Answered step by step

Verified Expert Solution

Question

1 Approved Answer

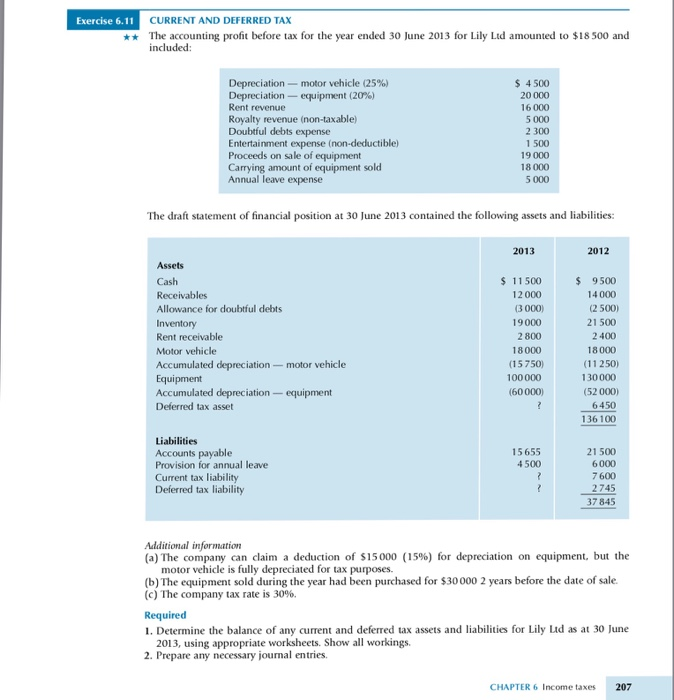

The accounting profit before tax for the year ended 30 June 2013 for Lily Ltd amounted to $18 500 and included: Additional information (a)The company

The accounting profit before tax for the year ended 30 June 2013 for Lily Ltd amounted to $18 500 and included:

Additional information

(a)The company can claim a deduction of $15000 (15%) for depreciation on equipment, but the motor vehicle is fully depreciated for tax purposes.

(b) The equipment sold during the year had been purchased for $30 000 2 years before the date of sale. (c) The company tax rate is 30%.

Required

1. Determine the balance of any current and deferred tax assets and liabilities for Lily Ltd as at 30 June 2013, using appropriate worksheets. Show all workings.

2. Prepare any necessary journal entries.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started