Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The accounts receivable balance for Highland Company ar December 31, 2015 was $23,000. During 2016, Highland earned revenue of $458,000 on account to %5of accounts

The accounts receivable balance for Highland Company ar December 31, 2015 was $23,000. During 2016, Highland earned revenue of $458,000 on account to %5of accounts receivable

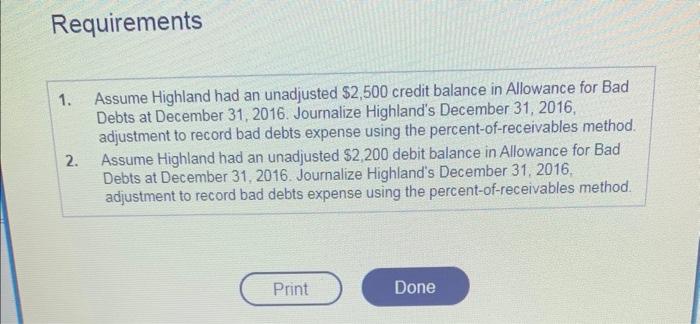

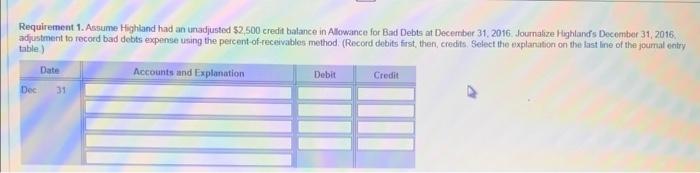

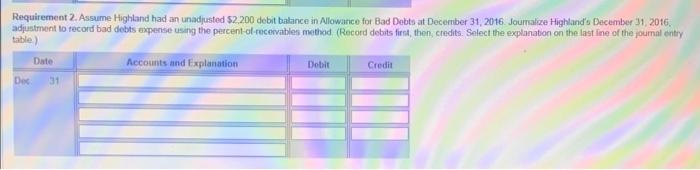

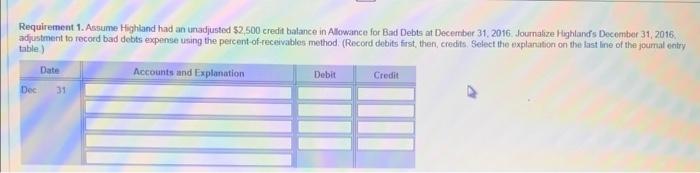

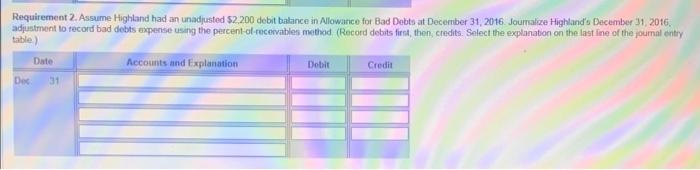

Requirements 1. Assume Highland had an unadjusted $2,500 credit balance in Allowance for Bad Debts at December 31,2016. Journalize Highland's December 31, 2016, adjustment to record bad debts expense using the percent-of-receivables method. 2. Assume Highland had an unadjusted $2,200 debit balance in Allowance for Bad Debts at December 31, 2016. Journalize Highland's December 31, 2016, adjustment to record bad debts expense using the percent-of-receivables method. Requirement 1. Assume Hightand had an unadjusted $2,500 eredit balance in Allowance for Bad Debts at December 31,2016. Journalize Highlandis December 31, 2016. adjustment to record bad debth expense using the percent-of-recevables method. (Record debits first, then, credits. Select the explanation on the last line of the journal entry table ) Requirement 2. Assume Highland had an unadjusted $2,200 debit balance in Alowarice for Bad Debts at December 31,2016. Jourralize Highand's December 31,2016. adpustment to tecond bad debts expense using the percent-of recevalbles methad (Rocord debits firnt, then, credits. Select the explanation on the last ine of the joumal entry table.) Requirements 1. Assume Highland had an unadjusted $2,500 credit balance in Allowance for Bad Debts at December 31,2016. Journalize Highland's December 31, 2016, adjustment to record bad debts expense using the percent-of-receivables method. 2. Assume Highland had an unadjusted $2,200 debit balance in Allowance for Bad Debts at December 31, 2016. Journalize Highland's December 31, 2016, adjustment to record bad debts expense using the percent-of-receivables method. Requirement 1. Assume Hightand had an unadjusted $2,500 eredit balance in Allowance for Bad Debts at December 31,2016. Journalize Highlandis December 31, 2016. adjustment to record bad debth expense using the percent-of-recevables method. (Record debits first, then, credits. Select the explanation on the last line of the journal entry table ) Requirement 2. Assume Highland had an unadjusted $2,200 debit balance in Alowarice for Bad Debts at December 31,2016. Jourralize Highand's December 31,2016. adpustment to tecond bad debts expense using the percent-of recevalbles methad (Rocord debits firnt, then, credits. Select the explanation on the last ine of the joumal entry table.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started