Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The acquisition agreement includes an earnings contingency agreement to be settled in cash; its fair value is $ 1 , 0 0 0 , 0

The acquisition agreement includes an earnings contingency agreement to be settled in cash; its fair value is $

It is determined that Summer has an unreported preacquisition contingency related to a pending lawsuit, consisting of a liability with an estimated present value of $

Inprocess research and development owned by Summer is worth $

The fair value of the percent noncontrolling interest in Summer is $

Required

a Prepare the acquisition entry made by Placer.

b Prepare the working paper eliminating entries to consolidate the trial balances of Placer and Summer at the date of acquisition.

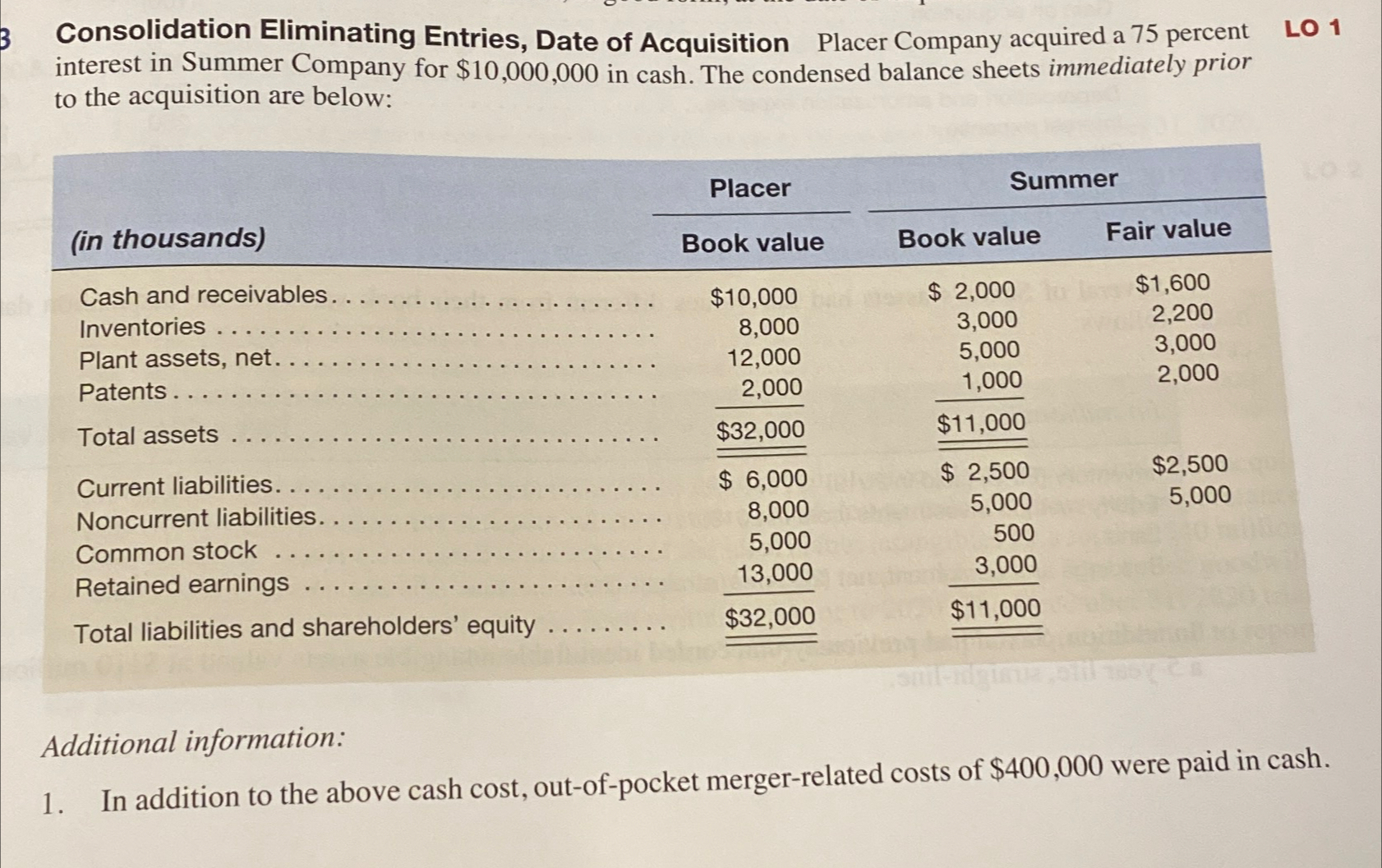

Consolidation Eliminating Entries, Date of Acquisition Placer Company acquired a percent

LO

interest in Summer Company for $ in cash. The condensed balance sheets immediately prior to the acquisition are below:

tablein thousandstablePlacerBook valueSummerBook value,Fair valueCash and receivables. $$$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started