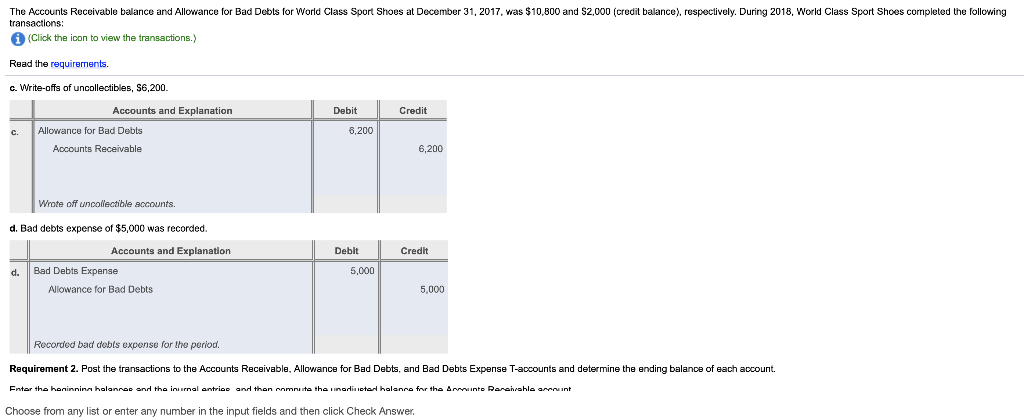

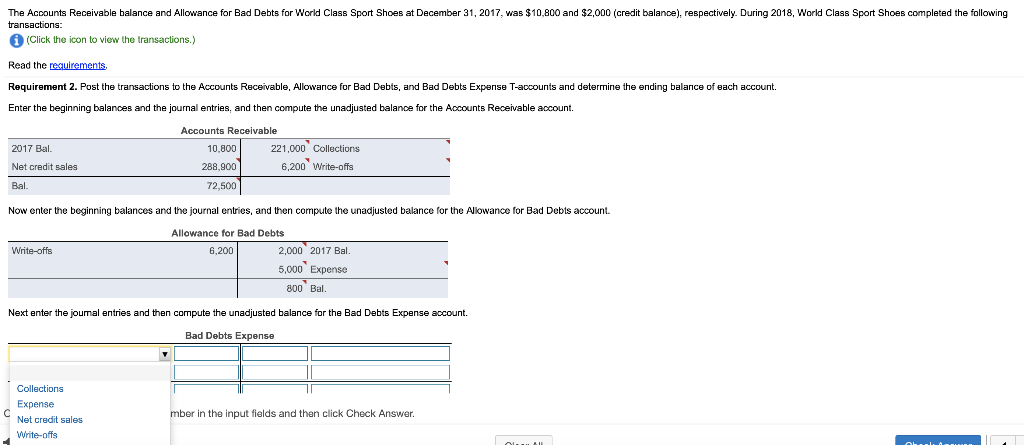

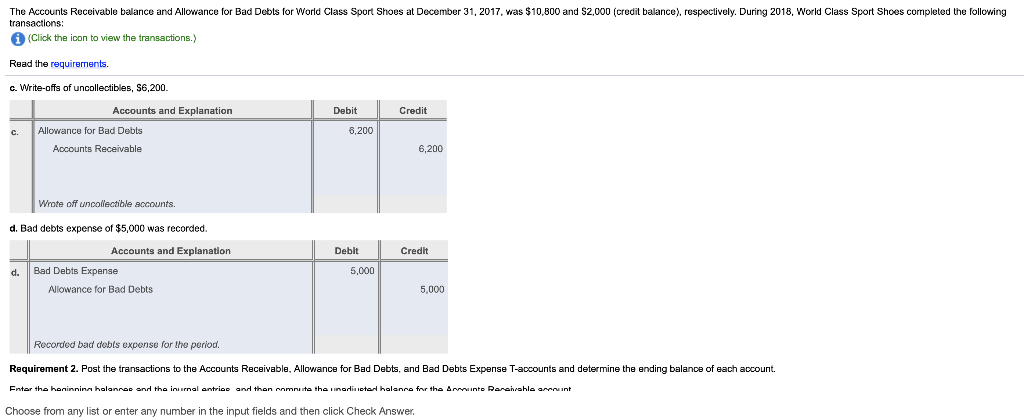

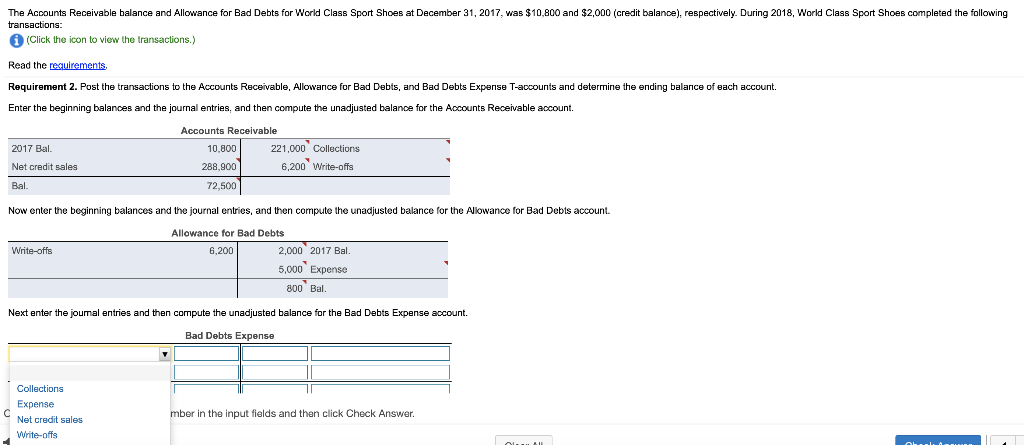

The Accounts Receivable balance and Allowance for Bad Debts for World Class Sport Shoes at December 31, 2017, was $10,000 and $2,000 (credit balance), respectively. During 2018, World Class Sport Shoes completed the following transactions (Click the icon to view the transactions.) Read the requirements. c. Write-offs of uncollectibles, S6,200 Debit Credit c. Accounts and Explanation Allowance for Bad Debts Accounts Receivable 8,200 6,200 Wrote off uncollectible accounts d. Bad debts expense of $5,000 was recorded. Debit Credit d Accounts and Explanation Bad Debts Expense Allowance for Bad Debts 5,000 5,000 Recorded bad dobls expense for the period. Requirement 2. Post the transactions to the Accounts Receivable, Allowance for Bad Debts, and Bad Debts Expense T-accounts and determine the ending balance of each account. Enter the honinnina halancee and the iniurnal antrice and then comutatha unadictor halance for the Anunto Receivable amint Choose from any list or enter any number in the input fields and then click Check Answer. The Accounts Receivable balance and Allowance for Bad Debts for World Class Sport Shoes at December 31, 2017, was $10,800 and $2,000 (credit balance), respectively. During 2018, World Class Sport Shoes completed the following transactions: (Click the icon to view the transactions.) Read the requirements Requirement 2. Post the transactions to the Accounts Receivable, Allowance for Bad Debts, and Bad Debts Expense T-accounts and determine the ending balance of each account. Enter the beginning balances and the journal entries, and then compute the unadjusted balance for the Accounts Receivable account. 2017 Bal. Accounts Receivable 10.800 221.000 Collections 288.900 6,200 Write-offs 72,500 Net credit sales Bal. Now enter the beginning balances and the journal entries, and then compute the unadjusted balance for the Allowance for Bad Debts account. Write-offs Allowance for Bad Debts 6,200 2,000 2017 Bal. 5,000 Expense 800 Bal. Next enter the joumal entries and then compute the unadjusted balance for the Bad Debts Expense account. Bad Debts Expense Collections Expense Net credit sales Write-offs mber in the input fields and then click Check Answer. The Accounts Receivable balance and Allowance for Bad Debts for World Class Sport Shoes at December 31, 2017, was $10,000 and $2,000 (credit balance), respectively. During 2018, World Class Sport Shoes completed the following transactions (Click the icon to view the transactions.) Read the requirements. c. Write-offs of uncollectibles, S6,200 Debit Credit c. Accounts and Explanation Allowance for Bad Debts Accounts Receivable 8,200 6,200 Wrote off uncollectible accounts d. Bad debts expense of $5,000 was recorded. Debit Credit d Accounts and Explanation Bad Debts Expense Allowance for Bad Debts 5,000 5,000 Recorded bad dobls expense for the period. Requirement 2. Post the transactions to the Accounts Receivable, Allowance for Bad Debts, and Bad Debts Expense T-accounts and determine the ending balance of each account. Enter the honinnina halancee and the iniurnal antrice and then comutatha unadictor halance for the Anunto Receivable amint Choose from any list or enter any number in the input fields and then click Check Answer. The Accounts Receivable balance and Allowance for Bad Debts for World Class Sport Shoes at December 31, 2017, was $10,800 and $2,000 (credit balance), respectively. During 2018, World Class Sport Shoes completed the following transactions: (Click the icon to view the transactions.) Read the requirements Requirement 2. Post the transactions to the Accounts Receivable, Allowance for Bad Debts, and Bad Debts Expense T-accounts and determine the ending balance of each account. Enter the beginning balances and the journal entries, and then compute the unadjusted balance for the Accounts Receivable account. 2017 Bal. Accounts Receivable 10.800 221.000 Collections 288.900 6,200 Write-offs 72,500 Net credit sales Bal. Now enter the beginning balances and the journal entries, and then compute the unadjusted balance for the Allowance for Bad Debts account. Write-offs Allowance for Bad Debts 6,200 2,000 2017 Bal. 5,000 Expense 800 Bal. Next enter the joumal entries and then compute the unadjusted balance for the Bad Debts Expense account. Bad Debts Expense Collections Expense Net credit sales Write-offs mber in the input fields and then click Check