Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The accounting firm you work for is preparing a booklet on personal tax, and the tax partner has asked you to prepare some of

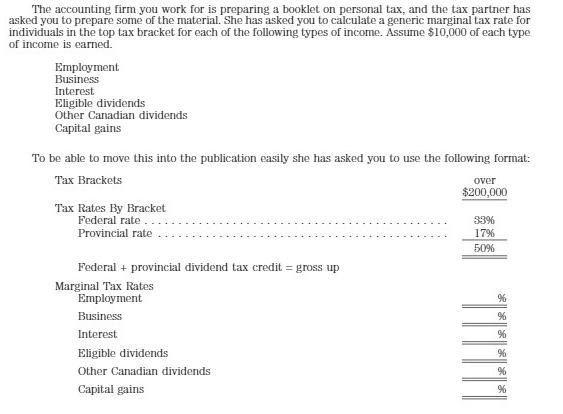

The accounting firm you work for is preparing a booklet on personal tax, and the tax partner has asked you to prepare some of the material. She has asked you to calculate a generic marginal tax rate for individuals in the top tax bracket for each of the following types of income. Assume $10,000 of each type of income is earned. Employment Business Interest Eligible dividends Other Canadian dividends Capital gains To be able to move this into the publication easily she has asked you to use the following format: Tax Brackets Tax Rates By Bracket Federal rate.. Provincial rate Federal + provincial dividend tax credit = gross up Marginal Tax Rates Employment Business Interest Eligible dividends Other Canadian dividends Capital gains over $200,000 33% 17% 50% 17111

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Generic Marginal Tax Rates for Top Tax Bracket over 200000 Tax Brackets over 200000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started