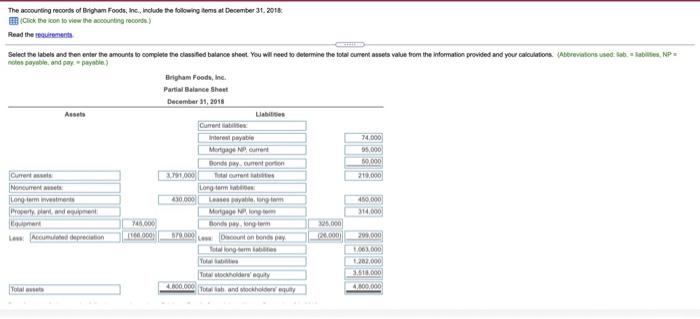

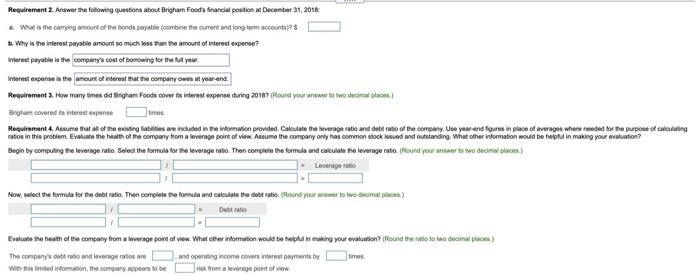

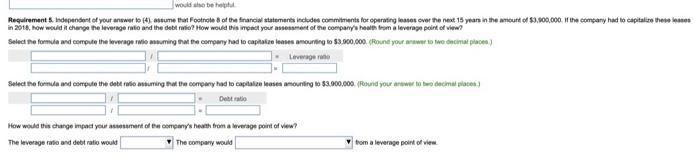

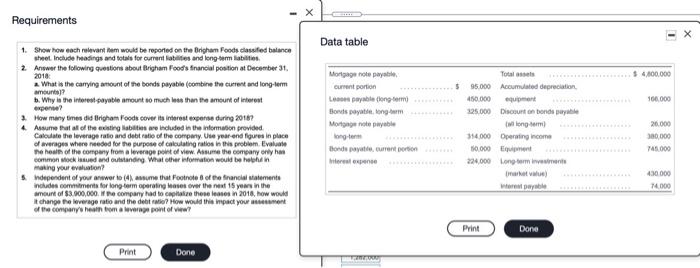

The accounting records of Brigham Foods, Inc., include the following terms at December 31, 2018 Coke icon to view the accounting records) Read the requirements Select the labels and then enter the amounts to complete the classified balance sheet. You will need determine the total current assets value from the information provided and your calculations. Abbreviations dob BNP cos payable and paypayati) Brigham Foods, Inc. Partial Balance Shout December 31, 2018 Asset Labis atittaen et payati 14.000 Mortgage current 95.000 Donde pay, current 50,000 Or 191.000 210,000 Long term Lorem 0000 Layanam 450.000 Very plant and Mortgage long to 314,000 Lot WOOD tem 25.000 10000 LAGU 70.00 Don Bonapay 000 29.000 100.000 22,000 3.000 To 100.000 and 4.800,000 Requirement 2. Answer the following questions about Brigham Food's financial position December 31, 2018 What is the carrying out of the bonds payable combine the current and long term account? b. Why is the interest payable amount so much less than the amount of interest expense? Interest payable is the cerpany's cost of bonowing for the full year. Interest expense is the amount of interest that the company owes at year-end. Requirement 3. How many times did Brigham Foods cover its interest expense during 20107 Round your answer to two decimallon) Begram covered the interest expense Requirement 4. Assume that all of the casting is included in the information provided. Calculate the leverage ratio and debt ratio of the company. Use year and figures in place of everages were needed for the purpose of calculating ratios in this problem. Evaluate the heart of the company from a leverage point of view. Assume the company only has common stock issued and outstanding. What other information would be helpful in making your evaluation? Begin by computing the leverage ratio Select the formula for the leverage ratio. The complete the formula and calculate the leverage rato. Round your answer to two decimal places) Leverage ratio Now, select the form for the debt ratio. Then complete the formula ad calculate the debt ratio. (found your new to wo decimal place) Det Evaluate health of the company from a verage point of view. What the information would be helpful in making your evaluation Round the tito bodecimal places) The company's debt to and leverage ratione and operating income covers interest payments by times With this time information, the company to be romaverage point of view would be Requirements. Independent of your answer to the stume that Footnotes of the financial statements includes commitments for operating intet over the next 15 year in the amount of 59,300,000. Il the company had to capitalise there are in 2018, how would it change the leverage ratio and the debt rati? How would this impact your assessment of the company's health from a leverage point of view? Select the formule and compute the leverage ratio muuming that the company had to capaze fases amounting to $3.900.000 (Round your new concimi place) Leverage Select the formula and compute the debt fitio msuming that the company had to capitalice se mounting 10 $2.000.000 (round your arower to be decimal places) Debat How would this change impact your smart of the company's health from a leverage point of view? The leverage rate and debt ratio would The company w tom a leverage point of view Requirements Data table $ 4,800.000 5 160.000 1. Show how each relevant from would be reported on the Brigham Foods classified balance sheet. Include tradings and totals for current abilities and long term habilities 2. Answer the following questions about Brigham Food's financial position at December 31 2018 What is the carrying amount of the bonds payable combine the current and long-term amounta? b. Why is the interest payable amount so much less than the amount of interest expen? 1. How many times did Brigham Foods cover its interest expense during 2018? 4 Assume that all of the cresting abs re included in the information provided Calculate the leverage rato and debt ratio of the company. Use year-end figures in place of o average where needed for the purpose of calculating ratlos in this problem. Evaluate he hour of the company from a leverage point of view. Assume the company only ha common ocksted and outstanding What other information would be hebben making your evaluation? Independent of your answer to (4) assume that Footnote of the financial atements Includes commitments for long-term operating fases over the next 15 years in the amount of $3,000,000. The company had to capitalize these letos n 2018, how would It change the leverage ratio and the debt? How would the impact your en of the company het om al pont of view? Mortgage note payable current portion Les payable long term Bonds payatong Mortgage note payable long-term tonde water current portion res Total 95.000 Accumulated depreciation 450.000 per 125.000 Downton bonds i longtem 314.000 Operating income 10.000 en 224,000 Longbomments reve) We payable 20.000 300.000 745.000 30 000 14000 Print Done Print Done The accounting records of Brigham Foods, Inc., include the following terms at December 31, 2018 Coke icon to view the accounting records) Read the requirements Select the labels and then enter the amounts to complete the classified balance sheet. You will need determine the total current assets value from the information provided and your calculations. Abbreviations dob BNP cos payable and paypayati) Brigham Foods, Inc. Partial Balance Shout December 31, 2018 Asset Labis atittaen et payati 14.000 Mortgage current 95.000 Donde pay, current 50,000 Or 191.000 210,000 Long term Lorem 0000 Layanam 450.000 Very plant and Mortgage long to 314,000 Lot WOOD tem 25.000 10000 LAGU 70.00 Don Bonapay 000 29.000 100.000 22,000 3.000 To 100.000 and 4.800,000 Requirement 2. Answer the following questions about Brigham Food's financial position December 31, 2018 What is the carrying out of the bonds payable combine the current and long term account? b. Why is the interest payable amount so much less than the amount of interest expense? Interest payable is the cerpany's cost of bonowing for the full year. Interest expense is the amount of interest that the company owes at year-end. Requirement 3. How many times did Brigham Foods cover its interest expense during 20107 Round your answer to two decimallon) Begram covered the interest expense Requirement 4. Assume that all of the casting is included in the information provided. Calculate the leverage ratio and debt ratio of the company. Use year and figures in place of everages were needed for the purpose of calculating ratios in this problem. Evaluate the heart of the company from a leverage point of view. Assume the company only has common stock issued and outstanding. What other information would be helpful in making your evaluation? Begin by computing the leverage ratio Select the formula for the leverage ratio. The complete the formula and calculate the leverage rato. Round your answer to two decimal places) Leverage ratio Now, select the form for the debt ratio. Then complete the formula ad calculate the debt ratio. (found your new to wo decimal place) Det Evaluate health of the company from a verage point of view. What the information would be helpful in making your evaluation Round the tito bodecimal places) The company's debt to and leverage ratione and operating income covers interest payments by times With this time information, the company to be romaverage point of view would be Requirements. Independent of your answer to the stume that Footnotes of the financial statements includes commitments for operating intet over the next 15 year in the amount of 59,300,000. Il the company had to capitalise there are in 2018, how would it change the leverage ratio and the debt rati? How would this impact your assessment of the company's health from a leverage point of view? Select the formule and compute the leverage ratio muuming that the company had to capaze fases amounting to $3.900.000 (Round your new concimi place) Leverage Select the formula and compute the debt fitio msuming that the company had to capitalice se mounting 10 $2.000.000 (round your arower to be decimal places) Debat How would this change impact your smart of the company's health from a leverage point of view? The leverage rate and debt ratio would The company w tom a leverage point of view Requirements Data table $ 4,800.000 5 160.000 1. Show how each relevant from would be reported on the Brigham Foods classified balance sheet. Include tradings and totals for current abilities and long term habilities 2. Answer the following questions about Brigham Food's financial position at December 31 2018 What is the carrying amount of the bonds payable combine the current and long-term amounta? b. Why is the interest payable amount so much less than the amount of interest expen? 1. How many times did Brigham Foods cover its interest expense during 2018? 4 Assume that all of the cresting abs re included in the information provided Calculate the leverage rato and debt ratio of the company. Use year-end figures in place of o average where needed for the purpose of calculating ratlos in this problem. Evaluate he hour of the company from a leverage point of view. Assume the company only ha common ocksted and outstanding What other information would be hebben making your evaluation? Independent of your answer to (4) assume that Footnote of the financial atements Includes commitments for long-term operating fases over the next 15 years in the amount of $3,000,000. The company had to capitalize these letos n 2018, how would It change the leverage ratio and the debt? How would the impact your en of the company het om al pont of view? Mortgage note payable current portion Les payable long term Bonds payatong Mortgage note payable long-term tonde water current portion res Total 95.000 Accumulated depreciation 450.000 per 125.000 Downton bonds i longtem 314.000 Operating income 10.000 en 224,000 Longbomments reve) We payable 20.000 300.000 745.000 30 000 14000 Print Done Print Done