Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Accounting Department has provided the following data concerning the proposed new product: HVM Drums Selling Price per frame..... Cost per frame: 13,112.00 Direct

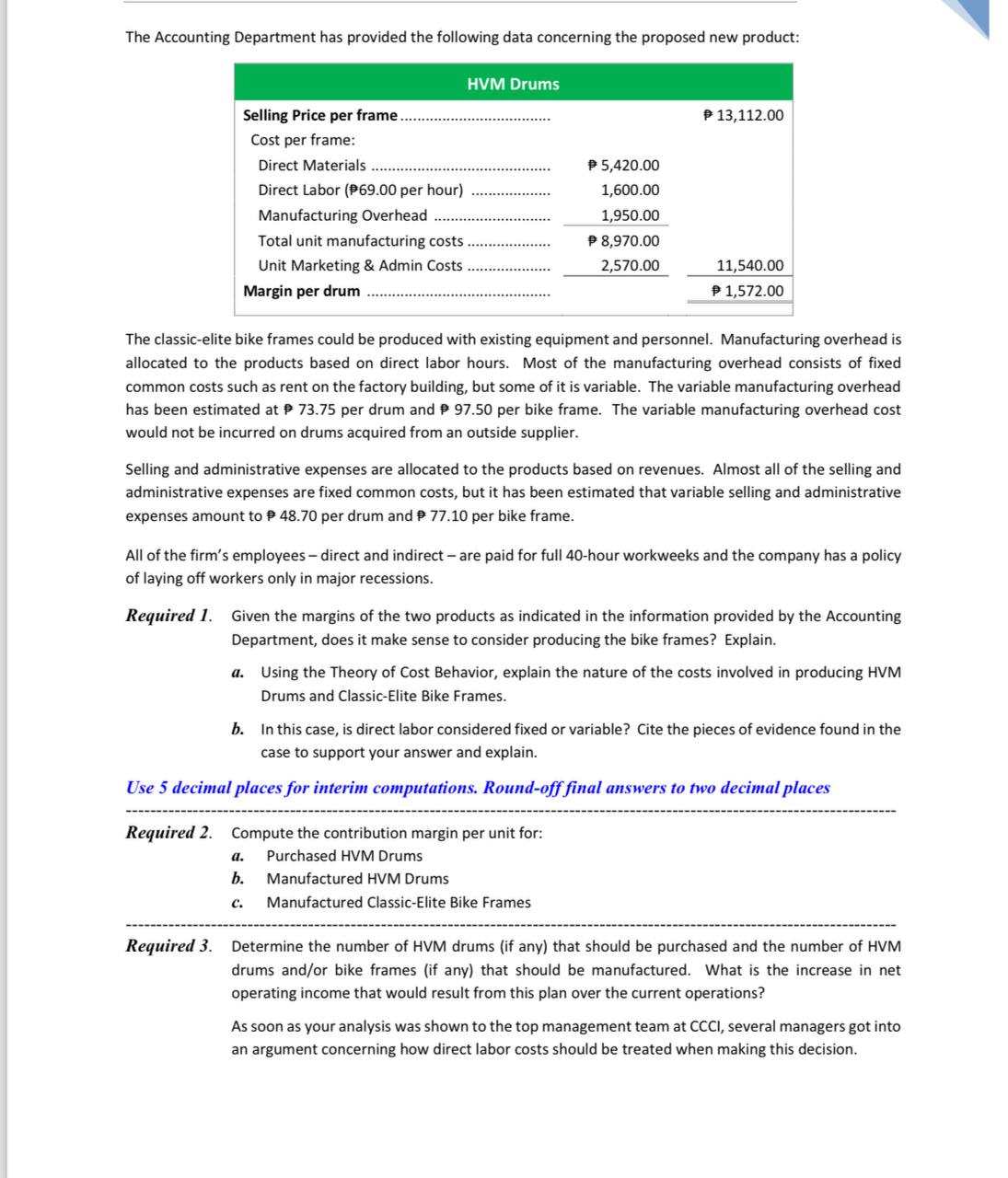

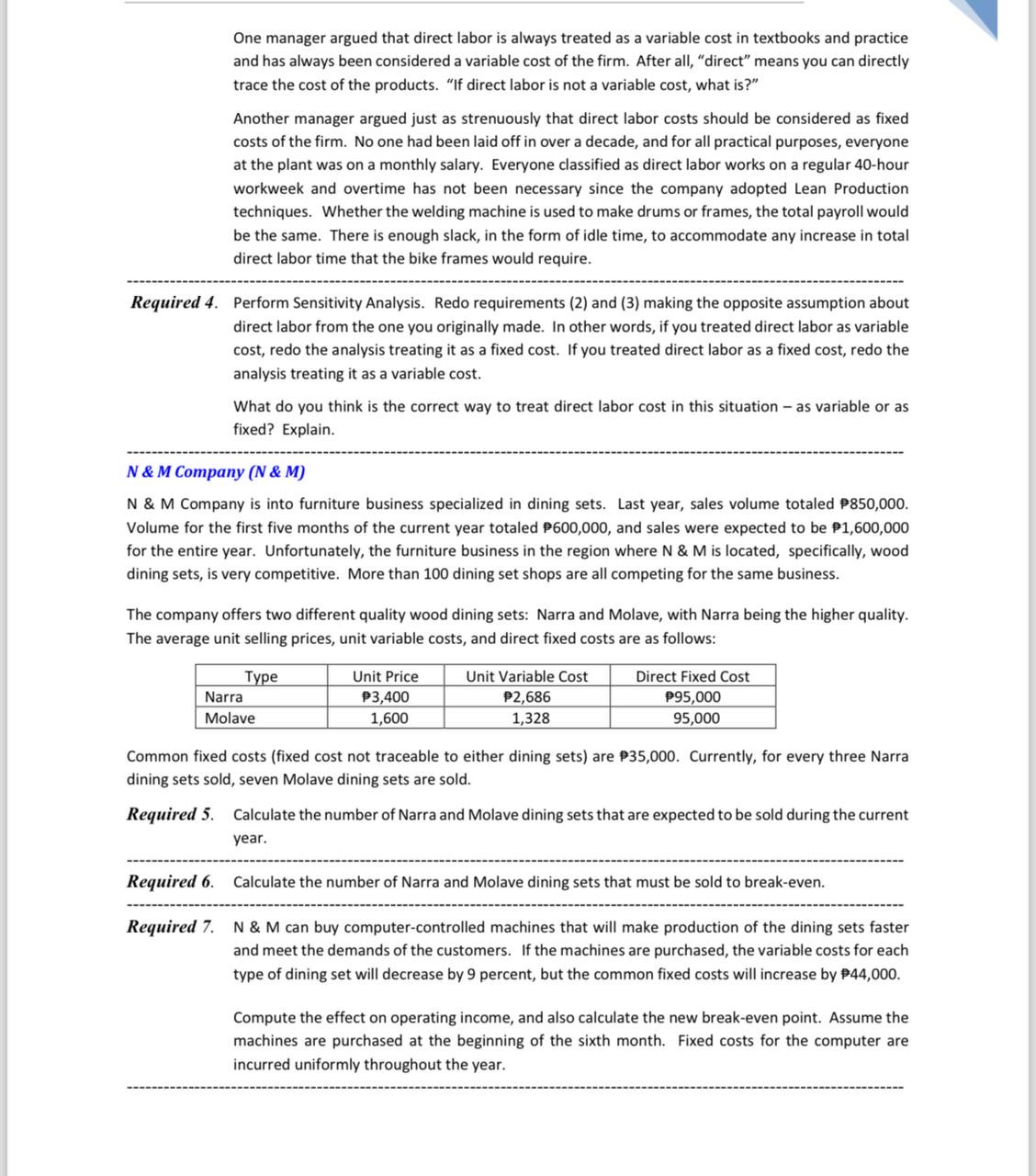

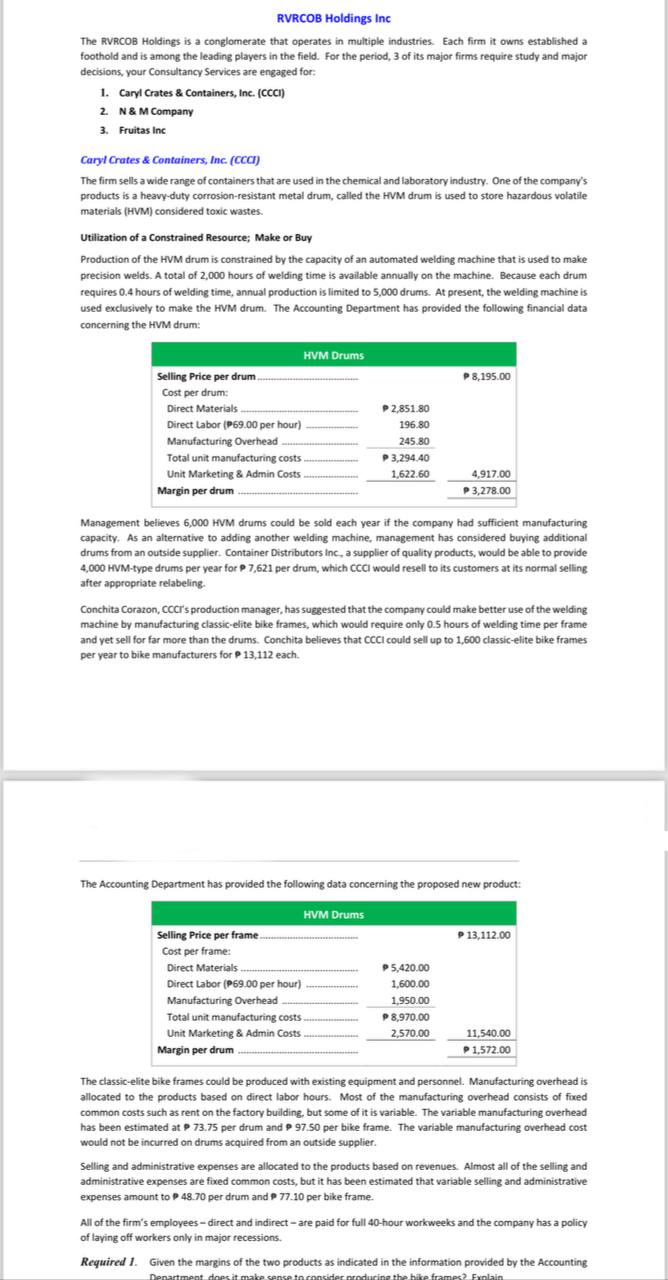

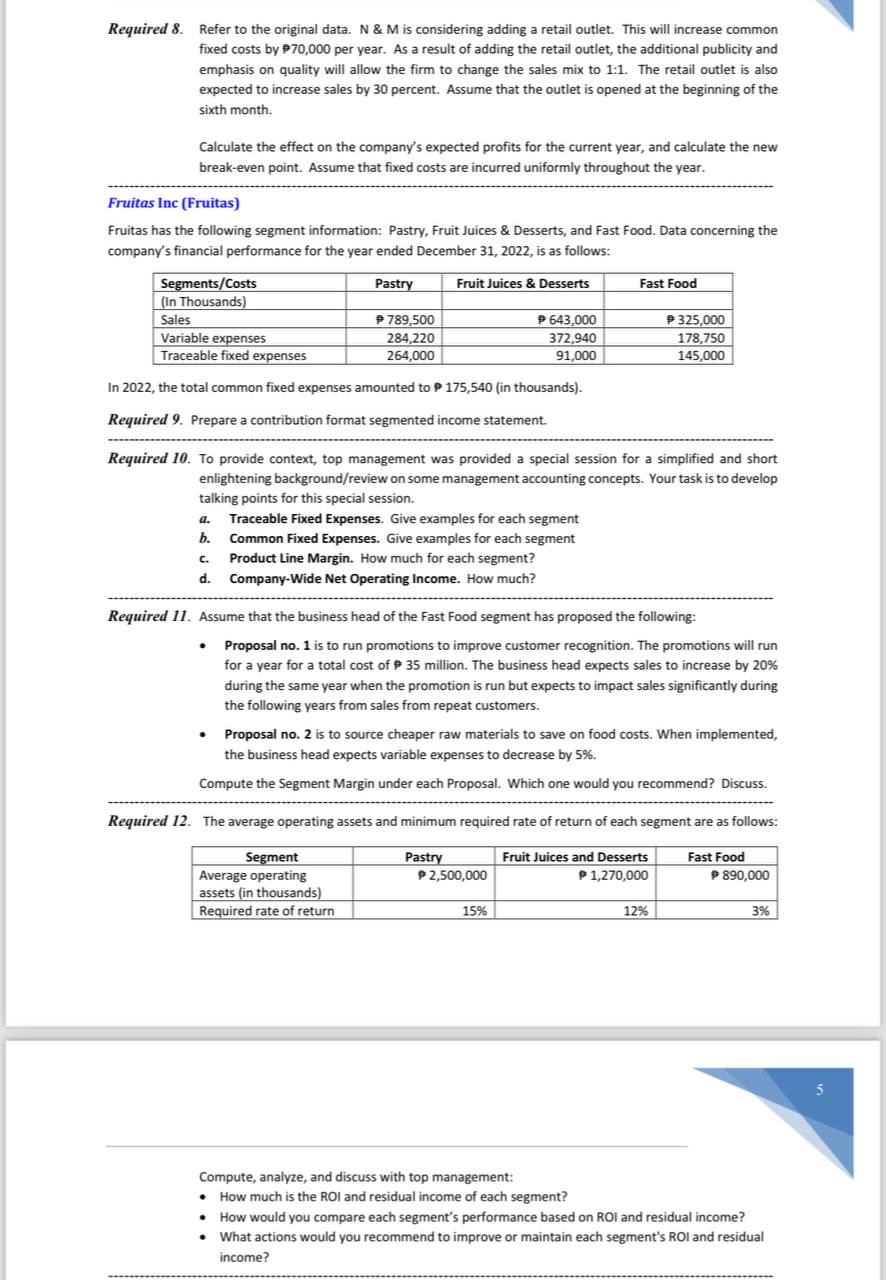

The Accounting Department has provided the following data concerning the proposed new product: HVM Drums Selling Price per frame..... Cost per frame: 13,112.00 Direct Materials 5,420.00 Direct Labor (P69.00 per hour) 1,600.00 Manufacturing Overhead 1,950.00 Total unit manufacturing costs. P 8,970.00 Unit Marketing & Admin Costs Margin per drum 2,570.00 11,540.00 1,572.00 The classic-elite bike frames could be produced with existing equipment and personnel. Manufacturing overhead is allocated to the products based on direct labor hours. Most of the manufacturing overhead consists of fixed common costs such as rent on the factory building, but some of it is variable. The variable manufacturing overhead has been estimated at 73.75 per drum and 97.50 per bike frame. The variable manufacturing overhead cost would not be incurred on drums acquired from an outside supplier. Selling and administrative expenses are allocated to the products based on revenues. Almost all of the selling and administrative expenses are fixed common costs, but it has been estimated that variable selling and administrative expenses amount to P 48.70 per drum and 77.10 per bike frame. All of the firm's employees - direct and indirect - are paid for full 40-hour workweeks and the company has a policy of laying off workers only in major recessions. Required 1. Given the margins of the two products as indicated in the information provided by the Accounting Department, does it make sense to consider producing the bike frames? Explain. a. Using the Theory of Cost Behavior, explain the nature of the costs involved in producing HVM Drums and Classic-Elite Bike Frames. b. In this case, is direct labor considered fixed or variable? Cite the pieces of evidence found in the case to support your answer and explain. Use 5 decimal places for interim computations. Round-off final answers to two decimal places Required 2. Compute the contribution margin per unit for: a. Purchased HVM Drums b. Manufactured HVM Drums C. Manufactured Classic-Elite Bike Frames Required 3. Determine the number of HVM drums (if any) that should be purchased and the number of HVM drums and/or bike frames (if any) that should be manufactured. What is the increase in net operating income that would result from this plan over the current operations? As soon as your analysis was shown to the top management team at CCCI, several managers got into an argument concerning how direct labor costs should be treated when making this decision. One manager argued that direct labor is always treated as a variable cost in textbooks and practice and has always been considered a variable cost of the firm. After all, "direct" means you can directly trace the cost of the products. "If direct labor is not a variable cost, what is?" Another manager argued just as strenuously that direct labor costs should be considered as fixed costs of the firm. No one had been laid off in over a decade, and for all practical purposes, everyone at the plant was on a monthly salary. Everyone classified as direct labor works on a regular 40-hour workweek and overtime has not been necessary since the company adopted Lean Production techniques. Whether the welding machine is used to make drums or frames, the total payroll would be the same. There is enough slack, in the form of idle time, to accommodate any increase in total direct labor time that the bike frames would require. Required 4. Perform Sensitivity Analysis. Redo requirements (2) and (3) making the opposite assumption about direct labor from the one you originally made. In other words, if you treated direct labor as variable cost, redo the analysis treating it as a fixed cost. If you treated direct labor as a fixed cost, redo the analysis treating it as a variable cost. What do you think is the correct way to treat direct labor cost in this situation - as variable or as fixed? Explain. N&M Company (N&M) N&M Company is into furniture business specialized in dining sets. Last year, sales volume totaled P850,000. Volume for the first five months of the current year totaled P600,000, and sales were expected to be P1,600,000 for the entire year. Unfortunately, the furniture business in the region where N & M is located, specifically, wood dining sets, is very competitive. More than 100 dining set shops are all competing for the same business. The company offers two different quality wood dining sets: Narra and Molave, with Narra being the higher quality. The average unit selling prices, unit variable costs, and direct fixed costs are as follows: Type Narra Molave Unit Price P3,400 1,600 Unit Variable Cost P2,686 1,328 Direct Fixed Cost P95,000 95,000 Common fixed costs (fixed cost not traceable to either dining sets) are P35,000. Currently, for every three Narra dining sets sold, seven Molave dining sets are sold. Required 5. Calculate the number of Narra and Molave dining sets that are expected to be sold during the current year. Required 6. Required 7. Calculate the number of Narra and Molave dining sets that must be sold to break-even. N & M can buy computer-controlled machines that will make production of the dining sets faster and meet the demands of the customers. If the machines are purchased, the variable costs for each type of dining set will decrease by 9 percent, but the common fixed costs will increase by 44,000. Compute the effect on operating income, and also calculate the new break-even point. Assume the machines are purchased at the beginning of the sixth month. Fixed costs for the computer are incurred uniformly throughout the year. RVRCOB Holdings Inc The RVRCOB Holdings is a conglomerate that operates in multiple industries. Each firm it owns established a foothold and is among the leading players in the field. For the period, 3 of its major firms require study and major decisions, your Consultancy Services are engaged for: 1. Caryl Crates & Containers, Inc. (CCCI) 2. N&M Company 3. Fruitas Inc Caryl Crates & Containers, Inc. (CCCI) The firm sells a wide range of containers that are used in the chemical and laboratory industry. One of the company's products is a heavy-duty corrosion-resistant metal drum, called the HVM drum is used to store hazardous volatile materials (HVM) considered toxic wastes. Utilization of a Constrained Resource; Make or Buy Production of the HVM drum is constrained by the capacity of an automated welding machine that is used to make precision welds. A total of 2,000 hours of welding time is available annually on the machine. Because each drum requires 0.4 hours of welding time, annual production is limited to 5,000 drums. At present, the welding machine is used exclusively to make the HVM drum. The Accounting Department has provided the following financial data concerning the HVM drum: Selling Price per drum. Cost per drum: Direct Materials HVM Drums P8,195.00 Direct Labor (P69.00 per hour) Manufacturing Overhead. Total unit manufacturing costs. Unit Marketing & Admin Costs. Margin per drum P 2,851.80 196.80 245.80 P 3,294.40 1,622.60 4,917.00 P3,278.00 Management believes 6,000 HVM drums could be sold each year if the company had sufficient manufacturing capacity. As an alternative to adding another welding machine, management has considered buying additional drums from an outside supplier. Container Distributors Inc., a supplier of quality products, would be able to provide 4,000 HVM-type drums per year for 7,621 per drum, which CCCI would resell to its customers at its normal selling after appropriate relabeling. Conchita Corazon, CCCI's production manager, has suggested that the company could make better use of the welding machine by manufacturing classic-elite bike frames, which would require only 0.5 hours of welding time per frame and yet sell for far more than the drums. Conchita believes that CCCI could sell up to 1,600 classic-elite bike frames per year to bike manufacturers for P 13,112 each. The Accounting Department has provided the following data concerning the proposed new product: HVM Drums Selling Price per frame. Cost per frame: Direct Materials Direct Labor (P69.00 per hour) Manufacturing Overhead P 5,420.00 13,112.00 1,600.00 1,950.00 Total unit manufacturing costs Unit Marketing & Admin Costs. Margin per drum P 8,970.00 2,570.00 11,540.00 1,572.00 The classic-elite bike frames could be produced with existing equipment and personnel. Manufacturing overhead is allocated to the products based on direct labor hours. Most of the manufacturing overhead consists of fixed common costs such as rent on the factory building, but some of it is variable. The variable manufacturing overhead has been estimated at P 73.75 per drum and P 97.50 per bike frame. The variable manufacturing overhead cost would not be incurred on drums acquired from an outside supplier. Selling and administrative expenses are allocated to the products based on revenues. Almost all of the selling and administrative expenses are fixed common costs, but it has been estimated that variable selling and administrative expenses amount to P 48.70 per drum and P77.10 per bike frame. All of the firm's employees-direct and indirect-are paid for full 40-hour workweeks and the company has a policy of laying off workers only in major recessions. Required 1. Given the margins of the two products as indicated in the information provided by the Accounting Department does it make sense to consider producing the bike frames? Explain Required 8. Refer to the original data. N & M is considering adding a retail outlet. This will increase common fixed costs by $70,000 per year. As a result of adding the retail outlet, the additional publicity and emphasis on quality will allow the firm to change the sales mix to 1:1. The retail outlet is also expected to increase sales by 30 percent. Assume that the outlet is opened at the beginning of the sixth month. Calculate the effect on the company's expected profits for the current year, and calculate the new break-even point. Assume that fixed costs are incurred uniformly throughout the year. Fruitas Inc (Fruitas) Fruitas has the following segment information: Pastry, Fruit Juices & Desserts, and Fast Food. Data concerning the company's financial performance for the year ended December 31, 2022, is as follows: Segments/Costs (In Thousands) Sales Variable expenses Traceable fixed expenses Pastry Fruit Juices & Desserts Fast Food 789,500 284,220 P643,000 372,940 325,000 178,750 264,000 91,000 145,000 In 2022, the total common fixed expenses amounted to 175,540 (in thousands). Required 9. Prepare a contribution format segmented income statement. Required 10. To provide context, top management was provided a special session for a simplified and short enlightening background/review on some management accounting concepts. Your task is to develop talking points for this special session. a. Traceable Fixed Expenses. Give examples for each segment b. Common Fixed Expenses. Give examples for each segment C. d. Product Line Margin. How much for each segment? Company-Wide Net Operating Income. How much? Required 11. Assume that the business head of the Fast Food segment has proposed the following: Proposal no. 1 is to run promotions to improve customer recognition. The promotions will run for a year for a total cost of 35 million. The business head expects sales to increase by 20% during the same year when the promotion is run but expects to impact sales significantly during the following years from sales from repeat customers. Proposal no. 2 is to source cheaper raw materials to save on food costs. When implemented, the business head expects variable expenses to decrease by 5%. Compute the Segment Margin under each Proposal. Which one would you recommend? Discuss. Required 12. The average operating assets and minimum required rate of return of each segment are as follows: Segment Average operating assets (in thousands) Required rate of return Pastry P2,500,000 Fruit Juices and Desserts P 1,270,000 15% 12% Fast Food 890,000 3% Compute, analyze, and discuss with top management: How much is the ROI and residual income of each segment? How would you compare each segment's performance based on ROI and residual income? What actions would you recommend to improve or maintain each segment's ROI and residual income? 5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer Required 1 Given the margins of the two products as indicated in the information provided by ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started