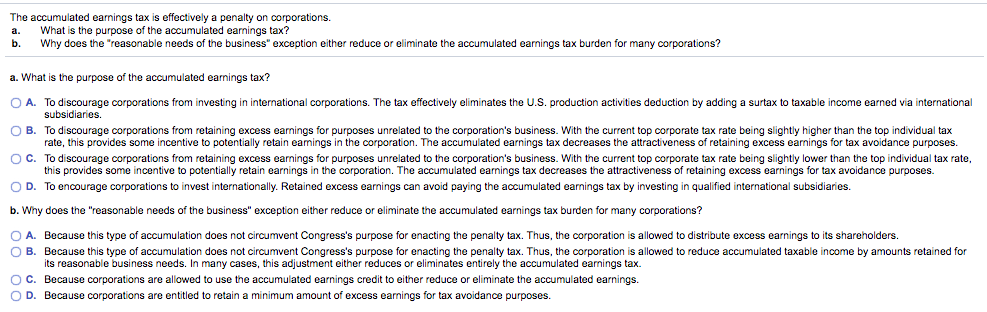

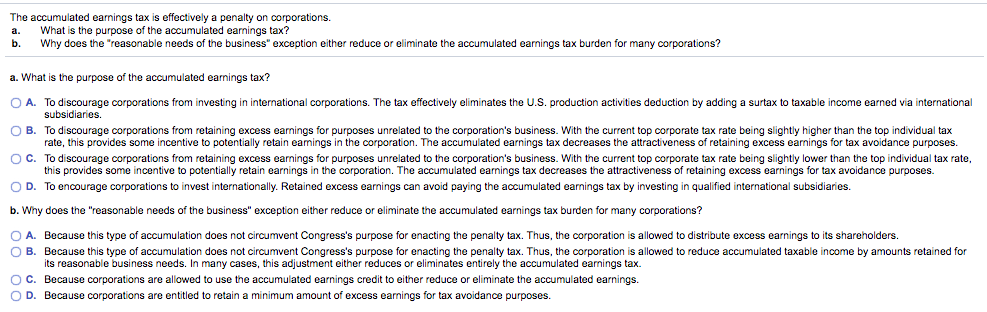

The accumulated earnings tax is effectively a penalty on corporations. a. What is the purpose of the accumulated earnings tax? b. Why does the "reasonable needs of the business" exception either reduce or eliminate the accumulated earnings tax burden for many corporations? a. What is the purpose of the accumulated earnings tax? O A. To discourage corporations from investing in international corporations. The tax effectively eliminates the U.S. production activities deduction by adding a surtax to taxable income earned via international O B. To discourage corporations from retaining excess earnings for purposes unrelated to the corporation's business. With the current top corporate tax rate being slightly higher than the top individual tax subsidiaries. rate, this provides some incentive to potentially retain eamings in the corporation. The accumulated earnings tax decreases the attractiveness of retaining excess earnings for tax avoidance purposes. ?. To discourage corporations rom retaining excess earnings or purposes unrelated o e corporation's business with the current top corporate tax rate being sligh y lower han the top individual ax rate O D. To encourage corporations to invest internationally. Retained excess earnings can avoid paying the accumulated earnings tax by investing in qualified international subsidiaries b. Why does the "reasonable needs of the business" exception either reduce or eliminate the accumulated earnings tax burden for many corporations? O A. Because this type o accumulation does not cr mvent Congress's purpose or enacting the penalty tax. Thus, the corporation is allowed to distribute excess earnings o its shareholders this provides some incentive to potentially retain earnings in the corporation. The accumulated earnings tax decreases the attractiveness of retaining excess earnings for tax avoidance purposes. O B. Because this type of accumulation does not circumvent Congress's purpose for enacting the penalty tax. Thus, the corporation is allowed to reduce accumulated taxable income by amounts retained for ts reasonable business needs. In many cases, this adjustment either reduces or eliminates entirely the accumulated earnings tax c. Because corporations are allowed to use tne accumulated earnings credit to either reduce or eliminate the accumulated earnings. D. Because corporations are entitled to retain a minimum amount of excess earnings for tax avoidance purposes