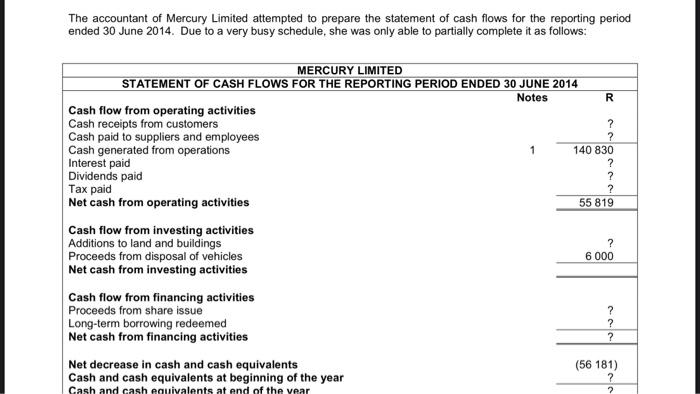

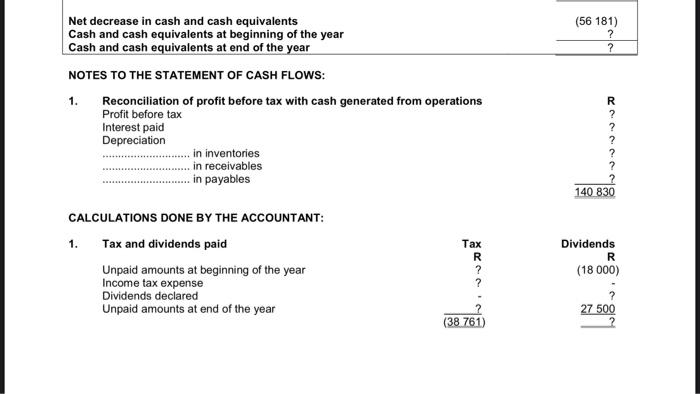

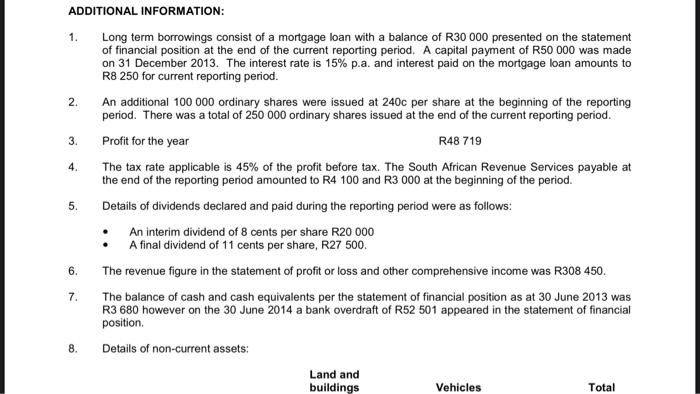

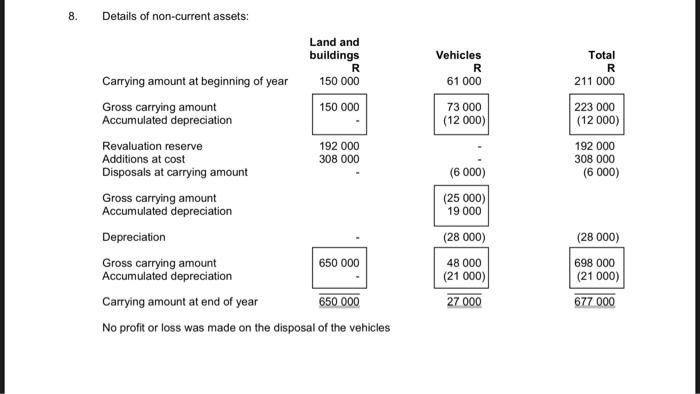

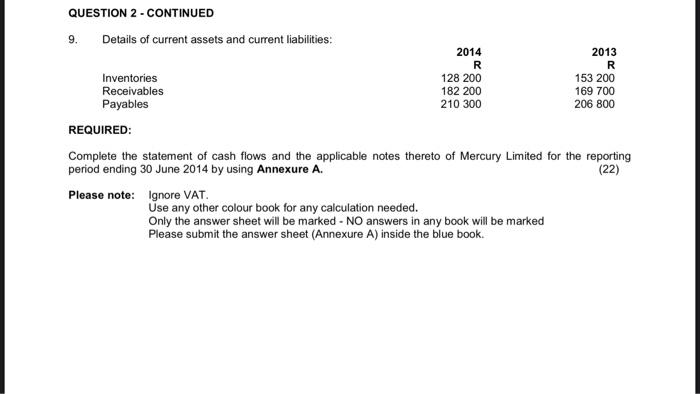

The accountant of Mercury Limited attempted to prepare the statement of cash flows for the reporting period ended 30 June 2014. Due to a very busy schedule, she was only able to partially complete it as follows: R ? MERCURY LIMITED STATEMENT OF CASH FLOWS FOR THE REPORTING PERIOD ENDED 30 JUNE 2014 Notes Cash flow from operating activities Cash receipts from customers ? Cash paid to suppliers and employees ? Cash generated from operations 140 830 Interest paid ? Dividends paid Tax paid ? Net cash from operating activities 55 819 Cash flow from investing activities Additions to land and buildings ? Proceeds from disposal of vehicles 6 000 Net cash from investing activities Cash flow from financing activities Proceeds from share issue ? Long-term borrowing redeemed ? Net cash from financing activities ? Net decrease in cash and cash equivalents (56 181) Cash and cash equivalents at beginning of the year Cash and cash equivalents at end of the vear ? (56 181) ? ? Net decrease in cash and cash equivalents Cash and cash equivalents at beginning of the year Cash and cash equivalents at end of the year NOTES TO THE STATEMENT OF CASH FLOWS: 1. Reconciliation of profit before tax with cash generated from operations Profit before tax Interest paid Depreciation in inventories in receivables ..in payables R ? ? ? ? ? 140 830 CALCULATIONS DONE BY THE ACCOUNTANT: 1. Tax and dividends paid Unpaid amounts at beginning of the year Income tax expense Dividends declared Unpaid amounts at end of the year Tax R ? Dividends R (18 000) 2 27 500 (38 761) ADDITIONAL INFORMATION: 1. Long term borrowings consist of a mortgage loan with a balance of R30 000 presented on the statement of financial position at the end of the current reporting period. A capital payment of R50 000 was made on 31 December 2013. The interest rate is 15% p.a. and interest paid on the mortgage loan amounts to R8 250 for current reporting period. 2. An additional 100 000 ordinary shares were issued at 240c per share at the beginning of the reporting period. There was a total of 250 000 ordinary shares issued at the end of the current reporting period. 3. Profit for the year R48 719 4. The tax rate applicable is 45% of the profit before tax. The South African Revenue Services payable at the end of the reporting period amounted to R4 100 and R3 000 at the beginning of the period. 5. Details of dividends declared and paid during the reporting period were as follows: An interim dividend of 8 cents per share R20 000 A final dividend of 11 cents per share, R27 500. 6. The revenue figure in the statement of profit or loss and other comprehensive income was R308 450. 7. The balance of cash and cash equivalents per the statement of financial position as at 30 June 2013 was R3 680 however on the 30 June 2014 a bank overdraft of R52 501 appeared in the statement of financial position 8. Details of non-current assets: Land and buildings Total Vehicles 8. Details of non-current assets: Vehicles R 61 000 73 000 (12 000) Total R 211 000 223 000 (12 000) 192 000 308 000 (6 000) Land and buildings R Carrying amount at beginning of year 150 000 Gross carrying amount 150 000 Accumulated depreciation Revaluation reserve 192 000 Additions at cost 308 000 Disposals at carrying amount Gross carrying amount Accumulated depreciation Depreciation Gross carrying amount 650 000 Accumulated depreciation Carrying amount at end of year 650 000 No profit or loss was made on the disposal of the vehicles (6000) (25 000) 19 000 (28000) 48 000 (21 000) 27 000 (28 000) 698 000 (21 000) 677 000 9. QUESTION 2 - CONTINUED Details of current assets and current liabilities: 2014 2013 R R Inventories 128 200 153 200 Receivables 182 200 169 700 Payables 210 300 206 800 REQUIRED: Complete the statement of cash flows and the applicable notes thereto of Mercury Limited for the reporting period ending 30 June 2014 by using Annexure A. (22) Please note: Ignore VAT Use any other colour book for any calculation needed. Only the answer sheet will be marked - NO answers in any book will be marked Please submit the answer sheet (Annexure A) inside the blue book