Question

The accountant of Mixed-up Traders requires your assistance to properly balance and reconcile the trade receivables control and trade payable control accounts with the total

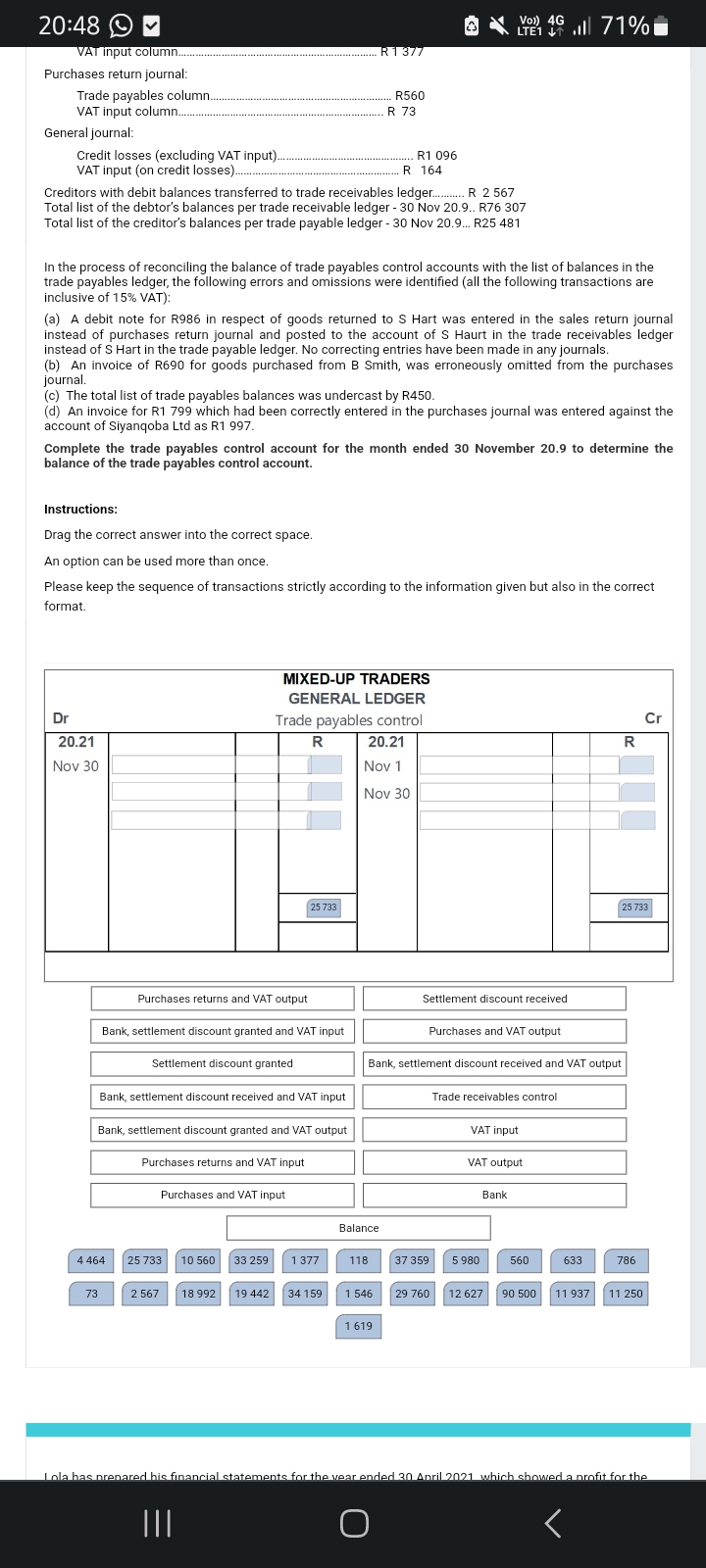

The accountant of Mixed-up Traders requires your assistance to properly balance and reconcile the trade receivables control and trade payable control accounts with the total list of trade receivables and total list of trade payables for the month ended on 30 November 20.9. The accountant provided you with the following information in respect of October and November 20.9 which was obtained from the records of Mixed-up Traders: Balance for trade payables control account - 31 October 20.9 R19 442 Balance for trade receivables control accounts - 31 October 20.9 R33 450 Totals for the month of November 20.9 Cash payment journal: Purchases R29 760 Trade payables column. R 5 980 Settlement discount received column.. R 786 VAT input column. R 4 464 VAT output column... R 118 Cash receipts journal: Sales R130 600 Trade receivables column R 42 500 Settlement discount granted column.. R 2 980 VAT input column... R 447 VAT output column. R 19 590 Sales journal: Trade receivables column. R90 500 VAT output column. R13 575 Sales return journal: Trade receivables column. R5 640 VAT output column.. R 846 Purchases journal: Trade payables column. R10 560 VAT input column R 1 377 Purchases return journal: Trade payables column R560 VAT input column.. R 73 General journal: Credit losses (excluding VAT input).. R1 096 VAT input (on credit losses) R 164 Creditors with debit balances transferred to trade receivables ledger.. R 2 567 Total list of the debtors balances per trade receivable ledger - 30 Nov 20.9.. R76 307 Total list of the creditors balances per trade payable ledger - 30 Nov 20.9 R25 481 In the process of reconciling the balance of trade payables control accounts with the list of balances in the trade payables ledger, the following errors and omissions were identified (all the following transactions are inclusive of 15% VAT): (a) A debit note for R986 in respect of goods returned to S Hart was entered in the sales return journal instead of purchases return journal and posted to the account of S Haurt in the trade receivables ledger instead of S Hart in the trade payable ledger. No correcting entries have been made in any journals. (b) An invoice of R690 for goods purchased from B Smith, was erroneously omitted from the purchases journal. (c) The total list of trade payables balances was undercast by R450. (d) An invoice for R1 799 which had been correctly entered in the purchases journal was entered against the account of Siyanqoba Ltd as R1 997. Complete the trade payables control account for the month ended 30 November 20.9 to determine the balance of the trade payables control account. Instructions:

The accountant of Mixed-up Traders requires your assistance to properly balance and reconcile the trade receivables control and trade payable control accounts with the total list of trade receivables and total list of trade payables for the month ended on 30 November 20.9. The accountant provided you with the following information in respect of October and November 20.9 which was obtained from the records of Mixed-up Traders: Balance for trade payables control account - 31 October 20.9 R19 442 Balance for trade receivables control accounts - 31 October 20.9 R33 450 Totals for the month of November 20.9 Cash payment journal: Purchases R29 760 Trade payables column. R 5 980 Settlement discount received column.. R 786 VAT input column. R 4 464 VAT output column... R 118 Cash receipts journal: Sales R130 600 Trade receivables column R 42 500 Settlement discount granted column.. R 2 980 VAT input column... R 447 VAT output column. R 19 590 Sales journal: Trade receivables column. R90 500 VAT output column. R13 575 Sales return journal: Trade receivables column. R5 640 VAT output column.. R 846 Purchases journal: Trade payables column. R10 560 VAT input column R 1 377 Purchases return journal: Trade payables column R560 VAT input column.. R 73 General journal: Credit losses (excluding VAT input).. R1 096 VAT input (on credit losses) R 164 Creditors with debit balances transferred to trade receivables ledger.. R 2 567 Total list of the debtors balances per trade receivable ledger - 30 Nov 20.9.. R76 307 Total list of the creditors balances per trade payable ledger - 30 Nov 20.9 R25 481 In the process of reconciling the balance of trade payables control accounts with the list of balances in the trade payables ledger, the following errors and omissions were identified (all the following transactions are inclusive of 15% VAT): (a) A debit note for R986 in respect of goods returned to S Hart was entered in the sales return journal instead of purchases return journal and posted to the account of S Haurt in the trade receivables ledger instead of S Hart in the trade payable ledger. No correcting entries have been made in any journals. (b) An invoice of R690 for goods purchased from B Smith, was erroneously omitted from the purchases journal. (c) The total list of trade payables balances was undercast by R450. (d) An invoice for R1 799 which had been correctly entered in the purchases journal was entered against the account of Siyanqoba Ltd as R1 997. Complete the trade payables control account for the month ended 30 November 20.9 to determine the balance of the trade payables control account. Instructions:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started