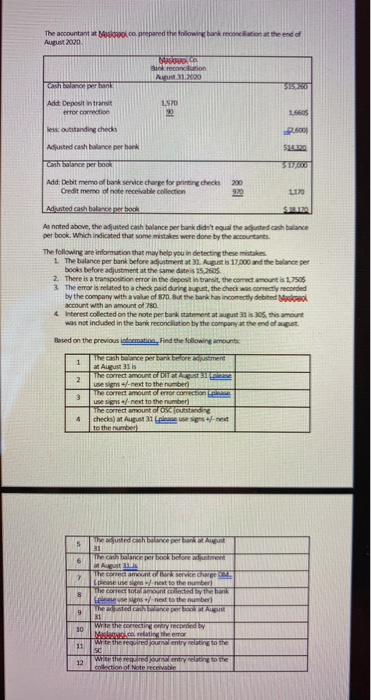

The accountant at a poco prepared the following bank reconciliation at the end of August 2020 : inkrecondition A 31000 cash banor per bank 315930 LSD Add Deposit in transit error correction less outstanding checks 2.500 Adjusted cash balance per bank 5143 Cash balance per book Add: Debit meme of bank service charge for ting checks 200 Credit memo of note receivable collection 1170 Adjusted cash balacabock As noted above, the adjusted ch balance per bark didn't equal the adjusted cash balance per book, Which indicated that some mistakes were done by the countants The following are information that may help you in detecting these mistakes The balance per bank before adjustment at 31. Augustis 17,000 and the balance per books before adjustment at the same date 15,2605 2. There is a transposition error in the deposit in transit, the correct amount 1.7505 3. The error is related to a check paid during august, the check was correctly recorded by the company with a vart of 870. But the bank has incorrectly debited account with an amount of 780. 4. Interest collected on the note per bank statement at august 31 is 305, this amount was not induded in the bank reconciliation by the company at the end of august Based on the previous indomation. Find the following amount 1 The cash balance per bare mere at August 31 is The correct amount 2 use signs of next to the number The correct amount or correction 3 use insext to the number) The correct amount Outstanding 4 checks) at August 31 please use signs of next to the bed 5 6 7 8 The justed cash bace per bankat August 31 per backbonement at Augusti The correct amounterwehr please use signs of next to the number the correct to mount corected by the bank next to the number The adjusted Concept ATM 31 Write the correcting recorded by Mel.corelating the error Write quired jours entry relating to the SC Write the required by going to the collection of Nottie 9 10 11 12 The accountant at a poco prepared the following bank reconciliation at the end of August 2020 : inkrecondition A 31000 cash banor per bank 315930 LSD Add Deposit in transit error correction less outstanding checks 2.500 Adjusted cash balance per bank 5143 Cash balance per book Add: Debit meme of bank service charge for ting checks 200 Credit memo of note receivable collection 1170 Adjusted cash balacabock As noted above, the adjusted ch balance per bark didn't equal the adjusted cash balance per book, Which indicated that some mistakes were done by the countants The following are information that may help you in detecting these mistakes The balance per bank before adjustment at 31. Augustis 17,000 and the balance per books before adjustment at the same date 15,2605 2. There is a transposition error in the deposit in transit, the correct amount 1.7505 3. The error is related to a check paid during august, the check was correctly recorded by the company with a vart of 870. But the bank has incorrectly debited account with an amount of 780. 4. Interest collected on the note per bank statement at august 31 is 305, this amount was not induded in the bank reconciliation by the company at the end of august Based on the previous indomation. Find the following amount 1 The cash balance per bare mere at August 31 is The correct amount 2 use signs of next to the number The correct amount or correction 3 use insext to the number) The correct amount Outstanding 4 checks) at August 31 please use signs of next to the bed 5 6 7 8 The justed cash bace per bankat August 31 per backbonement at Augusti The correct amounterwehr please use signs of next to the number the correct to mount corected by the bank next to the number The adjusted Concept ATM 31 Write the correcting recorded by Mel.corelating the error Write quired jours entry relating to the SC Write the required by going to the collection of Nottie 9 10 11 12