Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The account balances of Pacilio Security Services, Incorporated as of January 1, Year 3, are shown here: Cash $ 8,900 Accounts Receivable 1,500 Supplies 65

The account balances of Pacilio Security Services, Incorporated as of January 1, Year 3, are shown here:

| Cash | $ 8,900 |

|---|---|

| Accounts Receivable | 1,500 |

| Supplies | 65 |

| Prepaid Rent | 800 |

| Land | 4,000 |

| Accounts Payable | 1,050 |

| Unearned Revenue | 200 |

| Salaries Payable | 1,200 |

| Notes Payable | 2,000 |

| Common Stock | 8,000 |

| Retained Earnings | 2,815 |

During Year 3, Pacilio Security Services experienced the following transactions:

- Paid the salaries payable from Year 2.

- Paid the balance of $2,000 on the debt owed to the Small Business Government Agency. The loan is interest-free.

- Performed $32,000 of security services for numerous local events during the year; $21,000 was on account and $11,000 was for cash.

- On May 1, paid $3,000 for 12 months rent in advance.

- Purchased supplies on account for $700.

- Paid salaries expense for the year of $9,000.

- Incurred other operating expenses on account, $4,200.

- On October 1, Year 3, a customer paid $1,200 for services to be provided over the next 12 months.

- Collected $19,000 of accounts receivable during the year.

- Paid $5,950 on accounts payable.

- Paid $1,800 of advertising expenses for the year.

- Paid a cash dividend to the shareholders of $4,650.

- The market value of the land was determined to be $5,500 at December 31, Year 3.

Adjustments

- There was $120 of supplies on hand at the end of the year.

- Recognized the expired rent.

- Recognized the earned revenue from Year 2 and transaction no. 8.

- Accrued salaries were $1,000 at December 31, Year 3.

Appreciates if the the equations are explained as well!!!

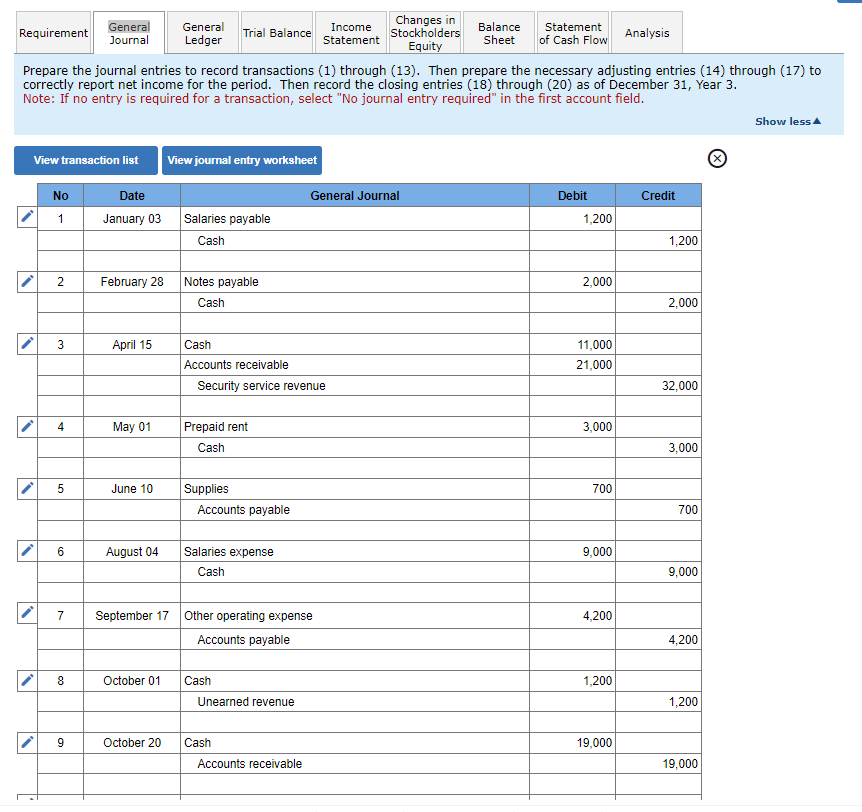

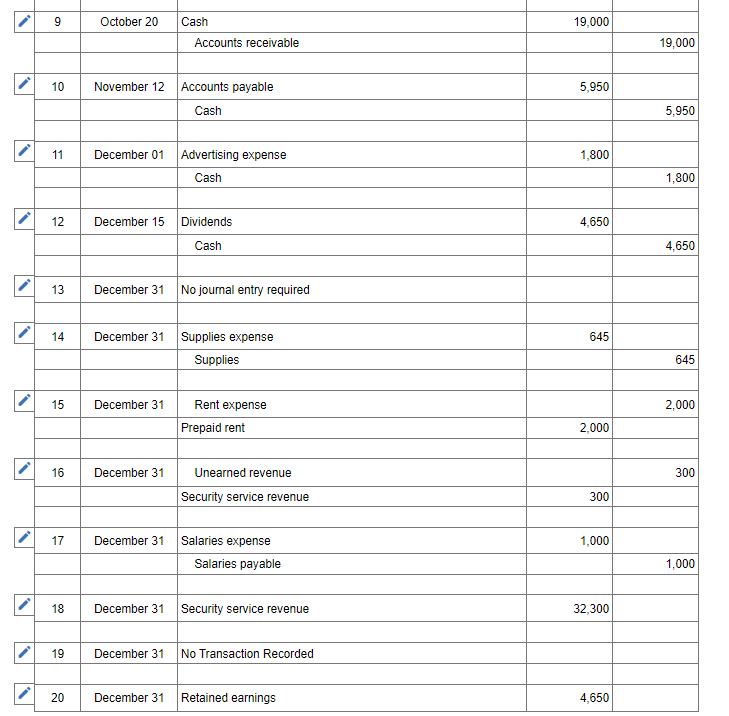

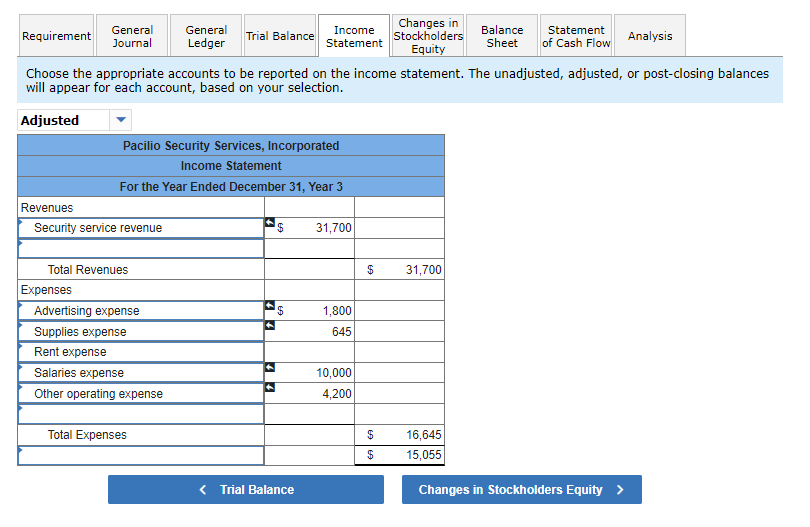

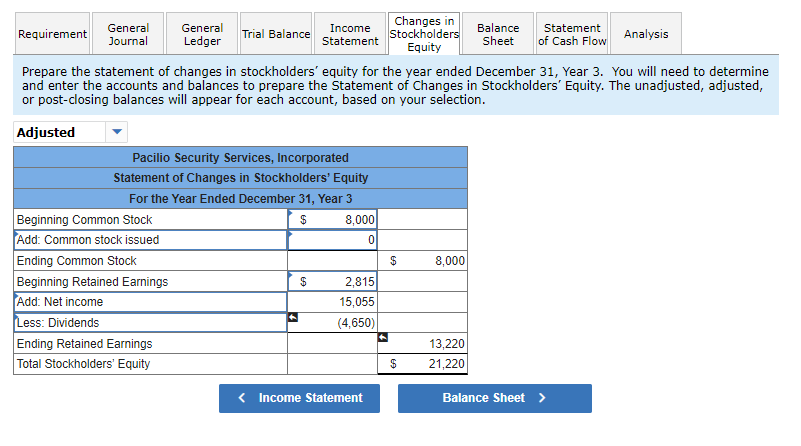

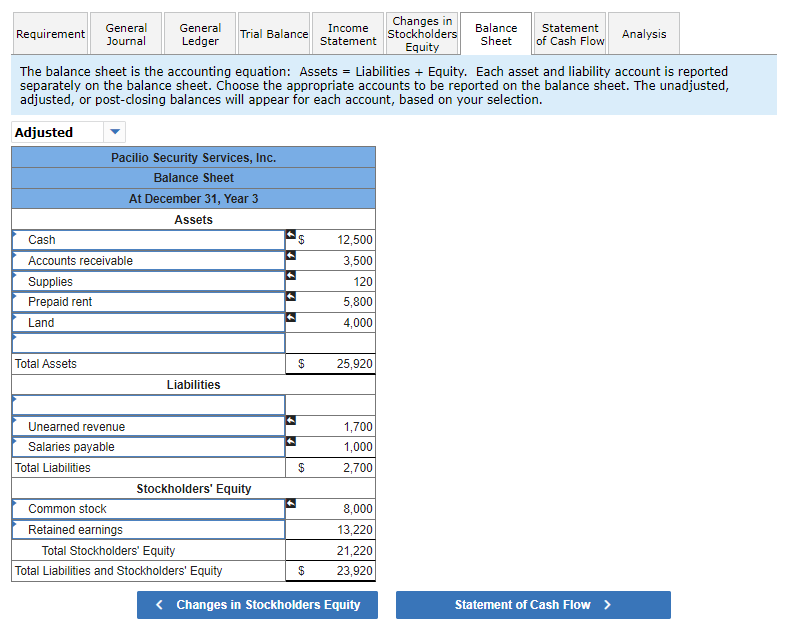

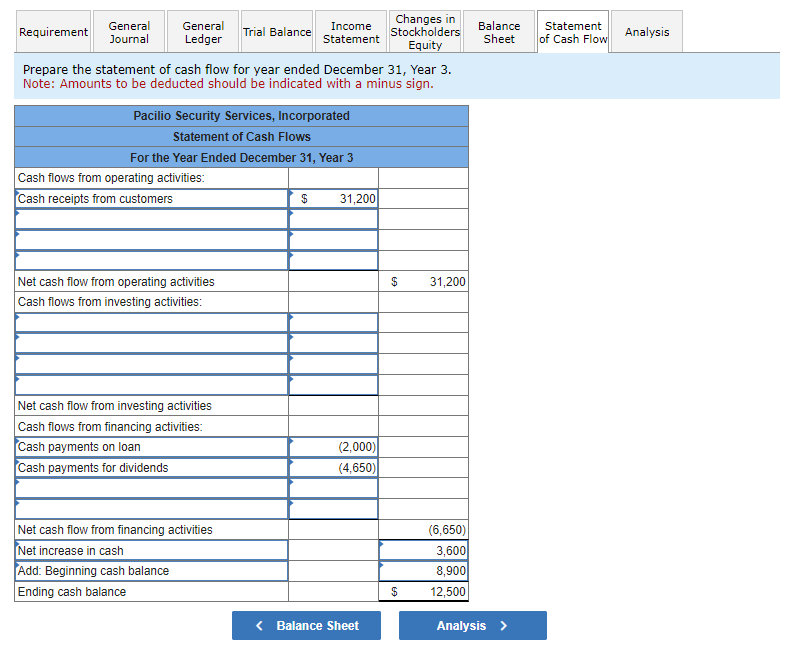

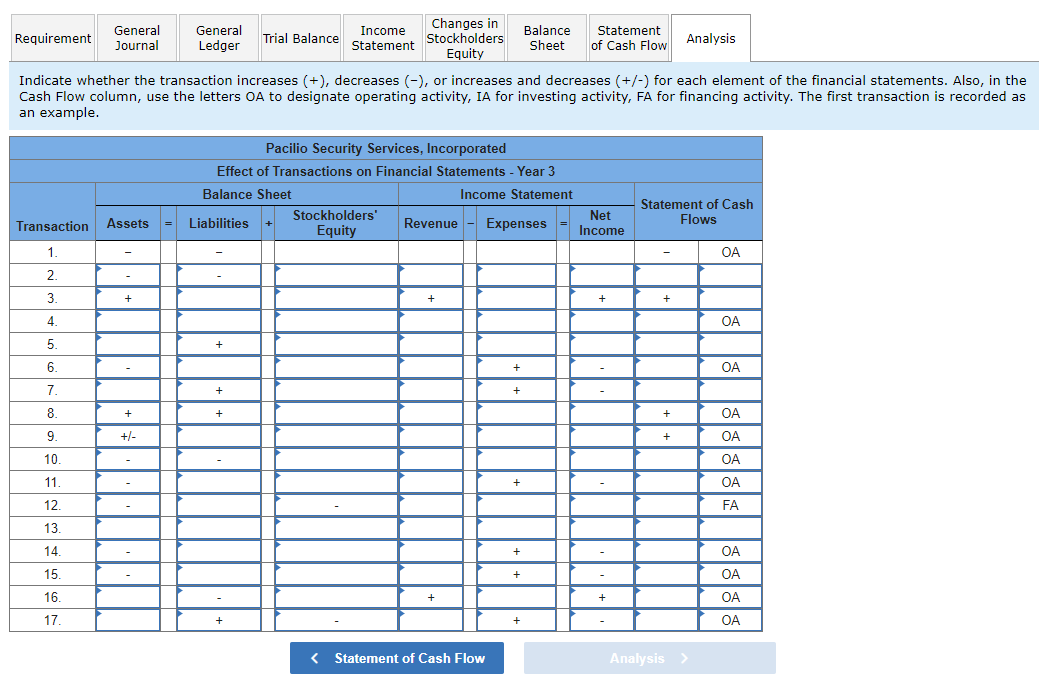

Prepare the journal entries to record transactions (1) through (13). Then prepare the necessary adjusting entries (14) through (17) to correctly report net income for the period. Then record the closing entries (18) through (20) as of December 31 , Year 3. Note: If no entry is required for a transaction, select "No journal entry required" in the first account field. Choose the appropriate accounts to be reported on the income statement. The unadjusted, adjusted, or post-closing balances will appear for each account, based on your selection. Prepare the statement of changes in stockholders' equity for the year ended December 31, Year 3 . You will need to determine and enter the accounts and balances to prepare the Statement of Changes in Stockholders' Equity. The unadjusted, adjusted, or post-closing balances will appear for each account, based on your selection. The balance sheet is the accounting equation: Assets = Liabilities + Equity. Each asset and liability account is reported separately on the balance sheet. Choose the appropriate accounts to be reported on the balance sheet. The unadjusted, adjusted, or post-closing balances will appear for each account, based on your selection. Prepare the statement of cash flow for year ended December 31, Year 3. Note: Amounts to be deducted should be indicated with a minus sign. Indicate whether the transaction increases (+), decreases (), or increases and decreases (+/) for each element of the financial statements. Also, in the Cash Flow column, use the letters OA to designate operating activity, IA for investing activity, FA for financing activity. The first transaction is recorded as an example. Prepare the journal entries to record transactions (1) through (13). Then prepare the necessary adjusting entries (14) through (17) to correctly report net income for the period. Then record the closing entries (18) through (20) as of December 31 , Year 3. Note: If no entry is required for a transaction, select "No journal entry required" in the first account field. Choose the appropriate accounts to be reported on the income statement. The unadjusted, adjusted, or post-closing balances will appear for each account, based on your selection. Prepare the statement of changes in stockholders' equity for the year ended December 31, Year 3 . You will need to determine and enter the accounts and balances to prepare the Statement of Changes in Stockholders' Equity. The unadjusted, adjusted, or post-closing balances will appear for each account, based on your selection. The balance sheet is the accounting equation: Assets = Liabilities + Equity. Each asset and liability account is reported separately on the balance sheet. Choose the appropriate accounts to be reported on the balance sheet. The unadjusted, adjusted, or post-closing balances will appear for each account, based on your selection. Prepare the statement of cash flow for year ended December 31, Year 3. Note: Amounts to be deducted should be indicated with a minus sign. Indicate whether the transaction increases (+), decreases (), or increases and decreases (+/) for each element of the financial statements. Also, in the Cash Flow column, use the letters OA to designate operating activity, IA for investing activity, FA for financing activity. The first transaction is recorded as an exampleStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started