Answered step by step

Verified Expert Solution

Question

1 Approved Answer

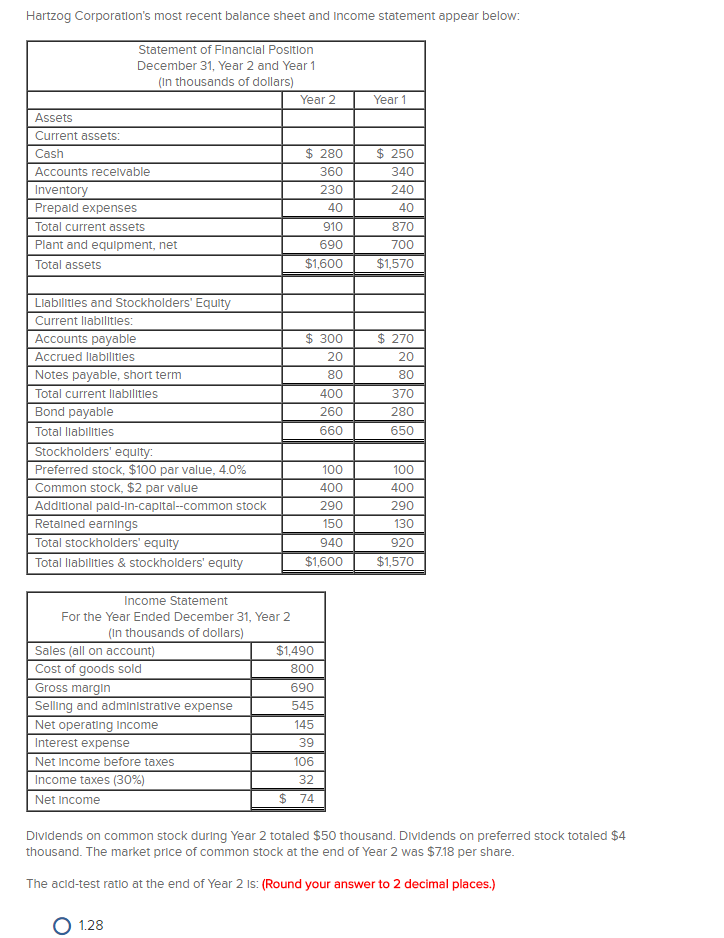

The acid-test ratio at the end of Year 2 is: (Round your answer to 2 decimal places.) 1.28 1.70 1.60 2.28 Hartzog Corporatlon's most recent

| The acid-test ratio at the end of Year 2 is: (Round your answer to 2 decimal places.) |

1.28

1.70

1.60

2.28

Hartzog Corporatlon's most recent balance sheet and Income statement appear below: Statement of Financlal Positlon December 31, Year 2 and Year 1 (In thousands of dollars) Assets Current assets: Cash 280 250 360 340 Accounts recelvable Inventory 230 240 40 40 Prepaid expenses Total current asset 910 870 Plant and equlpment, net a90 700 Total assets ILIablitles and Stockholders Equty Current lab lties: Accounts payable 300 270 Accrued lablittle 20 20 80 80 Notes payable, short term Total current liablitl 400 370 Eond payable 200 280 Total liabilties T 660 650 ders' equity Preferred Stock.$100 par Maue, 40% 100 1000 Common stock. S2 par value 400 400 I pald-In-capital--common stock 290 290 50 130 Retained earnings Total Stockholders equit 940 920 $157 Total liabilities & Stockholders' equity Income Statement For the Year Ended December 31, Year 2 (In thousands of dollars) $1.490 Sales (all on account) Cost goods sold 800 Gross margin 690 Selling and administratve expense S45 Net Operating Income 145 Interest expense 39 NetIncome before taxes 106 Income taxes 30% 32 Net Income DIvidends on common stock durIng Year 2 totaled $50 thousand. Dividends on preferred stock totaled $4 thousand. The market price of common stock at the end of Year 2 was $718 per share. The acid-test ratlo at the end of Year 2 ls: (Round your answer to 2 decimal places.) O 1.28Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started