The above is an example. The problem will ask similar questions.

The above is an example. The problem will ask similar questions.

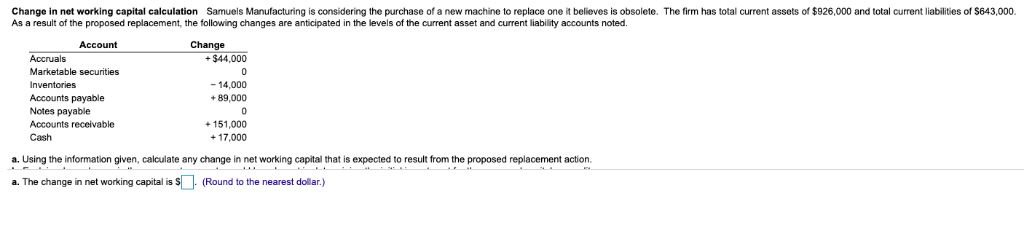

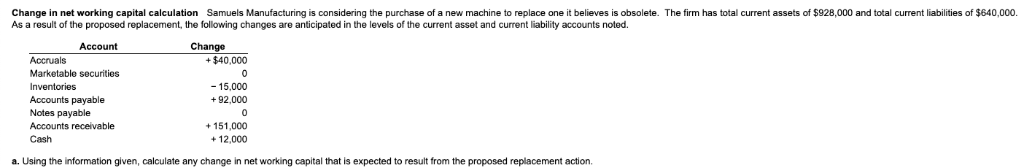

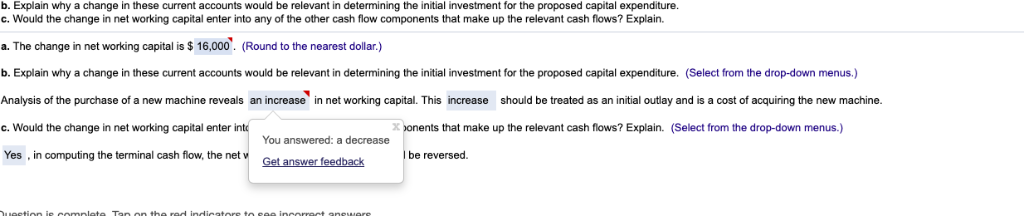

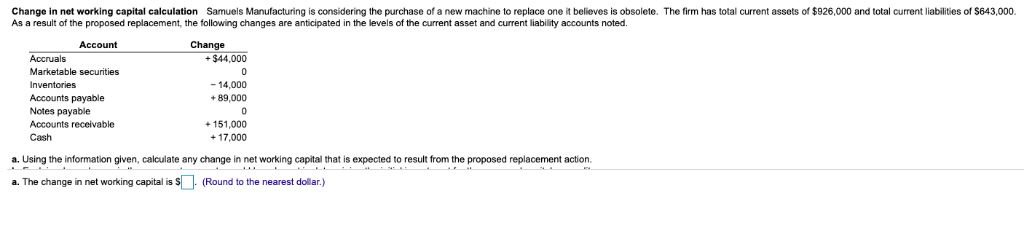

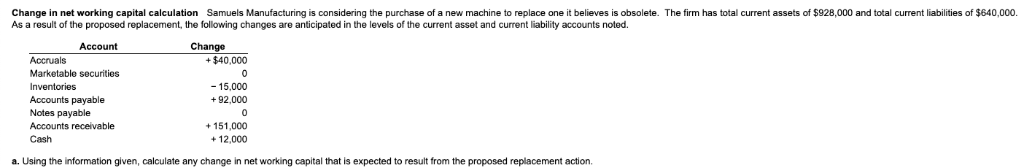

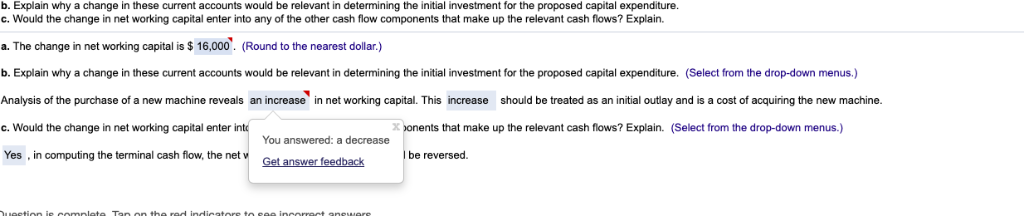

Change in net working capital calculation Samuels Manufacturing is considering the purchase of a new machine to replace one it believes is obsolete. The firm has total current assets of $928,000 and total current liabilities of $640,000 As a result of the proposed replacement, the following changes are anticipated in the levels of the current asset and current liability accounts noted Account Change +$40,000 Accruals Marketable securities 15,000 +92,000 Accounts payable Notes payable Accounts receivable Cash +151,000 +12,000 a. Using the information given, calculate any change in net working capital that is expected to result from the proposed replacement action b. Explain why a change in these current accounts would be relevant in determining the initial investment for the proposed capital expenditure. c. Would the change in net working capital enter into any of the other cash flow components that make up the relevant cash flows? Explain. a. The change in net working capital is $16,000. (Round to the nearest dollar.) b. Explain why a change in these current accounts would be relevant in determining the initial investment for the proposed capital expenditure. (Select from the drop-down menus.) Analysis of the purchase of a new machine reveals an increase in net working capital. This increase should be treated as an initial outlay and is a cost of acquiring the new machine. c. Would the change in net working capital enter in Yes, in computing the terminal cash flow, the net onents that make up the relevant cash flows? Explain. (Select from the drop-down menus.) You answered: a decrease l be reversed Change in net working capital calculation Samuels Manufacturing is considering the purchase of a new machine to replace one it believes is obsolete. The firm has total current assets of $926,000 and total current liabilities of S643,000. As a result of the proposed replacement, the following changes are anticipated in the levels of the current asset and current liability accounts noted Account Change $44,000 Accruals Marketable securities Inventories Accounts payable Notes payable 14,000 89,000 151,000 +17,000 Cash a. Using the information given, calculate any change in net working capital that is expected to result from the proposed replacement action. a. The change in net working capital is ( (Round to the nearest dolar.) Change in net working capital calculation Samuels Manufacturing is considering the purchase of a new machine to replace one it believes is obsolete. The firm has total current assets of $928,000 and total current liabilities of $640,000 As a result of the proposed replacement, the following changes are anticipated in the levels of the current asset and current liability accounts noted Account Change +$40,000 Accruals Marketable securities 15,000 +92,000 Accounts payable Notes payable Accounts receivable Cash +151,000 +12,000 a. Using the information given, calculate any change in net working capital that is expected to result from the proposed replacement action b. Explain why a change in these current accounts would be relevant in determining the initial investment for the proposed capital expenditure. c. Would the change in net working capital enter into any of the other cash flow components that make up the relevant cash flows? Explain. a. The change in net working capital is $16,000. (Round to the nearest dollar.) b. Explain why a change in these current accounts would be relevant in determining the initial investment for the proposed capital expenditure. (Select from the drop-down menus.) Analysis of the purchase of a new machine reveals an increase in net working capital. This increase should be treated as an initial outlay and is a cost of acquiring the new machine. c. Would the change in net working capital enter in Yes, in computing the terminal cash flow, the net onents that make up the relevant cash flows? Explain. (Select from the drop-down menus.) You answered: a decrease l be reversed Change in net working capital calculation Samuels Manufacturing is considering the purchase of a new machine to replace one it believes is obsolete. The firm has total current assets of $926,000 and total current liabilities of S643,000. As a result of the proposed replacement, the following changes are anticipated in the levels of the current asset and current liability accounts noted Account Change $44,000 Accruals Marketable securities Inventories Accounts payable Notes payable 14,000 89,000 151,000 +17,000 Cash a. Using the information given, calculate any change in net working capital that is expected to result from the proposed replacement action. a. The change in net working capital is ( (Round to the nearest dolar.)

The above is an example. The problem will ask similar questions.

The above is an example. The problem will ask similar questions.