Question

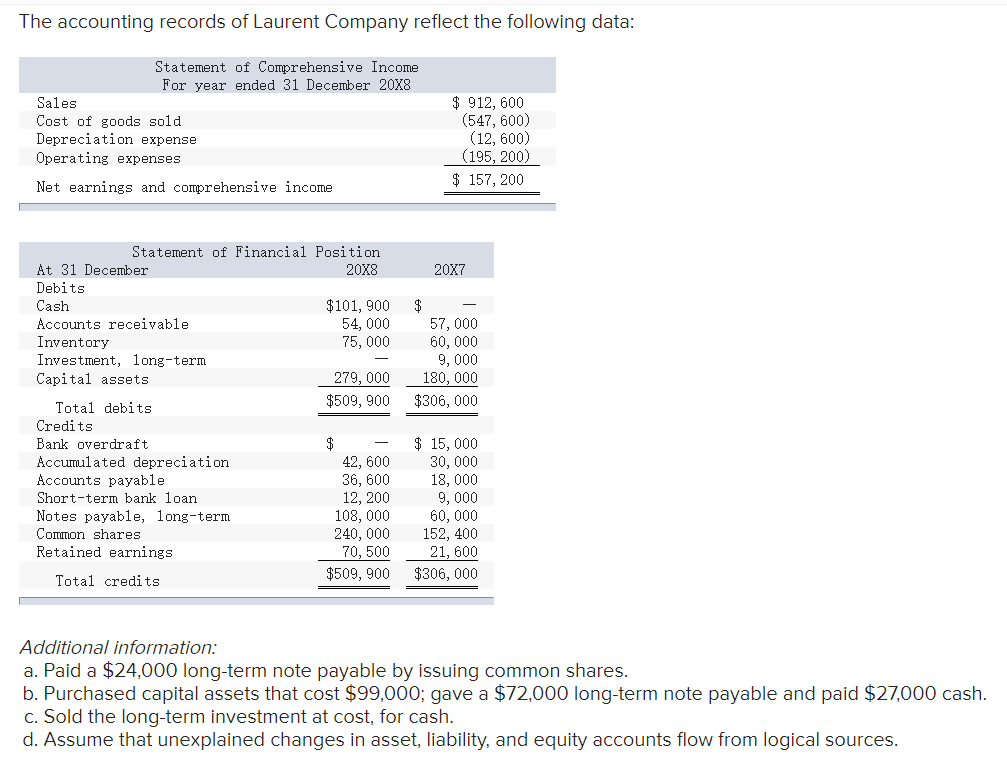

The accounting records of Laurent Company reflect the following data: Statement of Comprehensive Income For year ended 31 December 20X8 Sales $ 912,600 Cost of

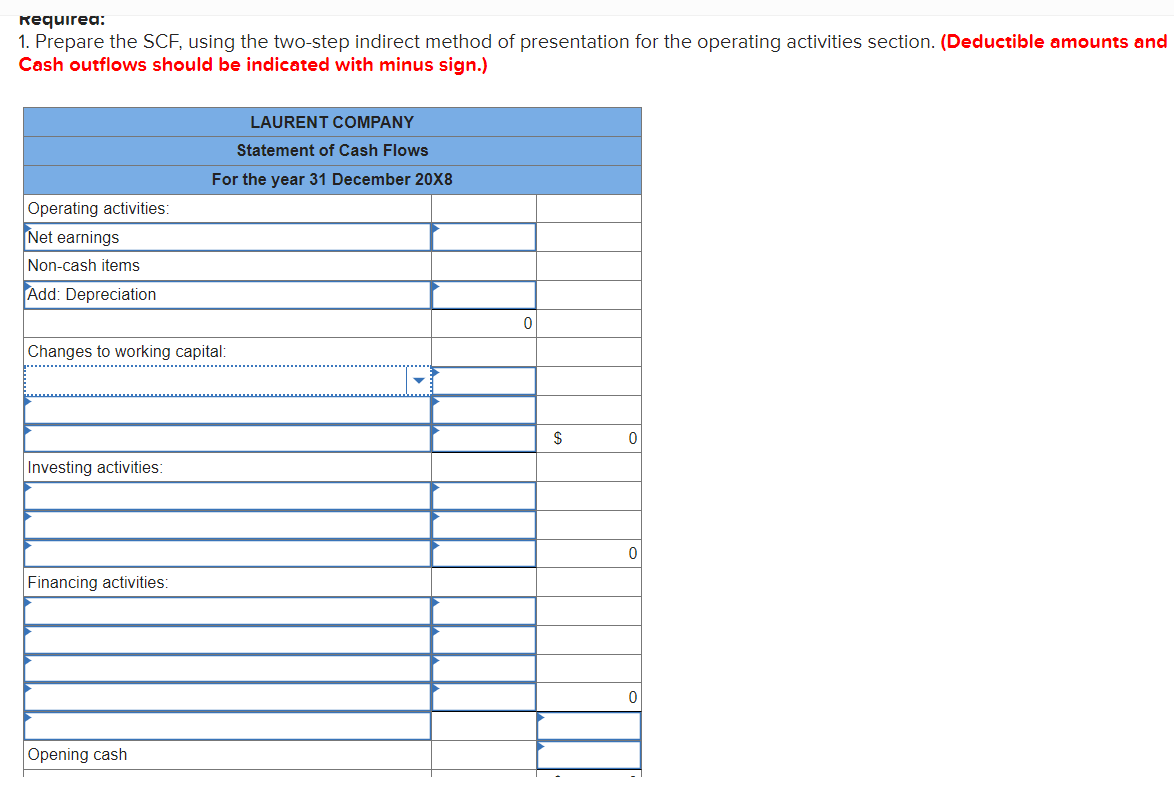

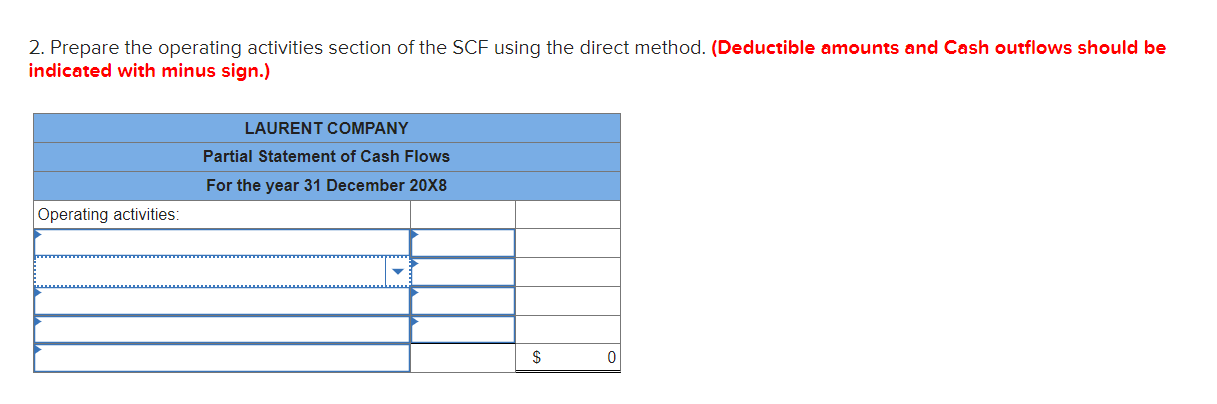

The accounting records of Laurent Company reflect the following data: Statement of Comprehensive Income For year ended 31 December 20X8 Sales $ 912,600 Cost of goods sold (547,600 ) Depreciation expense (12,600 ) Operating expenses (195,200 ) Net earnings and comprehensive income $ 157,200 Statement of Financial Position At 31 December 20X8 20X7 Debits Cash $ 101,900 $ Accounts receivable 54,000 57,000 Inventory 75,000 60,000 Investment, long-term 9,000 Capital assets 279,000 180,000 Total debits $ 509,900 $ 306,000 Credits Bank overdraft $ $ 15,000 Accumulated depreciation 42,600 30,000 Accounts payable 36,600 18,000 Short-term bank loan 12,200 9,000 Notes payable, long-term 108,000 60,000 Common shares 240,000 152,400 Retained earnings 70,500 21,600 Total credits $ 509,900 $ 306,000 Additional information: Paid a $24,000 long-term note payable by issuing common shares. Purchased capital assets that cost $99,000; gave a $72,000 long-term note payable and paid $27,000 cash. Sold the long-term investment at cost, for cash. Assume that unexplained changes in asset, liability, and equity accounts flow from logical sources. Required: 1. Prepare the SCF, using the two-step indirect method of presentation for the operating activities section. (Deductible amounts and Cash outflows should be indicated with minus sign.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started