Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The above is the question A. Smith and B. Jones are in partnership, trading as A. Smith & Co., retail drapers. The following trial balance

The above is the question

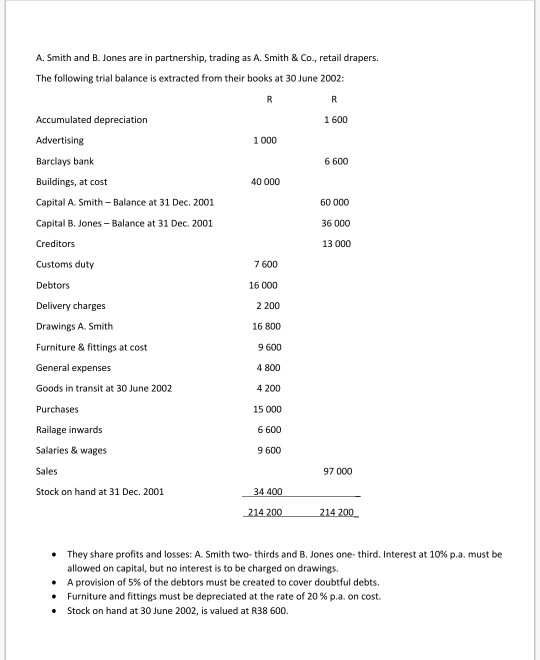

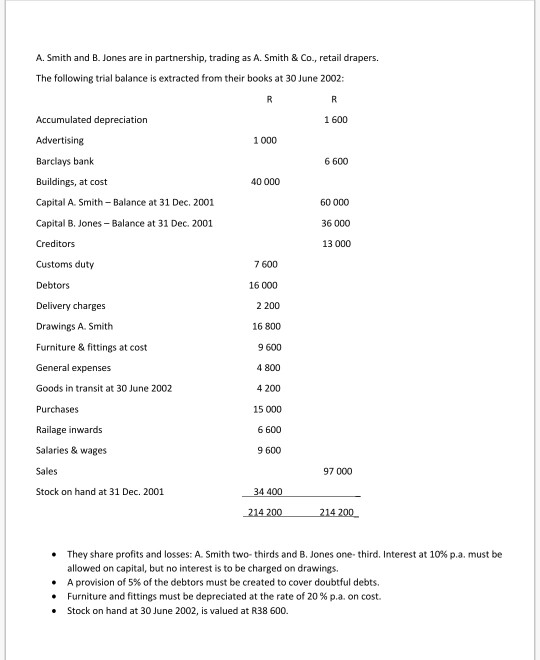

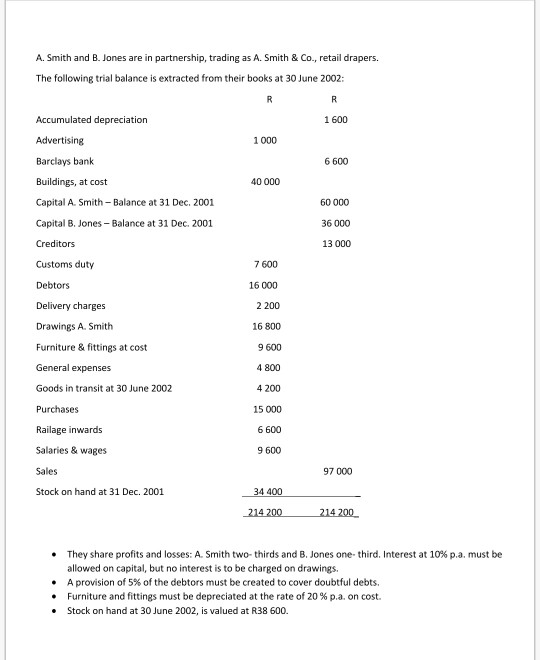

A. Smith and B. Jones are in partnership, trading as A. Smith & Co., retail drapers. The following trial balance is extracted from their books at 30 June 2002: Accumulated depreciation 1 600 1 000 6 600 Advertising Barclays bank Buildings, at cost Capital A. Smith-Balance at 31 Dec. 2001 Capital B. Jones - Balance at 31 Dec. 2001 40 000 60 000 36 000 13 000 Creditors Customs duty 7600 Debtors 16 000 2 200 Delivery charges Drawings A. Smith 16 800 Furniture & fittings at cost 9 600 General expenses 4 800 Goods in transit at 30 June 2002 4200 Purchases 15 000 Railage inwards 6 600 9 600 Salaries & wages Sales 97 000 Stock on hand at 31 Dec. 2001 34 400 214200 214 200 They share profits and losses: A. Smith two-thirds and B. Jones one-third. Interest at 10% p.a. must be allowed on capital, but no interest is to be charged on drawings. A provision of 5% of the debtors must be created to cover doubtful debts. Furniture and fittings must be depreciated at the rate of 20% p.a. on cost. Stock on hand at 30 June 2002, is valued at R38 600. A. Smith and B. Jones are in partnership, trading as A. Smith & Co., retail drapers. The following trial balance is extracted from their books at 30 June 2002: Accumulated depreciation 1 600 1 000 6 600 Advertising Barclays bank Buildings, at cost Capital A. Smith-Balance at 31 Dec. 2001 Capital B. Jones - Balance at 31 Dec. 2001 40 000 60 000 36 000 13 000 Creditors Customs duty 7600 Debtors 16 000 2 200 Delivery charges Drawings A. Smith 16 800 Furniture & fittings at cost 9 600 General expenses 4 800 Goods in transit at 30 June 2002 4200 Purchases 15 000 Railage inwards 6 600 9 600 Salaries & wages Sales 97 000 Stock on hand at 31 Dec. 2001 34 400 214200 214 200 They share profits and losses: A. Smith two-thirds and B. Jones one-third. Interest at 10% p.a. must be allowed on capital, but no interest is to be charged on drawings. A provision of 5% of the debtors must be created to cover doubtful debts. Furniture and fittings must be depreciated at the rate of 20% p.a. on cost. Stock on hand at 30 June 2002, is valued at R38 600. A. Smith and B. Jones are in partnership, trading as A. Smith & Co., retail drapers. The following trial balance is extracted from their books at 30 June 2002: Accumulated depreciation 1 600 1 000 6 600 Advertising Barclays bank Buildings, at cost Capital A. Smith-Balance at 31 Dec. 2001 Capital B. Jones - Balance at 31 Dec. 2001 40 000 60 000 36 000 13 000 Creditors Customs duty 7600 Debtors 16 000 2 200 Delivery charges Drawings A. Smith 16 800 Furniture & fittings at cost 9 600 General expenses 4 800 Goods in transit at 30 June 2002 4200 Purchases 15 000 Railage inwards 6 600 9 600 Salaries & wages Sales 97 000 Stock on hand at 31 Dec. 2001 34 400 214200 214 200 They share profits and losses: A. Smith two-thirds and B. Jones one-third. Interest at 10% p.a. must be allowed on capital, but no interest is to be charged on drawings. A provision of 5% of the debtors must be created to cover doubtful debts. Furniture and fittings must be depreciated at the rate of 20% p.a. on cost. Stock on hand at 30 June 2002, is valued at R38 600. Required Prepare the financial statementsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started