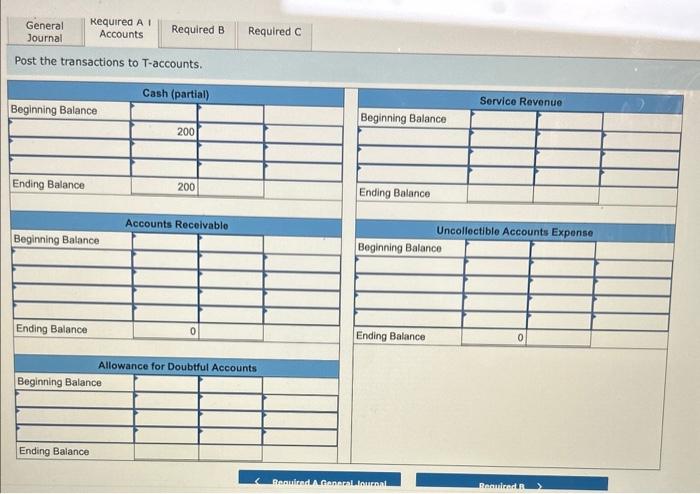

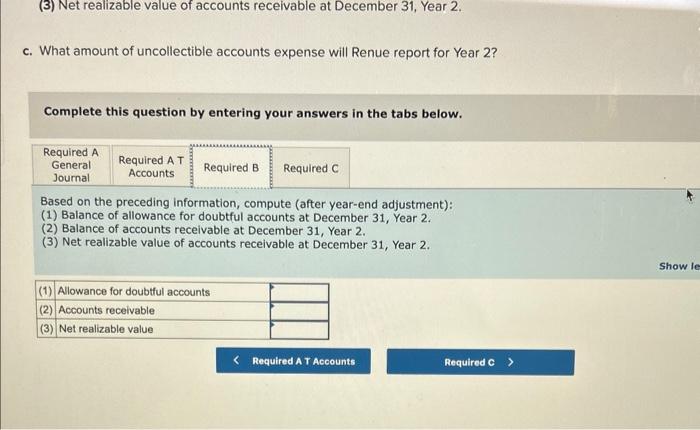

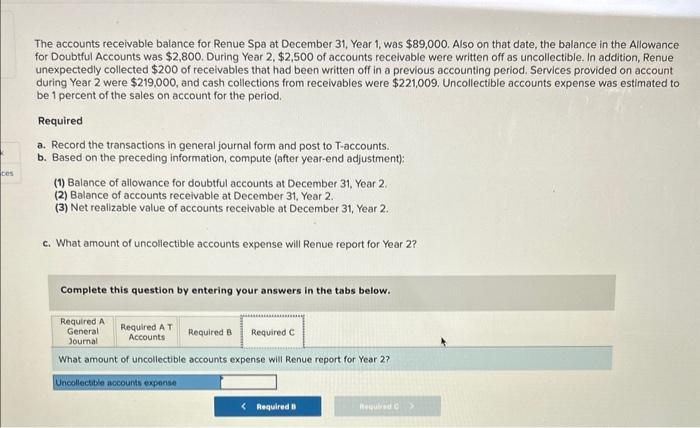

The accounts recelvable balance for Renue Spa at December 31 , Year 1 , was $89,000. Also on that date, the balance in the Allowance. for Doubtful Accounts was $2,800. During Year 2, $2,500 of accounts receivable were written off as uncollectible. In addition, Renue unexpectedly collected $200 of recelvables that had been written off in a previous accounting period. Services provided on account during Year 2 were $219,000, and cash collections from receivables were $221,009. Uncollectible accounts expense was estimated to be 1 percent of the sales on account for the period. Required a. Record the transactions in general journal form and post to T-accounts. b. Based on the preceding information, compute (after year-end adjustment): (1) Balance of allowance for doubtful accounts at December 31, Year 2. (2) Balance of accounts receivable at December 31 , Year 2. (3) Net realizable value of accounts receivable at December 31 , Year 2. c. What amount of uncollectible accounts expense will Renue report for Year 2 ? Complete this question by entering your answers in the tabs below. Post the transactions to T-accounts. Post the transactions to T-accounts. (3) Net realizable value of accounts receivable at December 31 , Year 2. c. What amount of uncollectible accounts expense will Renue report for Year 2 ? Complete this question by entering your answers in the tabs below. Based on the preceding information, compute (after year-end adjustment): (1) Balance of allowance for doubtful accounts at December 31 , Year 2. (2) Balance of accounts receivable at December 31 , Year 2. (3) Net realizable value of accounts receivable at December 31, Year 2. The accounts receivable balance for Renue Spa at December 31, Year 1 , was $89,000. Also on that date, the balance in the Allowance for Doubtful Accounts was $2,800. During Year 2,$2,500 of accounts recelvable were written off as uncollectible. In addition, Renue unexpectedly collected $200 of recelvables that had been written off in a previous accounting period. Services provided on account during Year 2 were $219,000, and cash collections from receivables were $221,009, Uncollectible accounts expense was estimated to be 1 percent of the sales on account for the period. Required a. Record the transactions in general journal form and post to T-accounts. b. Based on the preceding information, compute (after year-end adjustment): (1) Balance of allowance for doubtful accounts at December 31 , Year 2. (2) Balance of accounts receivable at December 31, Year 2. (3) Net realizable value of accounts recelvable at December 31 , Year 2. c. What amount of uncollectible accounts expense will Renue report for Year 2 ? Complete this question by entering your answers in the tabs below. What amount of uncollectible accounts expense will Renue report for Year 2