Question

The accounting records of Fabiano Distribution show the following assets and liabilities as of December 31, 2010 and 2011. December 31 2010 2011 Cash $

| The accounting records of Fabiano Distribution show the following assets and liabilities as of December 31, 2010 and 2011. |

| December 31 | 2010 | 2011 | ||

| Cash | $ | 43,894 | $ | 6,731 |

| Accounts receivable | 23,826 | 18,680 | ||

| Office supplies | 3,758 | 2,753 | ||

| Office Equipment | 115,374 | 122,895 | ||

| Trucks | 45,148 | 54,148 | ||

| Building | 0 | 150,502 | ||

| Land | 0 | 37,554 | ||

| Accounts Payable | 62,640 | 31,068 | ||

| Note payable | 0 | 88,056 | ||

| | ||||

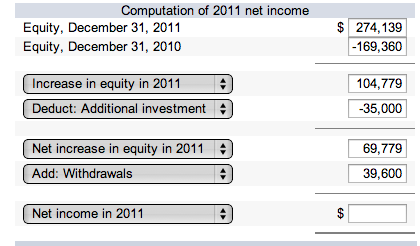

| Late in December 2011, the business purchased a small office building and land for $188,056. It paid $100,000 cash toward the purchase and an $88,056 note payable was signed for the balance. Mr. Fabiano had to invest $35,000 cash in the business in exchange for stock to enable it to pay the $100,000 cash. The business also pays $3,300 cash per month for dividends

|

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started