Answered step by step

Verified Expert Solution

Question

1 Approved Answer

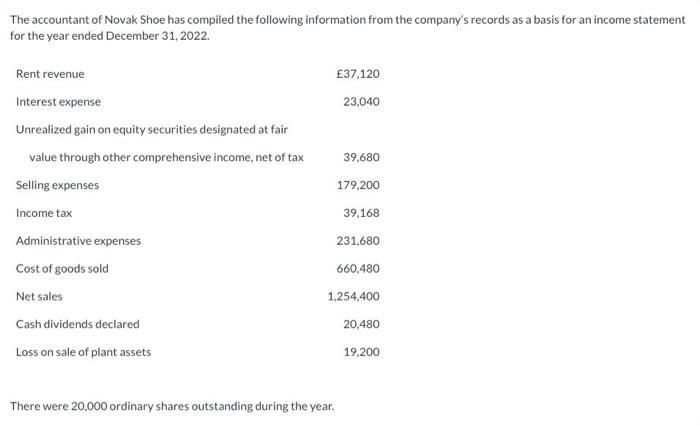

The accountant of Novak Shoe has compiled the following information from the company's records as a basis for an income statement for the year

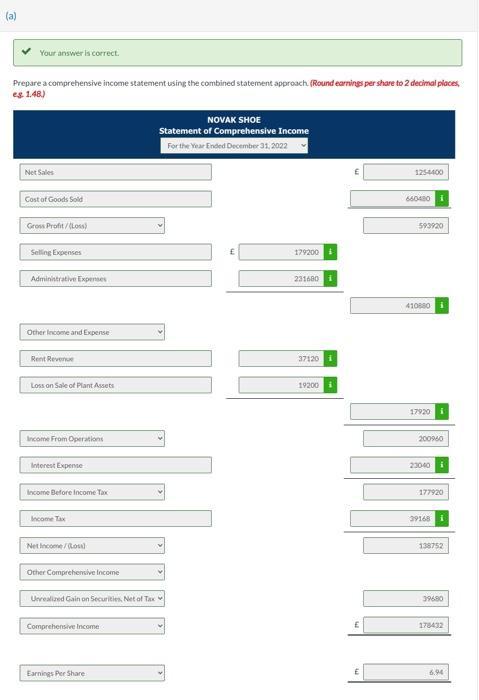

The accountant of Novak Shoe has compiled the following information from the company's records as a basis for an income statement for the year ended December 31, 2022. Rent revenue 37,120 Interest expense 23,040 Unrealized gain on equity securities designated at fair value through other comprehensive income, net of tax 39,680 Selling expenses 179,200 Income tax 39,168 Administrative expenses 231,680 Cost of goods sold 660,480 Net sales Cash dividends declared Loss on sale of plant assets 1,254,400 There were 20,000 ordinary shares outstanding during the year. 20,480 19,200 Your answer is correct. Prepare a comprehensive income statement using the combined statement approach (Round earnings per share to 2 decimal places, es. 1.48) Net Sales Cost of Goods Sold Gross Profit/(Loss) Selling Expenses Administrative Expenses Other Income and Expense Rent Revenue Loss on Sale of Plant Assets Income From Operations Interest Expense Income Before Income Tax Income Tax Net Income/(Loss) Other Comprehensive Income Unrealized Gain on Securities, Net of Tax Comprehensive Income Earnings Per Share NOVAK SHOE Statement of Comprehensive Income For the Year Ended December 31, 2022 179200 2316001 37120 i 19200 1254400 660480 593920 410880 i 17920 200960 23040 177920 39168 i 138752 39680 178432 E 6.94 (b) Prepare a comprehensive income statement using the two statement approach. (Round earnings per share to 2 decimal places.g. 148) NOVAK SHOE Income Statement NOVAK SHOE Comprehensive Income Statement

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started