Answered step by step

Verified Expert Solution

Question

1 Approved Answer

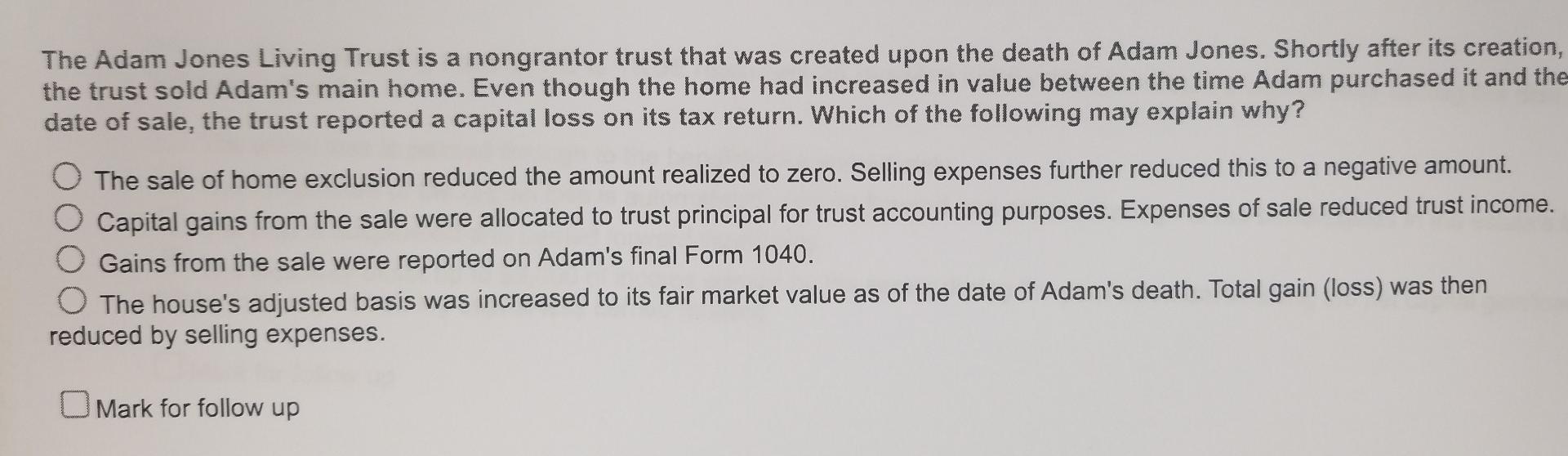

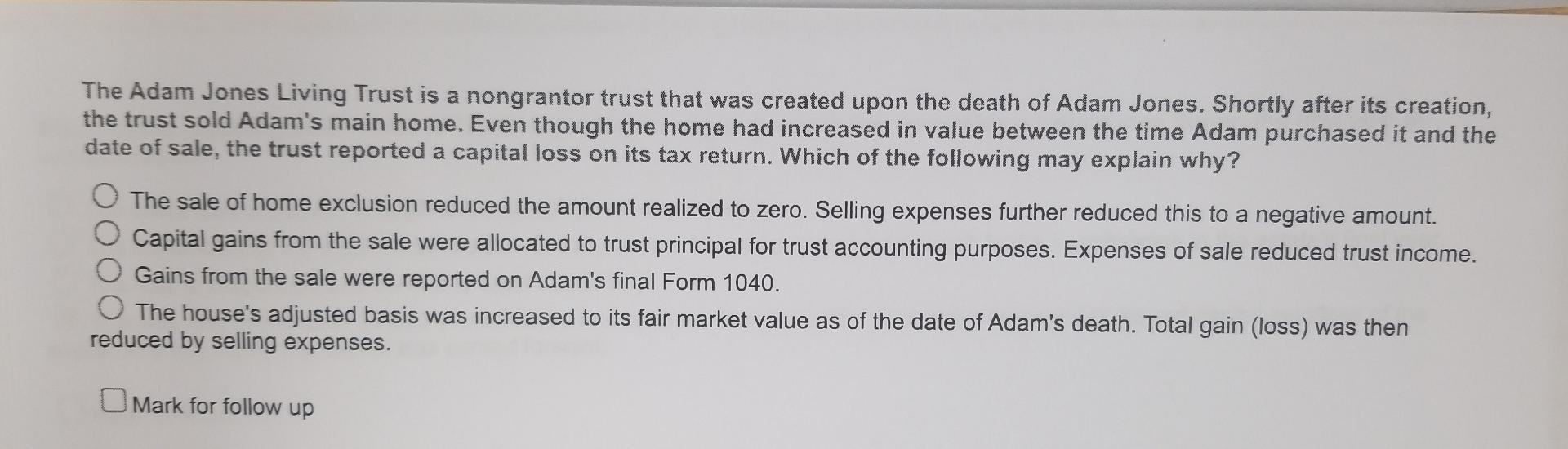

The Adam Jones Living Trust is a nongrantor trust that was created upon the death of Adam Jones. Shortly after its creation the trust sold

The Adam Jones Living Trust is a nongrantor trust that was created upon the death of Adam Jones. Shortly after its creation the trust sold Adam's main home. Even though the home had increased in value between the time Adam purchased it and th date of sale, the trust reported a capital loss on its tax return. Which of the following may explain why? The sale of home exclusion reduced the amount realized to zero. Selling expenses further reduced this to a negative amount. Capital gains from the sale were allocated to trust principal for trust accounting purposes. Expenses of sale reduced trust income. Gains from the sale were reported on Adam's final Form 1040. The house's adjusted basis was increased to its fair market value as of the date of Adam's death. Total gain (loss) was then reduced by selling expenses. Mark for follow up The Adam Jones Living Trust is a nongrantor trust that was created upon the death of Adam Jones. Shortly after its creation, the trust sold Adam's main home. Even though the home had increased in value between the time Adam purchased it and the date of sale, the trust reported a capital loss on its tax return. Which of the following may explain why? The sale of home exclusion reduced the amount realized to zero. Selling expenses further reduced this to a negative amount. Capital gains from the sale were allocated to trust principal for trust accounting purposes. Expenses of sale reduced trust income. Gains from the sale were reported on Adam's final Form 1040. The house's adjusted basis was increased to its fair market value as of the date of Adam's death. Total gain (loss) was then reduced by selling expenses. Mark for follow up

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started