Answered step by step

Verified Expert Solution

Question

1 Approved Answer

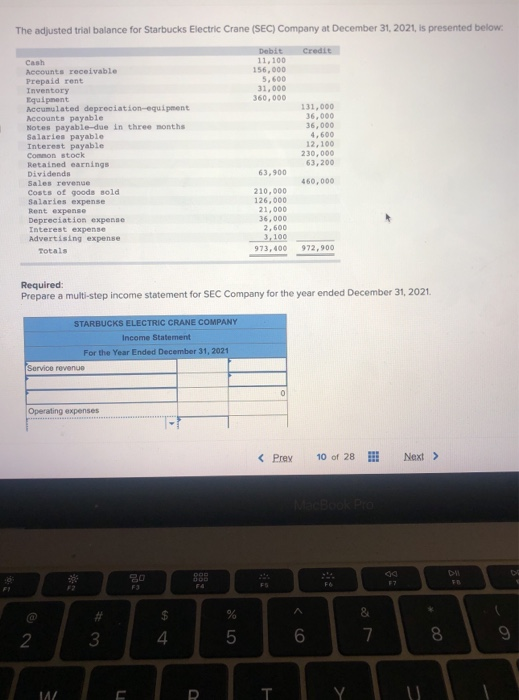

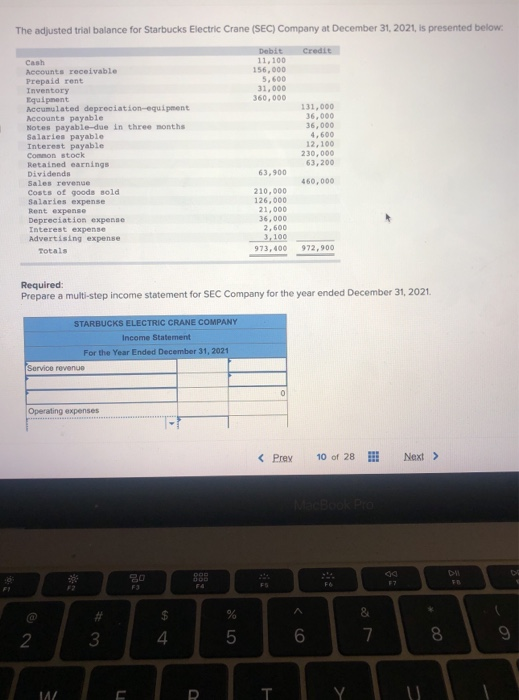

The adjusted trial balance for Starbucks Electric Crane (SEC) Company at December 31, 2021, is presented below: Debit Credit Cash 11,100 Accounts receivable 156,000 Prepaid

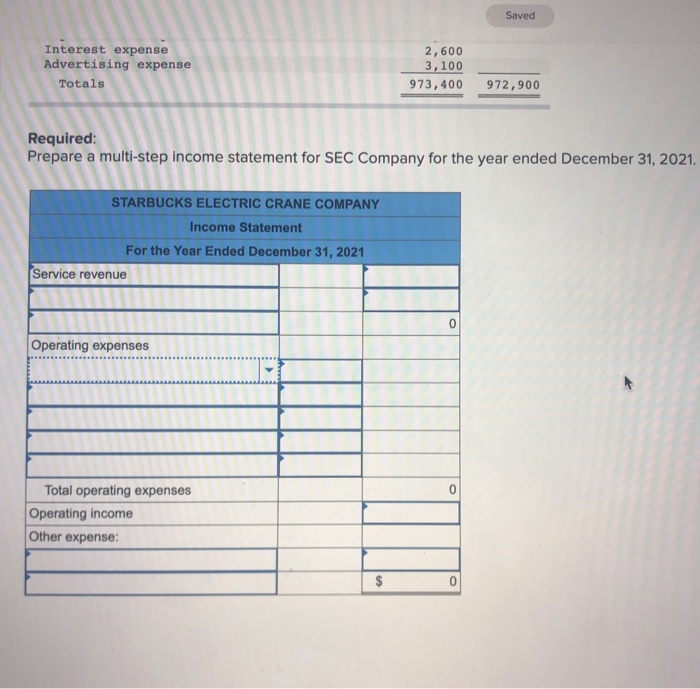

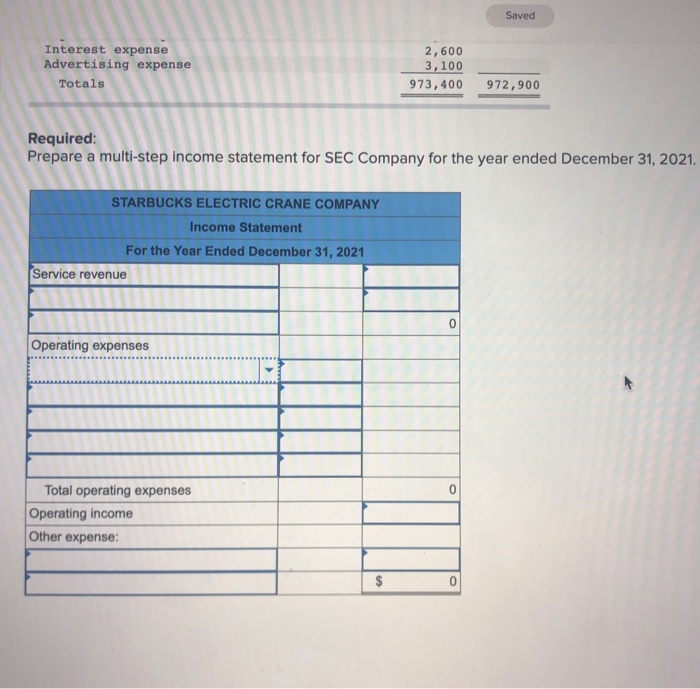

The adjusted trial balance for Starbucks Electric Crane (SEC) Company at December 31, 2021, is presented below: Debit Credit Cash 11,100 Accounts receivable 156,000 Prepaid rent 5,600 Inventory 31,000 Iquipment 360,000 Accumulated depreciation equipment 131,000 Accounts payable 36,000 Notes payable-due in three months 36,000 Salaries payable 4.600 Interest payable 12,100 Common stock 230,000 Retained earnings 63,200 Dividends 63,900 Sales revenue 460,000 Costs of goods sold 210,000 Salaries expense 126,000 Rent expense 21.000 Depreciation expense 36,000 Interest expense 2,600 Advertising expense 3,100 Totals 973,400 972,900 Required: Prepare a multi-step income statement for SEC Company for the year ended December 31, 2021 STARBUCKS ELECTRIC CRANE COMPANY Income Statement For the Year Ended December 31, 2021 Service revenue 0 Operating expenses MacBook DOS DHL *** FS od F7 F3 FO @ $ & 2 3 4 6 7 8 9 14 R T. Y U Saved Interest expense Advertising expense Totals 2,600 3,100 973,400 972,900 Required: Prepare a multi-step income statement for SEC Company for the year ended December 31, 2021. STARBUCKS ELECTRIC CRANE COMPANY Income Statement For the Year Ended December 31, 2021 Service revenue 0 Operating expenses 0 Total operating expenses Operating income Other expense: $ 0

The adjusted trial balance for Starbucks Electric Crane (SEC) Company at December 31, 2021, is presented below: Debit Credit Cash 11,100 Accounts receivable 156,000 Prepaid rent 5,600 Inventory 31,000 Iquipment 360,000 Accumulated depreciation equipment 131,000 Accounts payable 36,000 Notes payable-due in three months 36,000 Salaries payable 4.600 Interest payable 12,100 Common stock 230,000 Retained earnings 63,200 Dividends 63,900 Sales revenue 460,000 Costs of goods sold 210,000 Salaries expense 126,000 Rent expense 21.000 Depreciation expense 36,000 Interest expense 2,600 Advertising expense 3,100 Totals 973,400 972,900 Required: Prepare a multi-step income statement for SEC Company for the year ended December 31, 2021 STARBUCKS ELECTRIC CRANE COMPANY Income Statement For the Year Ended December 31, 2021 Service revenue 0 Operating expenses MacBook DOS DHL *** FS od F7 F3 FO @ $ & 2 3 4 6 7 8 9 14 R T. Y U Saved Interest expense Advertising expense Totals 2,600 3,100 973,400 972,900 Required: Prepare a multi-step income statement for SEC Company for the year ended December 31, 2021. STARBUCKS ELECTRIC CRANE COMPANY Income Statement For the Year Ended December 31, 2021 Service revenue 0 Operating expenses 0 Total operating expenses Operating income Other expense: $ 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started