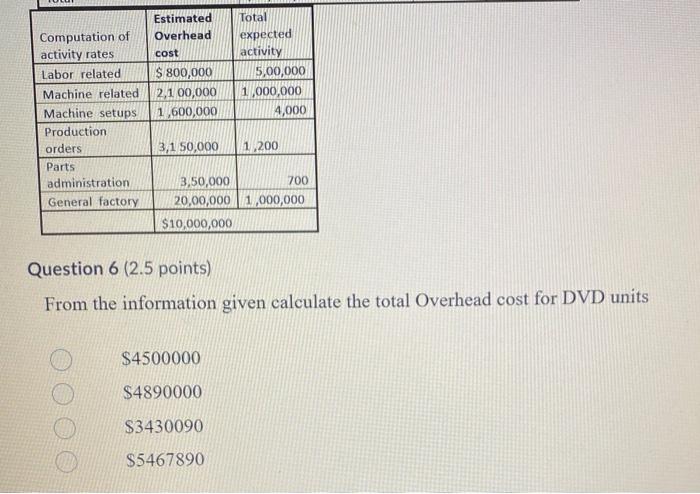

The ABC team gathered basic information relating to the company's two products. A summary of some of this information follows. For the current year, the company's budget provides for selling 50,000 DVD units and 200,000 CD units. Both products require two direct labor-hours to complete. Therefore, the company plans to work 500,000 direct labor-hours (DLHs) during the current year The ABC team then analyzed Comtek Sound, Inc.'s operations and identified six major activities to include in the new activity-based costing system. The machine setups activity cost pool, for example, was assigned $ 1,600.000 in overhead cost. The company expects to complete 4,000 setups during the year, of which 3JX) will be for DVD units and 1.000 will be for CD units. The ABC team then computed an activity rate for each activity. The activity rate of $4(X) per machine setup, for example, was computed by dividing the total estimated overhead cost in the activity cost pool, $ 1,600,000, by the expected amount of activity, 4,000 setups. This process was repeated for each of the other activities in the activity- based costing system Once the activity rates were calculated, it was easy to compute the overhead cost that would be allocated to each product. For example, the amount of machine setup cost allocated to DVD units was determined by multiplying the activity rate of S-100 per setup by the 3,000 expected setups for DVD units during the year. This yielded a total of S1,200.000 in machine setup costs to be assigned to the DVD units. Note that the use of an activity approach has resulted in $97.80 in overhead cost being assigned to each DVD unit and $25.55 to each CD unit. The ABC team then used these amounts to determine unit product costs under activity- based costing. Costs derived earlier when direct labor-hours were used as the base for assigning overhead costs to the products. The ABC team members summarized overhead cost being assigned to each DVD unit and $25.55 to each CD unit. The ABC team then used these amounts to determine unit product costs under activity- based costing. Costs derived earlier when direct labor-hours were used as the base for assigning overhead costs to the products. The ABC team members summarized their findings as follows in the team's report: In the past, the company has been charging $40.00 in overhead cost to a unit of either product, whereas it should have been charging $97.80 in overhead cost to each DVD. Following is the information regarding expected activity and estimated cost for CD and DVD. Find the allocation rate by dividing the estimated overhead cost with the total expected activity Expected Activity Estimated Overhead cost DVD Units CD Units Total S 800,000 100,000 4,00,000 5,00,000 Activities and Activity Measures Labor related (direct labor hours) Machine related (machine. hours) Machine setups (setups) Production orders (orders) Parts administration (part types) General factory machine hours) Total 2,100,000 1,600,000 3,150,000 3,00,000 2,00,000 1,000,000 3,000 1.000 4,000 800 400 1,200 400 300 700 3,50,000 3,00,000 7,00,000 1,000,000 20,00,000 $10,000,000 Estimated Overhead cost Total expected activity 5,00,000 1,000,000 4,000 Computation of activity rates Labor related Machine related Machine setups Production orders Parts administration General factory $ 800,000 2,100,000 1,600,000 3,150,000 1,200 3,50,000 700 20,00,000,000,000 $10,000,000 Question 6 (2.5 points) From the information given calculate the total Overhead cost for DVD units $4500000 S4890000 S3430090 $5467890 Question 7 (2.5 points) From the information given calculate the total Overhead cost for DVD units $4330850 $5367890 $3500000 $5110000