Answered step by step

Verified Expert Solution

Question

1 Approved Answer

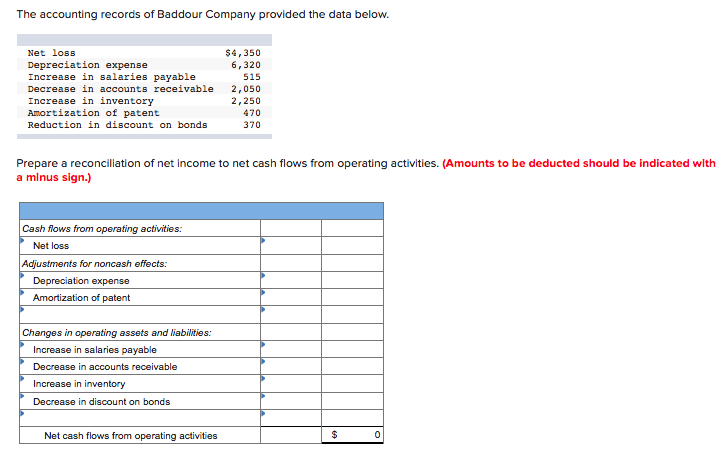

The accounting records of Baddour Company provided the data below. Net loss $4,350 6,320 Depreciation expense Increase in salaries payable 515 Decrease in accounts receivable

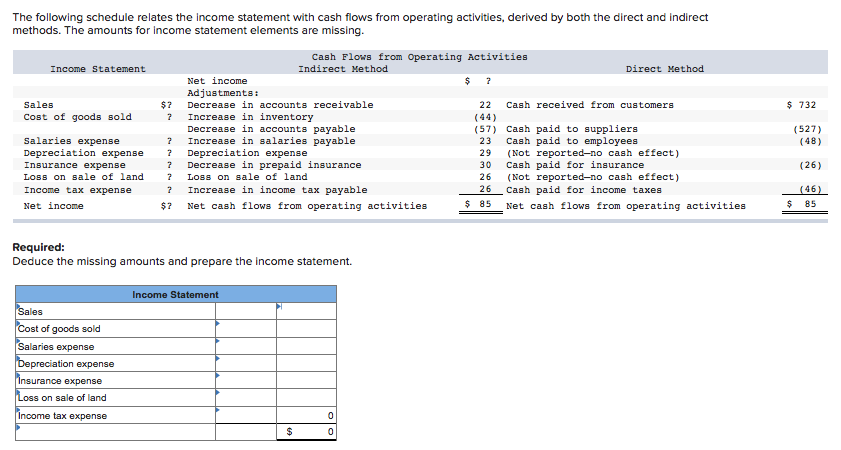

The accounting records of Baddour Company provided the data below. Net loss $4,350 6,320 Depreciation expense Increase in salaries payable 515 Decrease in accounts receivable 2,050 Increase in inventory Amortization of patent 2,250 470 Reduction in discount on bonds 370 Prepare a reconciliation of net income to net cash flows from operating activities. (Amounts to be deducted should be indicated with a minus sign.) Cash flows from operating activities: Net loss Adjustments for noncash effects: Depreciation expense Amortization of patent Changes in operating assets and liabilities: Increase in salaries payable Decrease in accounts receivable Increase in inventory Decrease in discount on bonds Net cash flows from operating activities The following schedule relates the income statement with cash flows from operating activities, derived by both the direct and indirect methods. The amounts for income statement elements are missing. Cash Flows from Operating Activities Direct Method Indirect Method Income Statement Net income 7 Adjustments: $ 732 Sales $7 Decrease in accounts receivable 22 Cash received from customers Cost of goods sold Increase in inventory Decrease in accounts payable Increase in salaries payable Depreciation expense (44) (57) Cash paid to suppliers Cash paid to employees (Not reported-no cash effect) Cash paid for insurance (Not reported-no cash effect) (527) (48) Salaries expense Depreciation expense Insurance expense 23 29 7 Decrease in prepaid insurance 30 (26) Loss on sale of land Loss on sale of land 26 26 (46) Income tax expense Increase in income tax payable Cash paid for income taxes $ 85 $85 Net income $? Net cash flows from operating activities Net cash flows from operating activities Required: Deduce the missing amounts and prepare the income statement Income Statement Sales Cost of goods sold Salaries expense Depreciation expense insurance expense Loss on sale of land Income tax expense $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started