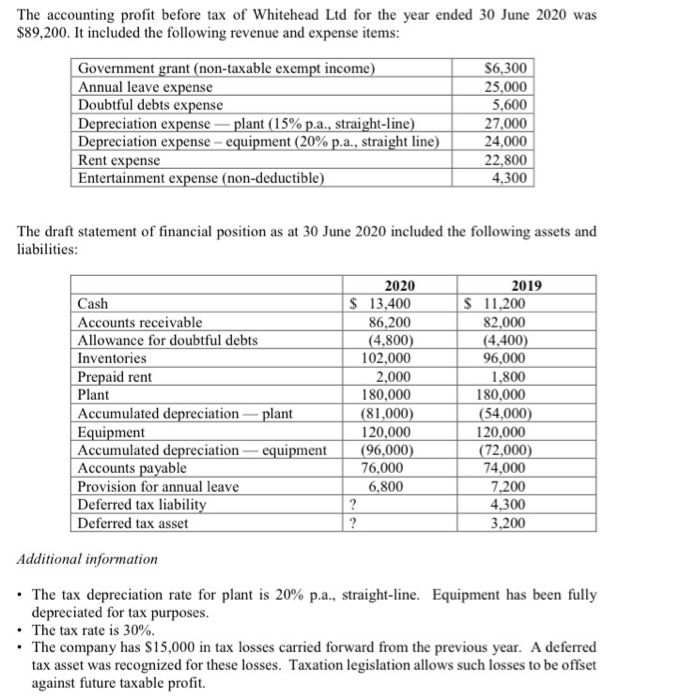

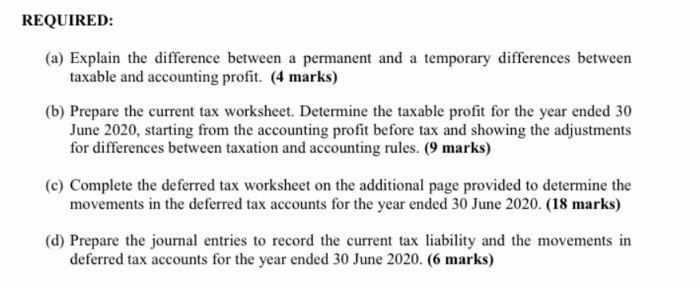

The accounting profit before tax of Whitehead Ltd for the year ended 30 June 2020 was $89,200. It included the following revenue and expense items: Government grant (non-taxable exempt income) $6,300 Annual leave expense 25,000 Doubtful debts expense 5,600 Depreciation expense - plant (15% p.a., straight-line) 27,000 Depreciation expense - equipment (20% p.a., straight line) 24,000 Rent expense 22,800 Entertainment expense (non-deductible) 4,300 The draft statement of financial position as at 30 June 2020 included the following assets and liabilities: Cash Accounts receivable Allowance for doubtful debts Inventories Prepaid rent Plant Accumulated depreciation - plant Equipment Accumulated depreciation - equipment Accounts payable Provision for annual leave Deferred tax liability Deferred tax asset 2020 $ 13,400 86,200 (4,800) 102,000 2,000 180,000 (81,000) 120,000 (96,000) 76,000 6,800 ? ? 2019 $ 11,200 82,000 (4,400) 96,000 1,800 180,000 (54,000) 120,000 (72,000) 74,000 7,200 4,300 3,200 Additional information The tax depreciation rate for plant is 20% p.a., straight-line. Equipment has been fully depreciated for tax purposes. The tax rate is 30%. The company has $15,000 in tax losses carried forward from the previous year. A deferred tax asset was recognized for these losses. Taxation legislation allows such losses to be offset against future taxable profit. REQUIRED: (a) Explain the difference between a permanent and a temporary differences between taxable and accounting profit. (4 marks) (b) Prepare the current tax worksheet. Determine the taxable profit for the year ended 30 June 2020, starting from the accounting profit before tax and showing the adjustments for differences between taxation and accounting rules. (9 marks) (c) Complete the deferred tax worksheet on the additional page provided to determine the movements in the deferred tax accounts for the year ended 30 June 2020. (18 marks) (d) Prepare the journal entries to record the current tax liability and the movements in deferred tax accounts for the year ended 30 June 2020. (6 marks) The accounting profit before tax of Whitehead Ltd for the year ended 30 June 2020 was $89,200. It included the following revenue and expense items: Government grant (non-taxable exempt income) $6,300 Annual leave expense 25,000 Doubtful debts expense 5,600 Depreciation expense - plant (15% p.a., straight-line) 27,000 Depreciation expense - equipment (20% p.a., straight line) 24,000 Rent expense 22,800 Entertainment expense (non-deductible) 4,300 The draft statement of financial position as at 30 June 2020 included the following assets and liabilities: Cash Accounts receivable Allowance for doubtful debts Inventories Prepaid rent Plant Accumulated depreciation - plant Equipment Accumulated depreciation - equipment Accounts payable Provision for annual leave Deferred tax liability Deferred tax asset 2020 $ 13,400 86,200 (4,800) 102,000 2,000 180,000 (81,000) 120,000 (96,000) 76,000 6,800 ? ? 2019 $ 11,200 82,000 (4,400) 96,000 1,800 180,000 (54,000) 120,000 (72,000) 74,000 7,200 4,300 3,200 Additional information The tax depreciation rate for plant is 20% p.a., straight-line. Equipment has been fully depreciated for tax purposes. The tax rate is 30%. The company has $15,000 in tax losses carried forward from the previous year. A deferred tax asset was recognized for these losses. Taxation legislation allows such losses to be offset against future taxable profit. REQUIRED: (a) Explain the difference between a permanent and a temporary differences between taxable and accounting profit. (4 marks) (b) Prepare the current tax worksheet. Determine the taxable profit for the year ended 30 June 2020, starting from the accounting profit before tax and showing the adjustments for differences between taxation and accounting rules. (9 marks) (c) Complete the deferred tax worksheet on the additional page provided to determine the movements in the deferred tax accounts for the year ended 30 June 2020. (18 marks) (d) Prepare the journal entries to record the current tax liability and the movements in deferred tax accounts for the year ended 30 June 2020. (6 marks)