Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The accounting records of Wall's China Shop reflected the following balances as of January 1, Year 2: Cash Beginning inventory Common stock Retained earnings

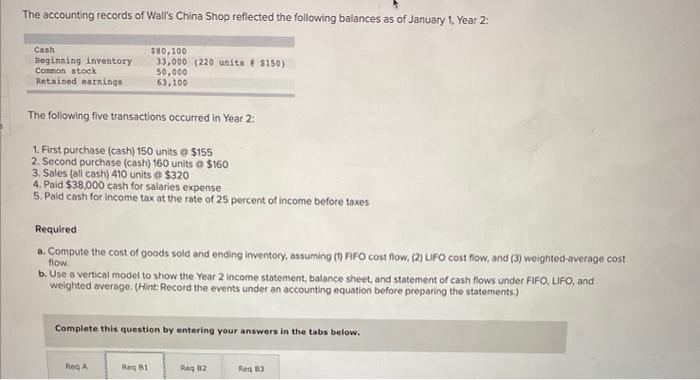

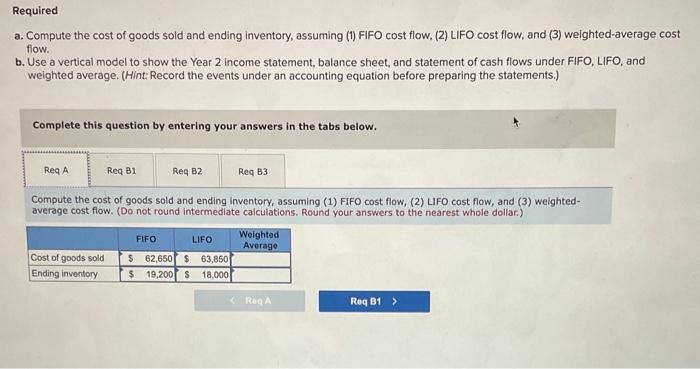

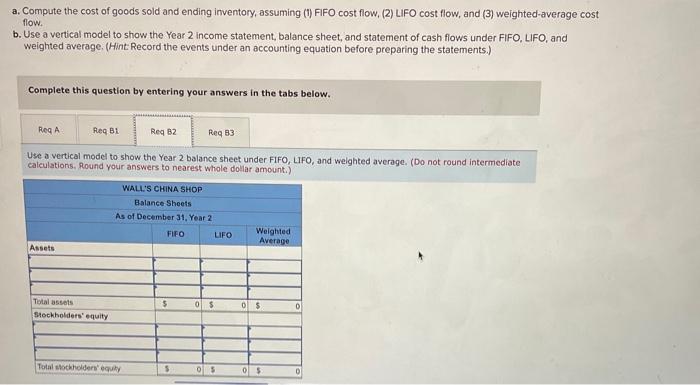

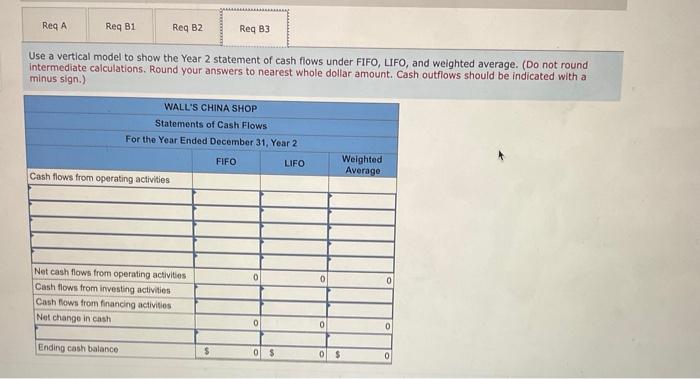

The accounting records of Wall's China Shop reflected the following balances as of January 1, Year 2: Cash Beginning inventory Common stock Retained earnings The following five transactions occurred in Year 2: 1. First purchase (cash) 150 units @ $155 2. Second purchase (cash) 160 units @ $160 $80,100 33,000 (220 units @ $150) 50,000 63,100 3. Sales (all cash) 410 units @ $320 4. Paid $38,000 cash for salaries expense 5. Paid cash for income tax at the rate of 25 percent of income before taxes Required a. Compute the cost of goods sold and ending inventory, assuming (1) FIFO cost flow, (2) LIFO cost flow, and (3) weighted-average cost flow. b. Use a vertical model to show the Year 2 income statement, balance sheet, and statement of cash flows under FIFO, LIFO, and weighted average. (Hint: Record the events under an accounting equation before preparing the statements.) Complete this question by entering your answers in the tabs below. Req A Req B1 Req 82 Req 83 Required a. Compute the cost of goods sold and ending inventory, assuming (1) FIFO cost flow. (2) LIFO cost flow, and (3) weighted-average cost flow. b. Use a vertical model to show the Year 2 income statement, balance sheet, and statement of cash flows under FIFO, LIFO, and weighted average. (Hint: Record the events under an accounting equation before preparing the statements.) Complete this question by entering your answers in the tabs below. Req B2 Req 83 Compute the cost of goods sold and ending inventory, assuming (1) FIFO cost flow, (2) LIFO cost flow, and (3) weighted- average cost flow. (Do not round intermediate calculations. Round your answers to the nearest whole dollar.) Req A Cost of goods sold Ending inventory Req B1 FIFO LIFO $ 62,650 $63,850 $ 19,200 $ 18,000. Weighted Average Required a. Compute the cost of goods sold and ending inventory, assuming (1) FIFO cost flow, (2) LIFO cost flow, and (3) weighted-average cost flow. b. Use a vertical model to show the Year 2 income statement, balance sheet, and statement of cash flows under FIFO, LIFO, and weighted average. (Hint: Record the events under an accounting equation before preparing the statements.) Complete this question by entering your answers in the tabs below. Req A Use a vertical model to show the Year 2 income statement under FIFO, LIFO, and weighted average. (Do not round intermediate calculations. Round your answers to nearest whole dollar amount.) Req B1 Sales Cost of goods sold Gross margin Req 82 WALL'S CHINA SHOP Income Statements For the Year Ended December 31, Year 2 FIFO LIFO $ 131,200 $131,200 62,650 68,550 38,000 30,550 7,638 Salaries expense Income before tax Income tax expenses Net income Req B3 63,850 67,350 38,000 29,350 7,338 Reg A Weighted Average $ 131,200 63,317 67,882 38,000 29,882 7,471 $ 22,412 < Prav Reg B2 > 21 21 Mant a. Compute the cost of goods sold and ending inventory, assuming (1) FIFO cost flow, (2) LIFO cost flow, and (3) weighted-average cost flow. b. Use a vertical model to show the Year 2 income statement, balance sheet, and statement of cash flows under FIFO, LIFO, and weighted average. (Hint: Record the events under an accounting equation before preparing the statements.) Complete this question by entering your answers in the tabs below. Reg A Req 82 Use a vertical model to show the Year 2 balance sheet under FIFO, LIFO, and weighted average. (Do not round intermediate calculations. Round your answers to nearest whole dollar amount.) Req Bi Assets Total assets Stockholders' equity WALL'S CHINA SHOP Balance Sheets As of December 31, Year 2 FIFO Total stockholders' equity $ Req 83 S 0 $ LIFO 0$ Weighted Average 0$ 0$ 0 0 Req A Req B1 Req B2 Use a vertical model to show the Year 2 statement of cash flows under FIFO, LIFO, and weighted average. (Do not round intermediate calculations. Round your answers to nearest whole dollar amount. Cash outflows should be indicated with a minus sign.) Cash flows from operating activities Ending cash balance WALL'S CHINA SHOP Statements of Cash Flows For the Year Ended December 31, Year 2 FIFO LIFO Net cash flows from operating activities Cash flows from investing activities Cash flows from financing activities Net change in cash Req B3 $ 0 0 0 $ 0 0 0 Weighted Average $ 0 0 0 The accounting records of Wall's China Shop reflected the following balances as of January 1, Year 2: Cash Beginning inventory Common stock Retained earnings The following five transactions occurred in Year 2: 1. First purchase (cash) 150 units @ $155 2. Second purchase (cash) 160 units @ $160 $80,100 33,000 (220 units @ $150) 50,000 63,100 3. Sales (all cash) 410 units @ $320 4. Paid $38,000 cash for salaries expense 5. Paid cash for income tax at the rate of 25 percent of income before taxes Required a. Compute the cost of goods sold and ending inventory, assuming (1) FIFO cost flow, (2) LIFO cost flow, and (3) weighted-average cost flow. b. Use a vertical model to show the Year 2 income statement, balance sheet, and statement of cash flows under FIFO, LIFO, and weighted average. (Hint: Record the events under an accounting equation before preparing the statements.) Complete this question by entering your answers in the tabs below. Req A Req B1 Req 82 Req 83 Required a. Compute the cost of goods sold and ending inventory, assuming (1) FIFO cost flow. (2) LIFO cost flow, and (3) weighted-average cost flow. b. Use a vertical model to show the Year 2 income statement, balance sheet, and statement of cash flows under FIFO, LIFO, and weighted average. (Hint: Record the events under an accounting equation before preparing the statements.) Complete this question by entering your answers in the tabs below. Req B2 Req 83 Compute the cost of goods sold and ending inventory, assuming (1) FIFO cost flow, (2) LIFO cost flow, and (3) weighted- average cost flow. (Do not round intermediate calculations. Round your answers to the nearest whole dollar.) Req A Cost of goods sold Ending inventory Req B1 FIFO LIFO $ 62,650 $63,850 $ 19,200 $ 18,000. Weighted Average Required a. Compute the cost of goods sold and ending inventory, assuming (1) FIFO cost flow, (2) LIFO cost flow, and (3) weighted-average cost flow. b. Use a vertical model to show the Year 2 income statement, balance sheet, and statement of cash flows under FIFO, LIFO, and weighted average. (Hint: Record the events under an accounting equation before preparing the statements.) Complete this question by entering your answers in the tabs below. Req A Use a vertical model to show the Year 2 income statement under FIFO, LIFO, and weighted average. (Do not round intermediate calculations. Round your answers to nearest whole dollar amount.) Req B1 Sales Cost of goods sold Gross margin Req 82 WALL'S CHINA SHOP Income Statements For the Year Ended December 31, Year 2 FIFO LIFO $ 131,200 $131,200 62,650 68,550 38,000 30,550 7,638 Salaries expense Income before tax Income tax expenses Net income Req B3 63,850 67,350 38,000 29,350 7,338 Reg A Weighted Average $ 131,200 63,317 67,882 38,000 29,882 7,471 $ 22,412 < Prav Reg B2 > 21 21 Mant a. Compute the cost of goods sold and ending inventory, assuming (1) FIFO cost flow, (2) LIFO cost flow, and (3) weighted-average cost flow. b. Use a vertical model to show the Year 2 income statement, balance sheet, and statement of cash flows under FIFO, LIFO, and weighted average. (Hint: Record the events under an accounting equation before preparing the statements.) Complete this question by entering your answers in the tabs below. Reg A Req 82 Use a vertical model to show the Year 2 balance sheet under FIFO, LIFO, and weighted average. (Do not round intermediate calculations. Round your answers to nearest whole dollar amount.) Req Bi Assets Total assets Stockholders' equity WALL'S CHINA SHOP Balance Sheets As of December 31, Year 2 FIFO Total stockholders' equity $ Req 83 S 0 $ LIFO 0$ Weighted Average 0$ 0$ 0 0 Req A Req B1 Req B2 Use a vertical model to show the Year 2 statement of cash flows under FIFO, LIFO, and weighted average. (Do not round intermediate calculations. Round your answers to nearest whole dollar amount. Cash outflows should be indicated with a minus sign.) Cash flows from operating activities Ending cash balance WALL'S CHINA SHOP Statements of Cash Flows For the Year Ended December 31, Year 2 FIFO LIFO Net cash flows from operating activities Cash flows from investing activities Cash flows from financing activities Net change in cash Req B3 $ 0 0 0 $ 0 0 0 Weighted Average $ 0 0 0 The accounting records of Wall's China Shop reflected the following balances as of January 1, Year 2: Cash Beginning inventory Common stock Retained earnings The following five transactions occurred in Year 2: 1. First purchase (cash) 150 units @ $155 2. Second purchase (cash) 160 units @ $160 $80,100 33,000 (220 units @ $150) 50,000 63,100 3. Sales (all cash) 410 units @ $320 4. Paid $38,000 cash for salaries expense 5. Paid cash for income tax at the rate of 25 percent of income before taxes Required a. Compute the cost of goods sold and ending inventory, assuming (1) FIFO cost flow, (2) LIFO cost flow, and (3) weighted-average cost flow. b. Use a vertical model to show the Year 2 income statement, balance sheet, and statement of cash flows under FIFO, LIFO, and weighted average. (Hint: Record the events under an accounting equation before preparing the statements.) Complete this question by entering your answers in the tabs below. Req A Req B1 Req 82 Req 83 Required a. Compute the cost of goods sold and ending inventory, assuming (1) FIFO cost flow. (2) LIFO cost flow, and (3) weighted-average cost flow. b. Use a vertical model to show the Year 2 income statement, balance sheet, and statement of cash flows under FIFO, LIFO, and weighted average. (Hint: Record the events under an accounting equation before preparing the statements.) Complete this question by entering your answers in the tabs below. Req B2 Req 83 Compute the cost of goods sold and ending inventory, assuming (1) FIFO cost flow, (2) LIFO cost flow, and (3) weighted- average cost flow. (Do not round intermediate calculations. Round your answers to the nearest whole dollar.) Req A Cost of goods sold Ending inventory Req B1 FIFO LIFO $ 62,650 $63,850 $ 19,200 $ 18,000. Weighted Average Required a. Compute the cost of goods sold and ending inventory, assuming (1) FIFO cost flow, (2) LIFO cost flow, and (3) weighted-average cost flow. b. Use a vertical model to show the Year 2 income statement, balance sheet, and statement of cash flows under FIFO, LIFO, and weighted average. (Hint: Record the events under an accounting equation before preparing the statements.) Complete this question by entering your answers in the tabs below. Req A Use a vertical model to show the Year 2 income statement under FIFO, LIFO, and weighted average. (Do not round intermediate calculations. Round your answers to nearest whole dollar amount.) Req B1 Sales Cost of goods sold Gross margin Req 82 WALL'S CHINA SHOP Income Statements For the Year Ended December 31, Year 2 FIFO LIFO $ 131,200 $131,200 62,650 68,550 38,000 30,550 7,638 Salaries expense Income before tax Income tax expenses Net income Req B3 63,850 67,350 38,000 29,350 7,338 Reg A Weighted Average $ 131,200 63,317 67,882 38,000 29,882 7,471 $ 22,412 < Prav Reg B2 > 21 21 Mant a. Compute the cost of goods sold and ending inventory, assuming (1) FIFO cost flow, (2) LIFO cost flow, and (3) weighted-average cost flow. b. Use a vertical model to show the Year 2 income statement, balance sheet, and statement of cash flows under FIFO, LIFO, and weighted average. (Hint: Record the events under an accounting equation before preparing the statements.) Complete this question by entering your answers in the tabs below. Reg A Req 82 Use a vertical model to show the Year 2 balance sheet under FIFO, LIFO, and weighted average. (Do not round intermediate calculations. Round your answers to nearest whole dollar amount.) Req Bi Assets Total assets Stockholders' equity WALL'S CHINA SHOP Balance Sheets As of December 31, Year 2 FIFO Total stockholders' equity $ Req 83 S 0 $ LIFO 0$ Weighted Average 0$ 0$ 0 0 Req A Req B1 Req B2 Use a vertical model to show the Year 2 statement of cash flows under FIFO, LIFO, and weighted average. (Do not round intermediate calculations. Round your answers to nearest whole dollar amount. Cash outflows should be indicated with a minus sign.) Cash flows from operating activities Ending cash balance WALL'S CHINA SHOP Statements of Cash Flows For the Year Ended December 31, Year 2 FIFO LIFO Net cash flows from operating activities Cash flows from investing activities Cash flows from financing activities Net change in cash Req B3 $ 0 0 0 $ 0 0 0 Weighted Average $ 0 0 0 The accounting records of Wall's China Shop reflected the following balances as of January 1, Year 2: Cash Beginning inventory Common stock Retained earnings The following five transactions occurred in Year 2: 1. First purchase (cash) 150 units @ $155 2. Second purchase (cash) 160 units @ $160 $80,100 33,000 (220 units @ $150) 50,000 63,100 3. Sales (all cash) 410 units @ $320 4. Paid $38,000 cash for salaries expense 5. Paid cash for income tax at the rate of 25 percent of income before taxes Required a. Compute the cost of goods sold and ending inventory, assuming (1) FIFO cost flow, (2) LIFO cost flow, and (3) weighted-average cost flow. b. Use a vertical model to show the Year 2 income statement, balance sheet, and statement of cash flows under FIFO, LIFO, and weighted average. (Hint: Record the events under an accounting equation before preparing the statements.) Complete this question by entering your answers in the tabs below. Req A Req B1 Req 82 Req 83 Required a. Compute the cost of goods sold and ending inventory, assuming (1) FIFO cost flow. (2) LIFO cost flow, and (3) weighted-average cost flow. b. Use a vertical model to show the Year 2 income statement, balance sheet, and statement of cash flows under FIFO, LIFO, and weighted average. (Hint: Record the events under an accounting equation before preparing the statements.) Complete this question by entering your answers in the tabs below. Req B2 Req 83 Compute the cost of goods sold and ending inventory, assuming (1) FIFO cost flow, (2) LIFO cost flow, and (3) weighted- average cost flow. (Do not round intermediate calculations. Round your answers to the nearest whole dollar.) Req A Cost of goods sold Ending inventory Req B1 FIFO LIFO $ 62,650 $63,850 $ 19,200 $ 18,000. Weighted Average Required a. Compute the cost of goods sold and ending inventory, assuming (1) FIFO cost flow, (2) LIFO cost flow, and (3) weighted-average cost flow. b. Use a vertical model to show the Year 2 income statement, balance sheet, and statement of cash flows under FIFO, LIFO, and weighted average. (Hint: Record the events under an accounting equation before preparing the statements.) Complete this question by entering your answers in the tabs below. Req A Use a vertical model to show the Year 2 income statement under FIFO, LIFO, and weighted average. (Do not round intermediate calculations. Round your answers to nearest whole dollar amount.) Req B1 Sales Cost of goods sold Gross margin Req 82 WALL'S CHINA SHOP Income Statements For the Year Ended December 31, Year 2 FIFO LIFO $ 131,200 $131,200 62,650 68,550 38,000 30,550 7,638 Salaries expense Income before tax Income tax expenses Net income Req B3 63,850 67,350 38,000 29,350 7,338 Reg A Weighted Average $ 131,200 63,317 67,882 38,000 29,882 7,471 $ 22,412 < Prav Reg B2 > 21 21 Mant a. Compute the cost of goods sold and ending inventory, assuming (1) FIFO cost flow, (2) LIFO cost flow, and (3) weighted-average cost flow. b. Use a vertical model to show the Year 2 income statement, balance sheet, and statement of cash flows under FIFO, LIFO, and weighted average. (Hint: Record the events under an accounting equation before preparing the statements.) Complete this question by entering your answers in the tabs below. Reg A Req 82 Use a vertical model to show the Year 2 balance sheet under FIFO, LIFO, and weighted average. (Do not round intermediate calculations. Round your answers to nearest whole dollar amount.) Req Bi Assets Total assets Stockholders' equity WALL'S CHINA SHOP Balance Sheets As of December 31, Year 2 FIFO Total stockholders' equity $ Req 83 S 0 $ LIFO 0$ Weighted Average 0$ 0$ 0 0 Req A Req B1 Req B2 Use a vertical model to show the Year 2 statement of cash flows under FIFO, LIFO, and weighted average. (Do not round intermediate calculations. Round your answers to nearest whole dollar amount. Cash outflows should be indicated with a minus sign.) Cash flows from operating activities Ending cash balance WALL'S CHINA SHOP Statements of Cash Flows For the Year Ended December 31, Year 2 FIFO LIFO Net cash flows from operating activities Cash flows from investing activities Cash flows from financing activities Net change in cash Req B3 $ 0 0 0 $ 0 0 0 Weighted Average $ 0 0 0 The accounting records of Wall's China Shop reflected the following balances as of January 1, Year 2: Cash Beginning inventory Common stock Retained earnings The following five transactions occurred in Year 2: 1. First purchase (cash) 150 units @ $155 2. Second purchase (cash) 160 units @ $160 $80,100 33,000 (220 units @ $150) 50,000 63,100 3. Sales (all cash) 410 units @ $320 4. Paid $38,000 cash for salaries expense 5. Paid cash for income tax at the rate of 25 percent of income before taxes Required a. Compute the cost of goods sold and ending inventory, assuming (1) FIFO cost flow, (2) LIFO cost flow, and (3) weighted-average cost flow. b. Use a vertical model to show the Year 2 income statement, balance sheet, and statement of cash flows under FIFO, LIFO, and weighted average. (Hint: Record the events under an accounting equation before preparing the statements.) Complete this question by entering your answers in the tabs below. Req A Req B1 Req 82 Req 83 Required a. Compute the cost of goods sold and ending inventory, assuming (1) FIFO cost flow. (2) LIFO cost flow, and (3) weighted-average cost flow. b. Use a vertical model to show the Year 2 income statement, balance sheet, and statement of cash flows under FIFO, LIFO, and weighted average. (Hint: Record the events under an accounting equation before preparing the statements.) Complete this question by entering your answers in the tabs below. Req B2 Req 83 Compute the cost of goods sold and ending inventory, assuming (1) FIFO cost flow, (2) LIFO cost flow, and (3) weighted- average cost flow. (Do not round intermediate calculations. Round your answers to the nearest whole dollar.) Req A Cost of goods sold Ending inventory Req B1 FIFO LIFO $ 62,650 $63,850 $ 19,200 $ 18,000. Weighted Average Required a. Compute the cost of goods sold and ending inventory, assuming (1) FIFO cost flow, (2) LIFO cost flow, and (3) weighted-average cost flow. b. Use a vertical model to show the Year 2 income statement, balance sheet, and statement of cash flows under FIFO, LIFO, and weighted average. (Hint: Record the events under an accounting equation before preparing the statements.) Complete this question by entering your answers in the tabs below. Req A Use a vertical model to show the Year 2 income statement under FIFO, LIFO, and weighted average. (Do not round intermediate calculations. Round your answers to nearest whole dollar amount.) Req B1 Sales Cost of goods sold Gross margin Req 82 WALL'S CHINA SHOP Income Statements For the Year Ended December 31, Year 2 FIFO LIFO $ 131,200 $131,200 62,650 68,550 38,000 30,550 7,638 Salaries expense Income before tax Income tax expenses Net income Req B3 63,850 67,350 38,000 29,350 7,338 Reg A Weighted Average $ 131,200 63,317 67,882 38,000 29,882 7,471 $ 22,412 < Prav Reg B2 > 21 21 Mant a. Compute the cost of goods sold and ending inventory, assuming (1) FIFO cost flow, (2) LIFO cost flow, and (3) weighted-average cost flow. b. Use a vertical model to show the Year 2 income statement, balance sheet, and statement of cash flows under FIFO, LIFO, and weighted average. (Hint: Record the events under an accounting equation before preparing the statements.) Complete this question by entering your answers in the tabs below. Reg A Req 82 Use a vertical model to show the Year 2 balance sheet under FIFO, LIFO, and weighted average. (Do not round intermediate calculations. Round your answers to nearest whole dollar amount.) Req Bi Assets Total assets Stockholders' equity WALL'S CHINA SHOP Balance Sheets As of December 31, Year 2 FIFO Total stockholders' equity $ Req 83 S 0 $ LIFO 0$ Weighted Average 0$ 0$ 0 0 Req A Req B1 Req B2 Use a vertical model to show the Year 2 statement of cash flows under FIFO, LIFO, and weighted average. (Do not round intermediate calculations. Round your answers to nearest whole dollar amount. Cash outflows should be indicated with a minus sign.) Cash flows from operating activities Ending cash balance WALL'S CHINA SHOP Statements of Cash Flows For the Year Ended December 31, Year 2 FIFO LIFO Net cash flows from operating activities Cash flows from investing activities Cash flows from financing activities Net change in cash Req B3 $ 0 0 0 $ 0 0 0 Weighted Average $ 0 0 0 The accounting records of Wall's China Shop reflected the following balances as of January 1, Year 2: Cash Beginning inventory Common stock Retained earnings The following five transactions occurred in Year 2: 1. First purchase (cash) 150 units @ $155 2. Second purchase (cash) 160 units @ $160 $80,100 33,000 (220 units @ $150) 50,000 63,100 3. Sales (all cash) 410 units @ $320 4. Paid $38,000 cash for salaries expense 5. Paid cash for income tax at the rate of 25 percent of income before taxes Required a. Compute the cost of goods sold and ending inventory, assuming (1) FIFO cost flow, (2) LIFO cost flow, and (3) weighted-average cost flow. b. Use a vertical model to show the Year 2 income statement, balance sheet, and statement of cash flows under FIFO, LIFO, and weighted average. (Hint: Record the events under an accounting equation before preparing the statements.) Complete this question by entering your answers in the tabs below. Req A Req B1 Req 82 Req 83 Required a. Compute the cost of goods sold and ending inventory, assuming (1) FIFO cost flow. (2) LIFO cost flow, and (3) weighted-average cost flow. b. Use a vertical model to show the Year 2 income statement, balance sheet, and statement of cash flows under FIFO, LIFO, and weighted average. (Hint: Record the events under an accounting equation before preparing the statements.) Complete this question by entering your answers in the tabs below. Req B2 Req 83 Compute the cost of goods sold and ending inventory, assuming (1) FIFO cost flow, (2) LIFO cost flow, and (3) weighted- average cost flow. (Do not round intermediate calculations. Round your answers to the nearest whole dollar.) Req A Cost of goods sold Ending inventory Req B1 FIFO LIFO $ 62,650 $63,850 $ 19,200 $ 18,000. Weighted Average Required a. Compute the cost of goods sold and ending inventory, assuming (1) FIFO cost flow, (2) LIFO cost flow, and (3) weighted-average cost flow. b. Use a vertical model to show the Year 2 income statement, balance sheet, and statement of cash flows under FIFO, LIFO, and weighted average. (Hint: Record the events under an accounting equation before preparing the statements.) Complete this question by entering your answers in the tabs below. Req A Use a vertical model to show the Year 2 income statement under FIFO, LIFO, and weighted average. (Do not round intermediate calculations. Round your answers to nearest whole dollar amount.) Req B1 Sales Cost of goods sold Gross margin Req 82 WALL'S CHINA SHOP Income Statements For the Year Ended December 31, Year 2 FIFO LIFO $ 131,200 $131,200 62,650 68,550 38,000 30,550 7,638 Salaries expense Income before tax Income tax expenses Net income Req B3 63,850 67,350 38,000 29,350 7,338 Reg A Weighted Average $ 131,200 63,317 67,882 38,000 29,882 7,471 $ 22,412 < Prav Reg B2 > 21 21 Mant a. Compute the cost of goods sold and ending inventory, assuming (1) FIFO cost flow, (2) LIFO cost flow, and (3) weighted-average cost flow. b. Use a vertical model to show the Year 2 income statement, balance sheet, and statement of cash flows under FIFO, LIFO, and weighted average. (Hint: Record the events under an accounting equation before preparing the statements.) Complete this question by entering your answers in the tabs below. Reg A Req 82 Use a vertical model to show the Year 2 balance sheet under FIFO, LIFO, and weighted average. (Do not round intermediate calculations. Round your answers to nearest whole dollar amount.) Req Bi Assets Total assets Stockholders' equity WALL'S CHINA SHOP Balance Sheets As of December 31, Year 2 FIFO Total stockholders' equity $ Req 83 S 0 $ LIFO 0$ Weighted Average 0$ 0$ 0 0 Req A Req B1 Req B2 Use a vertical model to show the Year 2 statement of cash flows under FIFO, LIFO, and weighted average. (Do not round intermediate calculations. Round your answers to nearest whole dollar amount. Cash outflows should be indicated with a minus sign.) Cash flows from operating activities Ending cash balance WALL'S CHINA SHOP Statements of Cash Flows For the Year Ended December 31, Year 2 FIFO LIFO Net cash flows from operating activities Cash flows from investing activities Cash flows from financing activities Net change in cash Req B3 $ 0 0 0 $ 0 0 0 Weighted Average $ 0 0 0 The accounting records of Wall's China Shop reflected the following balances as of January 1, Year 2: Cash Beginning inventory Common stock Retained earnings The following five transactions occurred in Year 2: 1. First purchase (cash) 150 units @ $155 2. Second purchase (cash) 160 units @ $160 $80,100 33,000 (220 units @ $150) 50,000 63,100 3. Sales (all cash) 410 units @ $320 4. Paid $38,000 cash for salaries expense 5. Paid cash for income tax at the rate of 25 percent of income before taxes Required a. Compute the cost of goods sold and ending inventory, assuming (1) FIFO cost flow, (2) LIFO cost flow, and (3) weighted-average cost flow. b. Use a vertical model to show the Year 2 income statement, balance sheet, and statement of cash flows under FIFO, LIFO, and weighted average. (Hint: Record the events under an accounting equation before preparing the statements.) Complete this question by entering your answers in the tabs below. Req A Req B1 Req 82 Req 83 Required a. Compute the cost of goods sold and ending inventory, assuming (1) FIFO cost flow. (2) LIFO cost flow, and (3) weighted-average cost flow. b. Use a vertical model to show the Year 2 income statement, balance sheet, and statement of cash flows under FIFO, LIFO, and weighted average. (Hint: Record the events under an accounting equation before preparing the statements.) Complete this question by entering your answers in the tabs below. Req B2 Req 83 Compute the cost of goods sold and ending inventory, assuming (1) FIFO cost flow, (2) LIFO cost flow, and (3) weighted- average cost flow. (Do not round intermediate calculations. Round your answers to the nearest whole dollar.) Req A Cost of goods sold Ending inventory Req B1 FIFO LIFO $ 62,650 $63,850 $ 19,200 $ 18,000. Weighted Average Required a. Compute the cost of goods sold and ending inventory, assuming (1) FIFO cost flow, (2) LIFO cost flow, and (3) weighted-average cost flow. b. Use a vertical model to show the Year 2 income statement, balance sheet, and statement of cash flows under FIFO, LIFO, and weighted average. (Hint: Record the events under an accounting equation before preparing the statements.) Complete this question by entering your answers in the tabs below. Req A Use a vertical model to show the Year 2 income statement under FIFO, LIFO, and weighted average. (Do not round intermediate calculations. Round your answers to nearest whole dollar amount.) Req B1 Sales Cost of goods sold Gross margin Req 82 WALL'S CHINA SHOP Income Statements For the Year Ended December 31, Year 2 FIFO LIFO $ 131,200 $131,200 62,650 68,550 38,000 30,550 7,638 Salaries expense Income before tax Income tax expenses Net income Req B3 63,850 67,350 38,000 29,350 7,338 Reg A Weighted Average $ 131,200 63,317 67,882 38,000 29,882 7,471 $ 22,412 < Prav Reg B2 > 21 21 Mant a. Compute the cost of goods sold and ending inventory, assuming (1) FIFO cost flow, (2) LIFO cost flow, and (3) weighted-average cost flow. b. Use a vertical model to show the Year 2 income statement, balance sheet, and statement of cash flows under FIFO, LIFO, and weighted average. (Hint: Record the events under an accounting equation before preparing the statements.) Complete this question by entering your answers in the tabs below. Reg A Req 82 Use a vertical model to show the Year 2 balance sheet under FIFO, LIFO, and weighted average. (Do not round intermediate calculations. Round your answers to nearest whole dollar amount.) Req Bi Assets Total assets Stockholders' equity WALL'S CHINA SHOP Balance Sheets As of December 31, Year 2 FIFO Total stockholders' equity $ Req 83 S 0 $ LIFO 0$ Weighted Average 0$ 0$ 0 0 Req A Req B1 Req B2 Use a vertical model to show the Year 2 statement of cash flows under FIFO, LIFO, and weighted average. (Do not round intermediate calculations. Round your answers to nearest whole dollar amount. Cash outflows should be indicated with a minus sign.) Cash flows from operating activities Ending cash balance WALL'S CHINA SHOP Statements of Cash Flows For the Year Ended December 31, Year 2 FIFO LIFO Net cash flows from operating activities Cash flows from investing activities Cash flows from financing activities Net change in cash Req B3 $ 0 0 0 $ 0 0 0 Weighted Average $ 0 0 0 The accounting records of Wall's China Shop reflected the following balances as of January 1, Year 2: Cash Beginning inventory Common stock Retained earnings The following five transactions occurred in Year 2: 1. First purchase (cash) 150 units @ $155 2. Second purchase (cash) 160 units @ $160 $80,100 33,000 (220 units @ $150) 50,000 63,100 3. Sales (all cash) 410 units @ $320 4. Paid $38,000 cash for salaries expense 5. Paid cash for income tax at the rate of 25 percent of income before taxes Required a. Compute the cost of goods sold and ending inventory, assuming (1) FIFO cost flow, (2) LIFO cost flow, and (3) weighted-average cost flow. b. Use a vertical model to show the Year 2 income statement, balance sheet, and statement of cash flows under FIFO, LIFO, and weighted average. (Hint: Record the events under an accounting equation before preparing the statements.) Complete this question by entering your answers in the tabs below. Req A Req B1 Req 82 Req 83 Required a. Compute the cost of goods sold and ending inventory, assuming (1) FIFO cost flow. (2) LIFO cost flow, and (3) weighted-average cost flow. b. Use a vertical model to show the Year 2 income statement, balance sheet, and statement of cash flows under FIFO, LIFO, and weighted average. (Hint: Record the events under an accounting equation before preparing the statements.) Complete this question by entering your answers in the tabs below. Req B2 Req 83 Compute the cost of goods sold and ending inventory, assuming (1) FIFO cost flow, (2) LIFO cost flow, and (3) weighted- average cost flow. (Do not round intermediate calculations. Round your answers to the nearest whole dollar.) Req A Cost of goods sold Ending inventory Req B1 FIFO LIFO $ 62,650 $63,850 $ 19,200 $ 18,000. Weighted Average Required a. Compute the cost of goods sold and ending inventory, assuming (1) FIFO cost flow, (2) LIFO cost flow, and (3) weighted-average cost flow. b. Use a vertical model to show the Year 2 income statement, balance sheet, and statement of cash flows under FIFO, LIFO, and weighted average. (Hint: Record the events under an accounting equation before preparing the statements.) Complete this question by entering your answers in the tabs below. Req A Use a vertical model to show the Year 2 income statement under FIFO, LIFO, and weighted average. (Do not round intermediate calculations. Round your answers to nearest whole dollar amount.) Req B1 Sales Cost of goods sold Gross margin Req 82 WALL'S CHINA SHOP Income Statements For the Year Ended December 31, Year 2 FIFO LIFO $ 131,200 $131,200 62,650 68,550 38,000 30,550 7,638 Salaries expense Income before tax Income tax expenses Net income Req B3 63,850 67,350 38,000 29,350 7,338 Reg A Weighted Average $ 131,200 63,317 67,882 38,000 29,882 7,471 $ 22,412 < Prav Reg B2 > 21 21 Mant a. Compute the cost of goods sold and ending inventory, assuming (1) FIFO cost flow, (2) LIFO cost flow, and (3) weighted-average cost flow. b. Use a vertical model to show the Year 2 income statement, balance sheet, and statement of cash flows under FIFO, LIFO, and weighted average. (Hint: Record the events under an accounting equation before preparing the statements.) Complete this question by entering your answers in the tabs below. Reg A Req 82 Use a vertical model to show the Year 2 balance sheet under FIFO, LIFO, and weighted average. (Do not round intermediate calculations. Round your answers to nearest whole dollar amount.) Req Bi Assets Total assets Stockholders' equity WALL'S CHINA SHOP Balance Sheets As of December 31, Year 2 FIFO Total stockholders' equity $ Req 83 S 0 $ LIFO 0$ Weighted Average 0$ 0$ 0 0 Req A Req B1 Req B2 Use a vertical model to show the Year 2 statement of cash flows under FIFO, LIFO, and weighted average. (Do not round intermediate calculations. Round your answers to nearest whole dollar amount. Cash outflows should be indicated with a minus sign.) Cash flows from operating activities Ending cash balance WALL'S CHINA SHOP Statements of Cash Flows For the Year Ended December 31, Year 2 FIFO LIFO Net cash flows from operating activities Cash flows from investing activities Cash flows from financing activities Net change in cash Req B3 $ 0 0 0 $ 0 0 0 Weighted Average $ 0 0 0 The accounting records of Wall's China Shop reflected the following balances as of January 1, Year 2: Cash Beginning inventory Common stock Retained earnings The following five transactions occurred in Year 2: 1. First purchase (cash) 150 units @ $155 2. Second purchase (cash) 160 units @ $160 $80,100 33,000 (220 units @ $150) 50,000 63,100 3. Sales (all cash) 410 units @ $320 4. Paid $38,000 cash for salaries expense 5. Paid cash for income tax at the rate of 25 percent of income before taxes Required a. Compute the cost of goods sold and ending inventory, assuming (1) FIFO cost flow, (2) LIFO cost flow, and (3) weighted-average cost flow. b. Use a vertical model to show the Year 2 income statement, balance sheet, and statement of cash flows under FIFO, LIFO, and weighted average. (Hint: Record the events under an accounting equation before preparing the statements.) Complete this question by entering your answers in the tabs below. Req A Req B1 Req 82 Req 83 Required a. Compute the cost of goods sold and ending inventory, assuming (1) FIFO cost flow. (2) LIFO cost flow, and (3) weighted-average cost flow. b. Use a vertical model to show the Year 2 income statement, balance sheet, and statement of cash flows under FIFO, LIFO, and weighted average. (Hint: Record the events under an accounting equation before preparing the statements.) Complete this question by entering your answers in the tabs below. Req B2 Req 83 Compute the cost of goods sold and ending inventory, assuming (1) FIFO cost flow, (2) LIFO cost flow, and (3) weighted- average cost flow. (Do not round intermediate calculations. Round your answers to the nearest whole dollar.) Req A Cost of goods sold Ending inventory Req B1 FIFO LIFO $ 62,650 $63,850 $ 19,200 $ 18,000. Weighted Average Required a. Compute the cost of goods sold and ending inventory, assuming (1) FIFO cost flow, (2) LIFO cost flow, and (3) weighted-average cost flow. b. Use a vertical model to show the Year 2 income statement, balance sheet, and statement of cash flows under FIFO, LIFO, and weighted average. (Hint: Record the events under an accounting equation before preparing the statements.) Complete this question by entering your answers in the tabs below. Req A Use a vertical model to show the Year 2 income statement under FIFO, LIFO, and weighted average. (Do not round intermediate calculations. Round your answers to nearest whole dollar amount.) Req B1 Sales Cost of goods sold Gross margin Req 82 WALL'S CHINA SHOP Income Statements For the Year Ended December 31, Year 2 FIFO LIFO $ 131,200 $131,200 62,650 68,550 38,000 30,550 7,638 Salaries expense Income before tax Income tax expenses Net income Req B3 63,850 67,350 38,000 29,350 7,338 Reg A Weighted Average $ 131,200 63,317 67,882 38,000 29,882 7,471 $ 22,412 < Prav Reg B2 > 21 21 Mant a. Compute the cost of goods sold and ending inventory, assuming (1) FIFO cost flow, (2) LIFO cost flow, and (3) weighted-average cost flow. b. Use a vertical model to show the Year 2 income statement, balance sheet, and statement of cash flows under FIFO, LIFO, and weighted average. (Hint: Record the events under an accounting equation before preparing the statements.) Complete this question by entering your answers in the tabs below. Reg A Req 82 Use a vertical model to show the Year 2 balance sheet under FIFO, LIFO, and weighted average. (Do not round intermediate calculations. Round your answers to nearest whole dollar amount.) Req Bi Assets Total assets Stockholders' equity WALL'S CHINA SHOP Balance Sheets As of December 31, Year 2 FIFO Total stockholders' equity $ Req 83 S 0 $ LIFO 0$ Weighted Average 0$ 0$ 0 0 Req A Req B1 Req B2 Use a vertical model to show the Year 2 statement of cash flows under FIFO, LIFO, and weighted average. (Do not round intermediate calculations. Round your answers to nearest whole dollar amount. Cash outflows should be indicated with a minus sign.) Cash flows from operating activities Ending cash balance WALL'S CHINA SHOP Statements of Cash Flows For the Year Ended December 31, Year 2 FIFO LIFO Net cash flows from operating activities Cash flows from investing activities Cash flows from financing activities Net change in cash Req B3 $ 0 0 0 $ 0 0 0 Weighted Average $ 0 0 0 The accounting records of Wall's China Shop reflected the following balances as of January 1, Year 2: Cash Beginning inventory Common stock Retained earnings The following five transactions occurred in Year 2: 1. First purchase (cash) 150 units @ $155 2. Second purchase (cash) 160 units @ $160 $80,100 33,000 (220 units @ $150) 50,000 63,100 3. Sales (all cash) 410 units @ $320 4. Paid $38,000 cash for salaries expense 5. Paid cash for income tax at the rate of 25 percent of income before taxes Required a. Compute the cost of goods sold and ending inventory, assuming (1) FIFO cost flow, (2) LIFO cost flow, and (3) weighted-average cost flow. b. Use a vertical model to show the Year 2 income statement, balance sheet, and statement of cash flows under FIFO, LIFO, and weighted average. (Hint: Record the events under an accounting equation before preparing the statements.) Complete this question by entering your answers in the tabs below. Req A Req B1 Req 82 Req 83 Required a. Compute the cost of goods sold and ending inventory, assuming (1) FIFO cost flow. (2) LIFO cost flow, and (3) weighted-average cost flow. b. Use a vertical model to show the Year 2 income statement, balance sheet, and statement of cash flows under FIFO, LIFO, and weighted average. (Hint: Record the events under an accounting equation before preparing the statements.) Complete this question by entering your answers in the tabs below. Req B2 Req 83 Compute the cost of goods sold and ending inventory, assuming (1) FIFO cost flow, (2) LIFO cost flow, and (3) weighted- average cost flow. (Do not round intermediate calculations. Round your answers to the nearest whole dollar.) Req A Cost of goods sold Ending inventory Req B1 FIFO LIFO $ 62,650 $63,850 $ 19,200 $ 18,000. Weighted Average Required a. Compute the cost of goods sold and ending inventory, assuming (1) FIFO cost flow, (2) LIFO cost flow, and (3) weighted-average cost flow. b. Use a vertical model to show the Year 2 income statement, balance sheet, and statement of cash flows under FIFO, LIFO, and weighted average. (Hint: Record the events under an accounting equation before preparing the statements.) Complete this question by entering your answers in the tabs below. Req A Use a vertical model to show the Year 2 income statement under FIFO, LIFO, and weighted average. (Do not round intermediate calculations. Round your answers to nearest whole dollar amount.) Req B1 Sales Cost of goods sold Gross margin Req 82 WALL'S CHINA SHOP Income Statements For the Year Ended December 31, Year 2 FIFO LIFO $ 131,200 $131,200 62,650 68,550 38,000 30,550 7,638 Salaries expense Income before tax Income tax expenses Net income Req B3 63,850 67,350 38,000 29,350 7,338 Reg A Weighted Average $ 131,200 63,317 67,882 38,000 29,882 7,471 $ 22,412 < Prav Reg B2 > 21 21 Mant a. Compute the cost of goods sold and ending inventory, assuming (1) FIFO cost flow, (2) LIFO cost flow, and (3) weighted-average cost flow. b. Use a vertical model to show the Year 2 income statement, balance sheet, and statement of cash flows under FIFO, LIFO, and weighted average. (Hint: Record the events under an accounting equation before preparing the statements.) Complete this question by entering your answers in the tabs below. Reg A Req 82 Use a vertical model to show the Year 2 balance sheet under FIFO, LIFO, and weighted average. (Do not round intermediate calculations. Round your answers to nearest whole dollar amount.) Req Bi Assets Total assets Stockholders' equity WALL'S CHINA SHOP Balance Sheets As of December 31, Year 2 FIFO Total stockholders' equity $ Req 83 S 0 $ LIFO 0$ Weighted Average 0$ 0$ 0 0 Req A Req B1 Req B2 Use a vertical model to show the Year 2 statement of cash flows under FIFO, LIFO, and weighted average. (Do not round intermediate calculations. Round your answers to nearest whole dollar amount. Cash outflows should be indicated with a minus sign.) Cash flows from operating activities Ending cash balance WALL'S CHINA SHOP Statements of Cash Flows For the Year Ended December 31, Year 2 FIFO LIFO Net cash flows from operating activities Cash flows from investing activities Cash flows from financing activities Net change in cash Req B3 $ 0 0 0 $ 0 0 0 Weighted Average $ 0 0 0 The accounting records of Wall's China Shop reflected the following balances as of January 1, Year 2: Cash Beginning inventory Common stock Retained earnings The following five transactions occurred in Year 2: 1. First purchase (cash) 150 units @ $155 2. Second purchase (cash) 160 units @ $160 $80,100 33,000 (220 units @ $150) 50,000 63,100 3. Sales (all cash) 410 units @ $320 4. Paid $38,000 cash for salaries expense 5. Paid cash for income tax at the rate of 25 percent of income before taxes Required a. Compute the cost of goods sold and ending inventory, assuming (1) FIFO cost flow, (2) LIFO cost flow, and (3) weighted-average cost flow. b. Use a vertical model to show the Year 2 income statement, balance sheet, and statement of cash flows under FIFO, LIFO, and weighted average. (Hint: Record the events under an accounting equation before preparing the statements.) Complete this question by entering your answers in the tabs below. Req A Req B1 Req 82 Req 83 Required a. Compute the cost of goods sold and ending inventory, assuming (1) FIFO cost flow. (2) LIFO cost flow, and (3) weighted-average cost flow. b. Use a vertical model to show the Year 2 income statement, balance sheet, and statement of cash flows under FIFO, LIFO, and weighted average. (Hint: Record the events under an accounting equation before preparing the statements.) Complete this question by entering your answers in the tabs below. Req B2 Req 83 Compute the cost of goods sold and ending inventory, assuming (1) FIFO cost flow, (2) LIFO cost flow, and (3) weighted- average cost flow. (Do not round intermediate calculations. Round your answers to the nearest whole dollar.) Req A Cost of goods sold Ending inventory Req B1 FIFO LIFO $ 62,650 $63,850 $ 19,200 $ 18,000. Weighted Average Required a. Compute the cost of goods sold and ending inventory, assuming (1) FIFO cost flow, (2) LIFO cost flow, and (3) weighted-average cost flow. b. Use a vertical model to show the Year 2 income statement, balance sheet, and statement of cash flows under FIFO, LIFO, and weighted average. (Hint: Record the events under an accounting equation before preparing the statements.) Complete this question by entering your answers in the tabs below. Req A Use a vertical model to show the Year 2 income statement under FIFO, LIFO, and weighted average. (Do not round intermediate calculations. Round your answers to nearest whole dollar amount.) Req B1 Sales Cost of goods sold Gross margin Req 82 WALL'S CHINA SHOP Income Statements For the Year Ended December 31, Year 2 FIFO LIFO $ 131,200 $131,200 62,650 68,550 38,000 30,550 7,638 Salaries expense Income before tax Income tax expenses Net income Req B3 63,850 67,350 38,000 29,350 7,338 Reg A Weighted Average $ 131,200 63,317 67,882 38,000 29,882 7,471 $ 22,412 < Prav Reg B2 > 21 21 Mant a. Compute the cost of goods sold and ending inventory, assuming (1) FIFO cost flow, (2) LIFO cost flow, and (3) weighted-average cost flow. b. Use a vertical model to show the Year 2 income statement, balance sheet, and statement of cash flows under FIFO, LIFO, and weighted average. (Hint: Record the events under an accounting equation before preparing the statements.) Complete this question by entering your answers in the tabs below. Reg A Req 82 Use a vertical model to show the Year 2 balance sheet under FIFO, LIFO, and weighted average. (Do not round intermediate calculations. Round your answers to nearest whole dollar amount.) Req Bi Assets Total assets Stockholders' equity WALL'S CHINA SHOP Balance Sheets As of December 31, Year 2 FIFO Total stockholders' equity $ Req 83 S 0 $ LIFO 0$ Weighted Average 0$ 0$ 0 0 Req A Req B1 Req B2 Use a vertical model to show the Year 2 statement of cash flows under FIFO, LIFO, and weighted average. (Do not round intermediate calculations. Round your answers to nearest whole dollar amount. Cash outflows should be indicated with a minus sign.) Cash flows from operating activities Ending cash balance WALL'S CHINA SHOP Statements of Cash Flows For the Year Ended December 31, Year 2 FIFO LIFO Net cash flows from operating activities Cash flows from investing activities Cash flows from financing activities Net change in cash Req B3 $ 0 0 0 $ 0 0 0 Weighted Average $ 0 0 0

Step by Step Solution

★★★★★

3.38 Rating (142 Votes )

There are 3 Steps involved in it

Step: 1

a Cost of goods sold and ending inventory calculations FIFO Cost Flow First purchase 150 units 155 2...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started