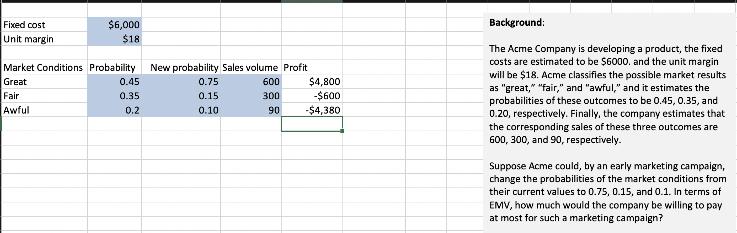

Question: Background: $6,000 $18 Fixed cost Unit margin The Acme Company is developing a product, the fixed costs are estimated to be $6000. and the

Background: $6,000 $18 Fixed cost Unit margin The Acme Company is developing a product, the fixed costs are estimated to be $6000. and the unit margin will be $18. Acme classifies the possible market results as "great," "fair," and "awful," and it estimates the probabilities of these outcomes to be 0.45, 0.35, and 0.20, respectively. Finally, the company estimates that the corresponding sales of these three outcomes are 600, 300, and 90, respectively. Market Conditions Probability New probability Sales volume Profit $4,800 -$600 Great 0.45 0.75 600 Fair Awful 0.35 0.15 300 0.2 0.10 90 -$4,380 Suppose Acme could, by an early marketing campaign, change the probabilities of the market conditions from their current values to 0.75, 0.15, and 0.1. In terms of EMV, how much would the company be willing to pay at most for such a marketing campaign?

Step by Step Solution

3.50 Rating (160 Votes )

There are 3 Steps involved in it

The given fixed cost is 6000 unit margin is 18 The probability o... View full answer

Get step-by-step solutions from verified subject matter experts