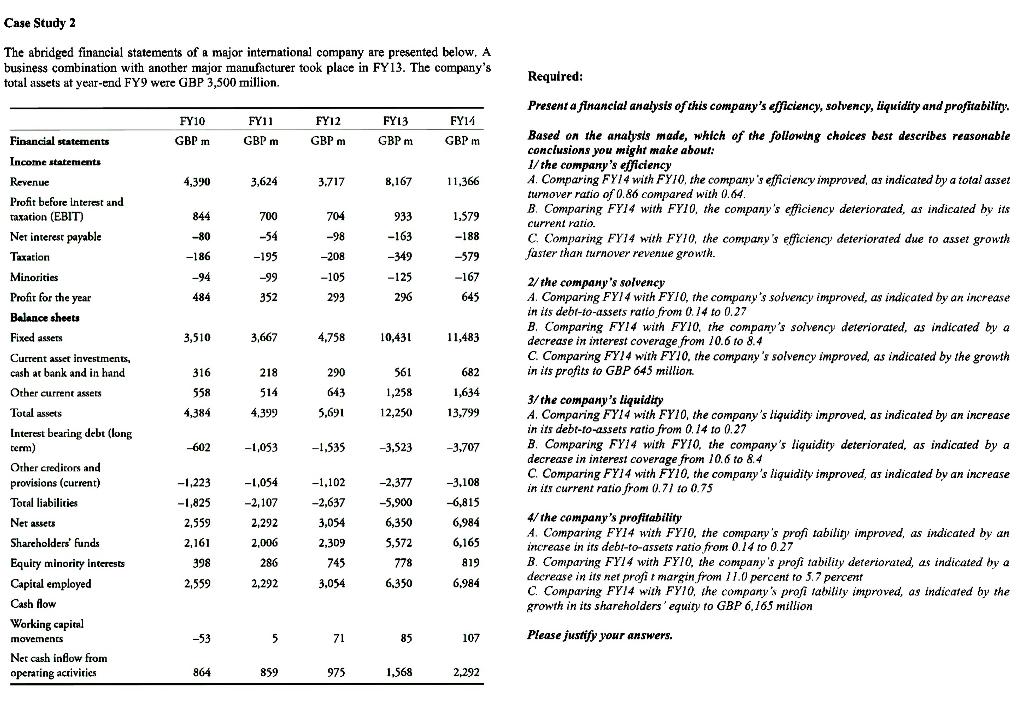

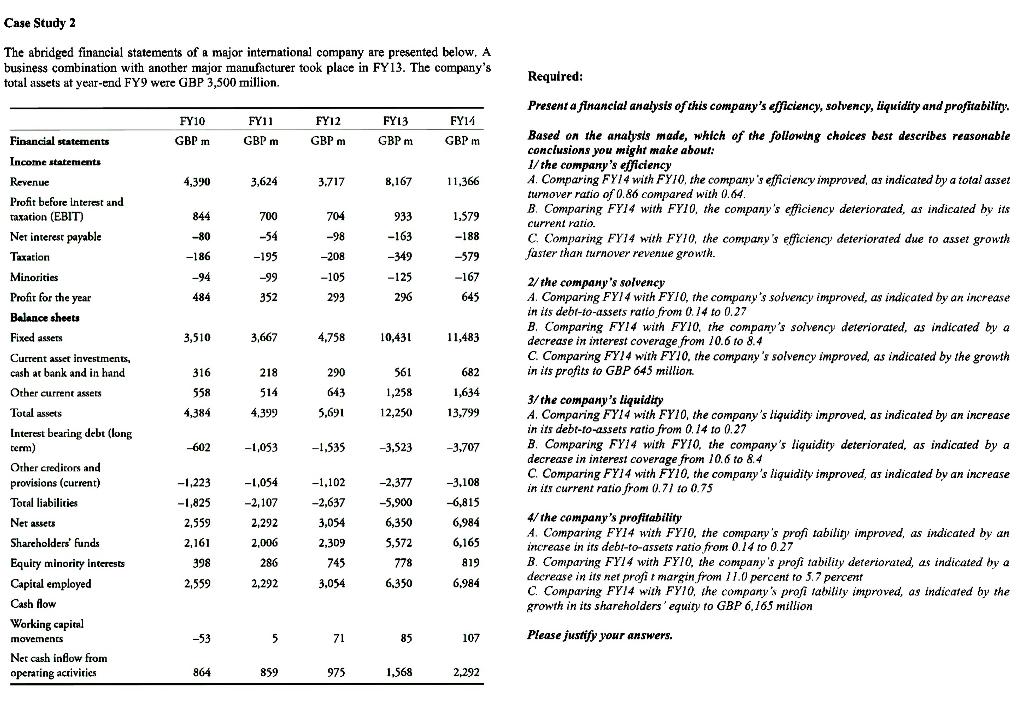

The abridged financial statements of a major international company are presented below, A business combination with another major manufacturer took place in FY13. The company's total assets at year-end FY9 were GBP 3,500 million. Required: Present a fitancial analysis of this company's efficiency, solvency, liquidity and profitability. Based on the antalysis made, which of the following choices best describes reasonable conclusions you might make about: 1/the company's efficiency A. Comparing FYI4 with FYIO, the company's efficiency improved, as indicated by a total asset turnover ratio of 0.86 compared with 0.64. B. Comparing FY14 with FY10, the company's efficiency deteriorated, as indicated by its current ratio. C. Comparing FYI4 with FYIO, the company's efficiency deteriorated due to asset growth faster than turnover revenue growth. 2/ the company's solvency A. Comparing FY14 with FYJO, the company's solvency improved, as indicated by an increase in its debt-to-assets ratio from 0.14 to 0.27 B. Comparing FYI4 with FY10, the company's solvency deteriorated, as indicated by a decrease in interest coverage from 10.6 to 8.4 C. Comparing FY14 with FY10, the company's solvency improved, as indicaled by the growth in its profits to GBP 645 million. 3/ the company's liquidity A. Comparing FYIL with FY10, the company's liquidity improved, as indicated by an increase it its debt-to-assets ratio from 0.14 to 0.27 B. Comparing FYI4 with FY10, the company's liquidity deteriorated, as indicated by a decrease in interest coverage from 10.6 to 8.4 C. Comparing FY14 with FY10, the company's liquidity improved, as indicated by an increase in its current ratio from 0.71 to 0.75 4/the company's proftiability A. Comparing FYI4 with FYIO, the company's profi tability improved, as indicated by an increase in its debt-to-assets ratio from 0.14 to 0.27 B. Comparing FYI 4 with FYIO, the company's profs tability deteriorated, as indicated by a decrease in its net profi t margin from 11.0 percent to 5.7 percent C. Comparing FY14 with FY10, the company's profi tability improved, as indicated by the growth in its shareholders' equity to GBP 6,165 million Please justify your answers. The abridged financial statements of a major international company are presented below, A business combination with another major manufacturer took place in FY13. The company's total assets at year-end FY9 were GBP 3,500 million. Required: Present a fitancial analysis of this company's efficiency, solvency, liquidity and profitability. Based on the antalysis made, which of the following choices best describes reasonable conclusions you might make about: 1/the company's efficiency A. Comparing FYI4 with FYIO, the company's efficiency improved, as indicated by a total asset turnover ratio of 0.86 compared with 0.64. B. Comparing FY14 with FY10, the company's efficiency deteriorated, as indicated by its current ratio. C. Comparing FYI4 with FYIO, the company's efficiency deteriorated due to asset growth faster than turnover revenue growth. 2/ the company's solvency A. Comparing FY14 with FYJO, the company's solvency improved, as indicated by an increase in its debt-to-assets ratio from 0.14 to 0.27 B. Comparing FYI4 with FY10, the company's solvency deteriorated, as indicated by a decrease in interest coverage from 10.6 to 8.4 C. Comparing FY14 with FY10, the company's solvency improved, as indicaled by the growth in its profits to GBP 645 million. 3/ the company's liquidity A. Comparing FYIL with FY10, the company's liquidity improved, as indicated by an increase it its debt-to-assets ratio from 0.14 to 0.27 B. Comparing FYI4 with FY10, the company's liquidity deteriorated, as indicated by a decrease in interest coverage from 10.6 to 8.4 C. Comparing FY14 with FY10, the company's liquidity improved, as indicated by an increase in its current ratio from 0.71 to 0.75 4/the company's proftiability A. Comparing FYI4 with FYIO, the company's profi tability improved, as indicated by an increase in its debt-to-assets ratio from 0.14 to 0.27 B. Comparing FYI 4 with FYIO, the company's profs tability deteriorated, as indicated by a decrease in its net profi t margin from 11.0 percent to 5.7 percent C. Comparing FY14 with FY10, the company's profi tability improved, as indicated by the growth in its shareholders' equity to GBP 6,165 million Please justify your answers