Question

The accounting team of WhichWay Transit is contemplating the classification of an upcoming lease of ten tractor trailers. The lease commences on December 31 of

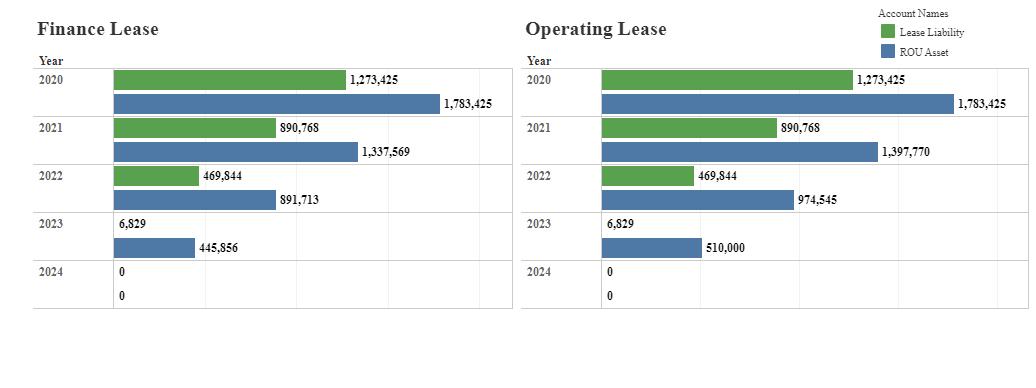

The accounting team of WhichWay Transit is contemplating the classification of an upcoming lease of ten tractor trailers. The lease commences on December 31 of 2020 and calls for four $510,000 payments, payable at the commencement of the lease and the beginning of 2022, 2023, and 2024. The payments are based on an interest rate of 10%. At issue is the fact that the fair value of the tractor trailers is $2 million and the present value of the lease payments is $1,783,425, which is 89.2% of that fair value. “That seems to be on the borderline of whether the present value is ‘substantially all’ of the fair value, making it a finance lease,” says your colleague. “Does it make a difference now that the new lease accounting rules require both operating and finance leases to be included in our balance sheet?” To aid in your decision as to whether to try to persuade your auditors that it’s an operating lease, you create the following Tableau Dashboard.

1.) If the lease is classified as a finance lease, what would be the amortization expense in 2021 and 2024:

A.) 2021: $445,856; 2024: $445,856

B.) 2021: $385,655; 2024: $510,000

C.) 2021: $500,000; 2024: $500,000

2.) Over the four-year lease term, the amortization expense, if it's a finance lease is:

A.) Increasing, while the amortization expense would remain constant if it were an operating lease.

B.) Decreasing, while the amortization expense would remain constant if it were an operating lease.

C.) Remaining constant.

3.) Over the four-year lease term, the interest expense, if it's a finance lease is:

A.) Increasing, while the interest expense would remain constant if it were an operating lease.

B.) Decreasing, while the interest expense would remain constant if it were an operating lease.

C.) The same as it would be if it were an operating lease.

4.) If it's classified as a finance lease, the right-of-use asset decreases:

A.) At the same rate as if it were an operating lease.

B.) Faster than if it were an operating lease.

C.) Slower than if it were an operating.

5.) A benefit of a lease being classified as an operating lease is that operating leases:

A.) Result in the lease liability being reported at a lower amount than if classified as a finance lease.

B.) Result in a lower total lease expense over the entire lease term.

C.) Avoid the "front loading" of lease expense that occurs in a finance lease due to the fact that interest is higher during the initial stages of a lease, while amortization of the ROU asset remains the same.

Account Names Finance Lease | Amortization Expense Operating Lease Interest Expense 600K I Total Expense 500K 500K 500K 500K 400K 400K 400K 400K 300K 300K 300K 300K 200K 200K 200K 200K 100K 100K 100K 100K OK OK OK OK 2020 2021 2022 2023 2024 2025 2020 2021 2022 2023 2024 2025 Year Year Amortization & Interest Expense Total Expense Amortization & Operating Expense

Step by Step Solution

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

1 If the lease is classified as a finance lease what would be t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started