Question

The accountant for Potter Corporation has developed the following information for the company's defined-benefit pension plan for 2020: Service cost $300,000 Actual return on plan

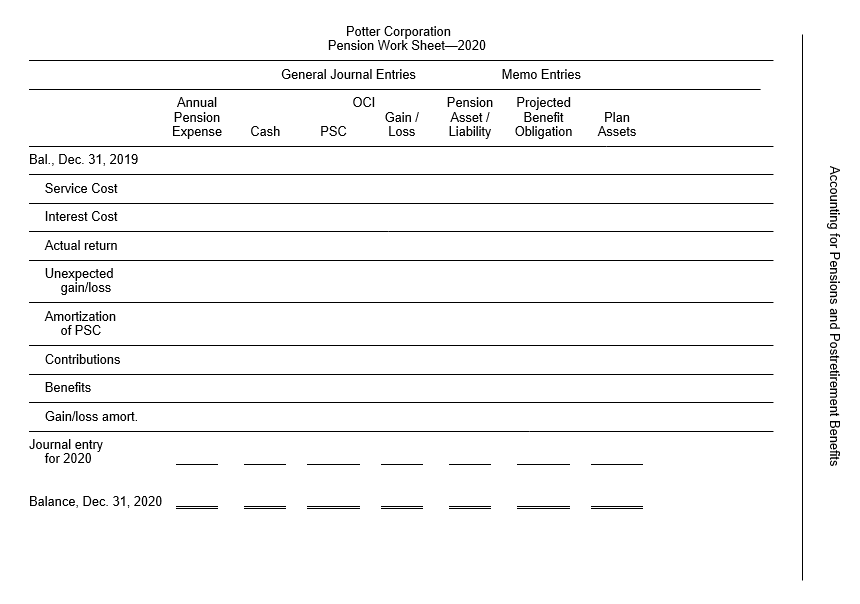

The accountant for Potter Corporation has developed the following information for the company's defined-benefit pension plan for 2020:

Service cost $300,000

Actual return on plan assets 250,000

Annual contribution to the plan 800,000

Amortization of prior service cost 125,000

Benefits paid to retirees 200,000

Settlement rate 8%

Expected rate of return on plan assets 7%

The projected benefit obligation on December 31, 2019, amounted to $3,500,000 and plan assets are $3,300,000 on the same date. The accumulated OCI on December 31, 2019, was $600,000.

Instructions

- Using the above information for the Corporation, complete the pension worksheet for 2020. Indicate (credit) entries by parentheses. Calculated amounts should be supported.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started