Answered step by step

Verified Expert Solution

Question

1 Approved Answer

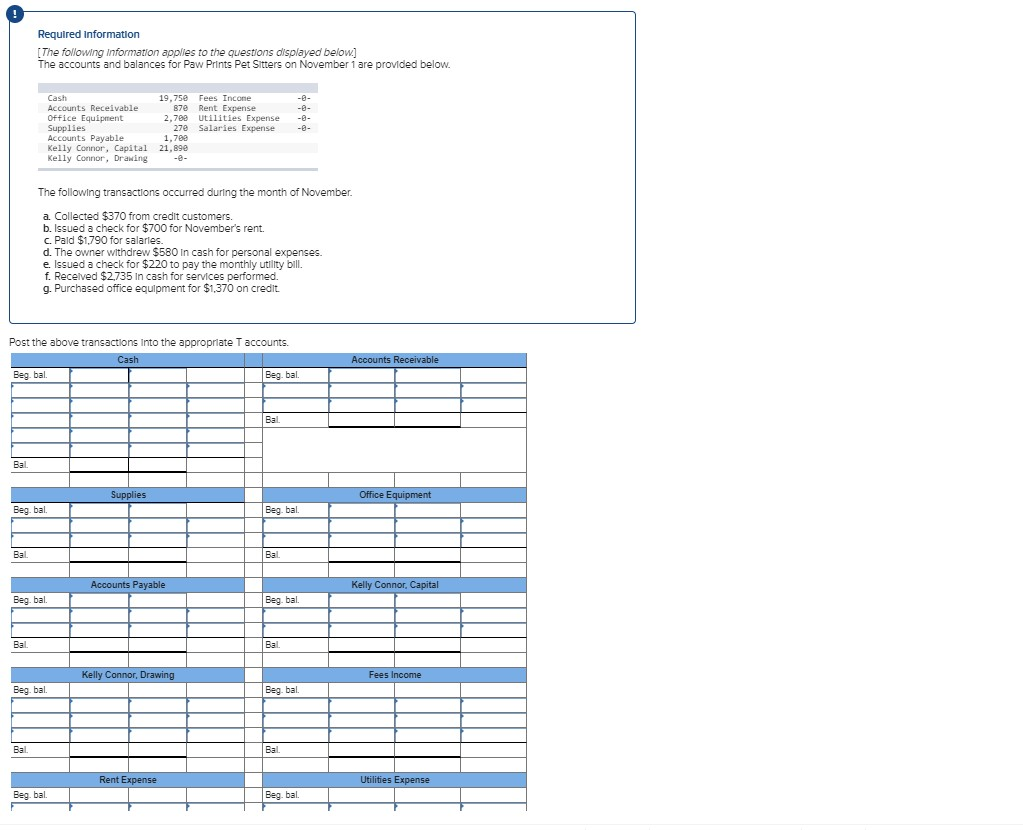

the accounts and balances for paw prints pet sitters on november 1 are provided below post the above transactions into the appropriate t accounts Required

the accounts and balances for paw prints pet sitters on november 1 are provided below post the above transactions into the appropriate t accounts

Required information The following Information applies to the questions displayed below] The accounts and balances for Paw Prints Pet Sitters on November 1 are provided below -0 Cash 19,750 Fees Incone 87e Rent Expense 2,700 27e Salaries Expense 1,708 Accounts Receivable Office Equipment Supplies Accounts Payable Kelly Connor, Capital 21,89e Kelly Connor, Drawing -0- Utilities Expense -0- -0- -0- The following transactions occurred during the month of November. a. Collected $370 from credit customers. b. Issued a check for $700 for November's rent. c. Pald $1,790 for salaries. d. The owner withdrew $580 In cash for personal expenses. e. Issued a check for $220 to pay the monthly utility bill. f. Recelved $2735 In cash for services performed. g. Purchased office equipment for $1,370 on credit Post the above transactions Into the appropriate T accounts. Accounts Receivable Cash Beg. bal Beg. bal Bal. Bal. Supplies Office Equipment Beg. bal Beg. bal Bal. Bal Accounts Payable Kelly Connor, Capital Beg. bal. Beg. bal Bal. Bal Kelly Connor, Drawing Fees Income Beg. bal Beg bal Bal. Bal. Utilities Expense Rent Expense Beg. bal Beg. bal

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started