Answered step by step

Verified Expert Solution

Question

1 Approved Answer

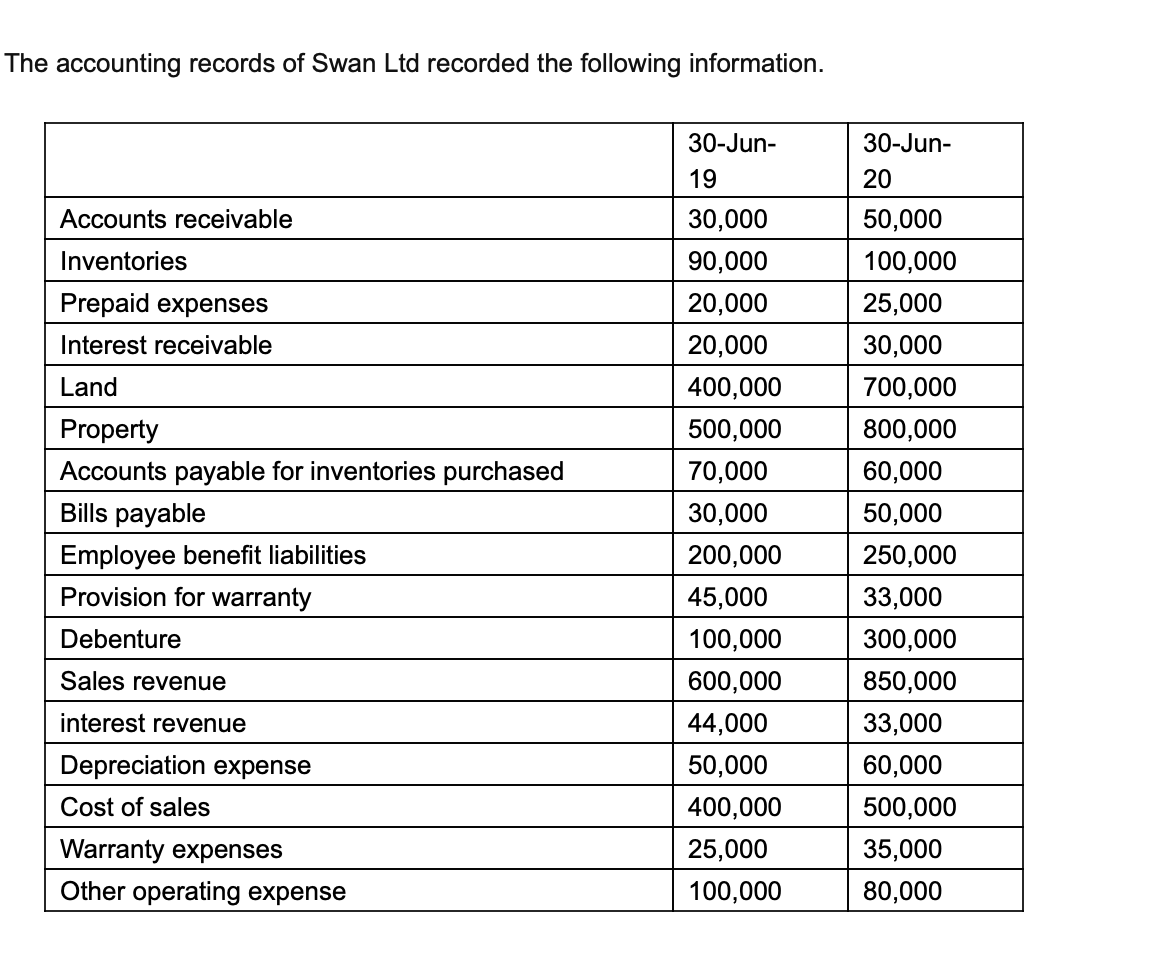

The accounting records of Swan Ltd recorded the following information. Required: Calculate the total amount of cash paid to suppliers and employees during the year

The accounting records of Swan Ltd recorded the following information.

Required: Calculate the total amount of cash paid to suppliers and employees during the year ended 30 June 2020. (8 marks). Both direct method and the use of T-ledgers are accepted.) Are all the accounts given in the table above related to cash paid to suppliers and employees? If not, which account/accounts is/are not and what activities do they belong to? (4 marks).

The accounting records of Swan Ltd recorded the following information. 30-Jun- 19 30-Jun- 20 Accounts receivable Inventories Prepaid expenses Interest receivable Land Property Accounts payable for inventories purchased Bills payable Employee benefit liabilities Provision for warranty Debenture 30,000 90,000 20,000 20,000 400,000 500,000 70,000 30,000 200,000 45,000 100,000 600,000 44,000 50,000 400,000 25,000 100,000 50,000 100,000 25,000 30,000 700,000 800,000 60,000 50,000 250,000 33,000 300,000 850,000 33,000 60,000 500,000 35,000 80,000 Sales revenue interest revenue Depreciation expense Cost of sales Warranty expenses Other operating expenseStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started