Answered step by step

Verified Expert Solution

Question

1 Approved Answer

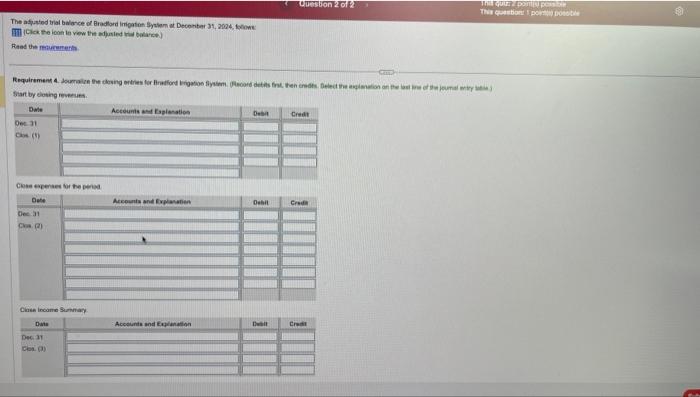

The adjusted trial balance of Bradford Irrigation System at December 31, 2024, follows: (Click the icon to view the adjusted trial balance.) Read the

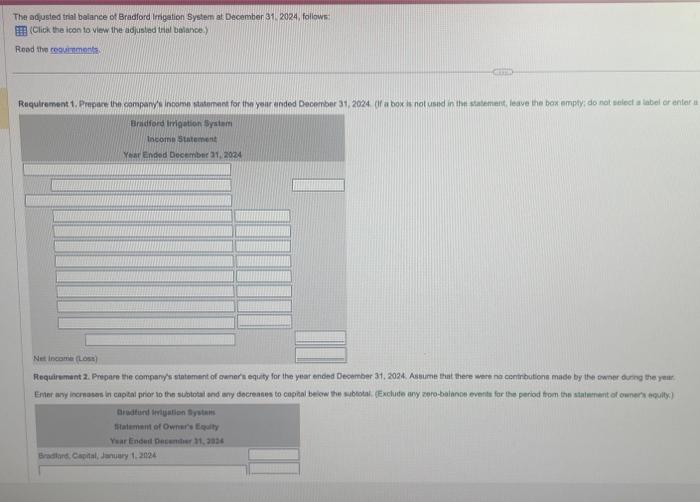

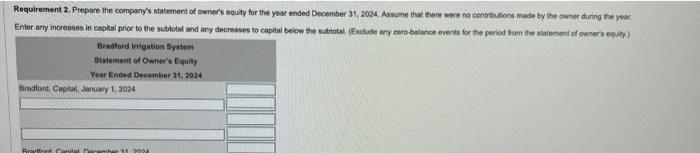

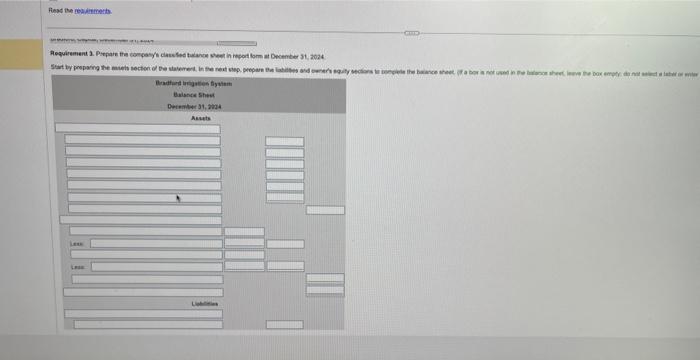

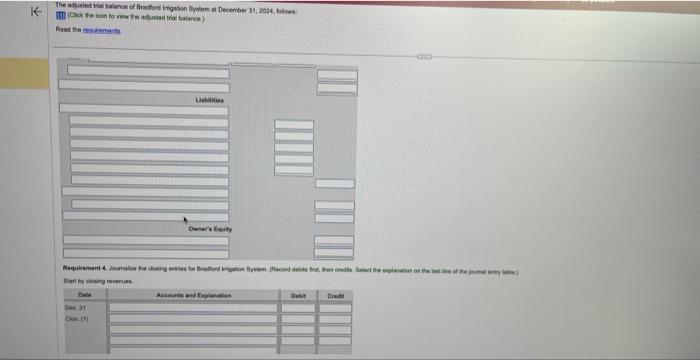

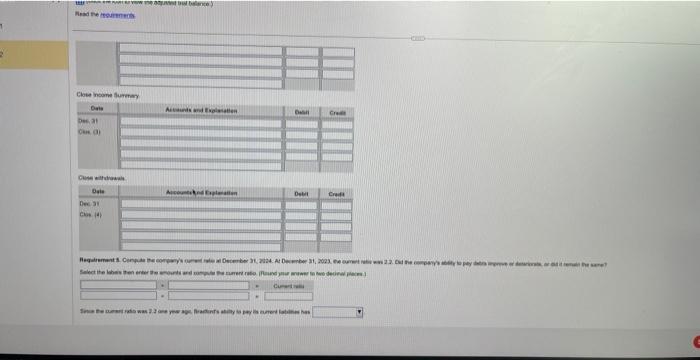

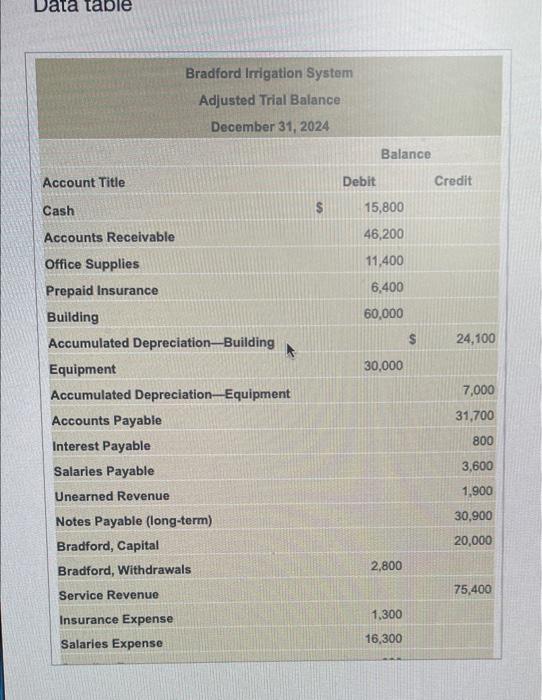

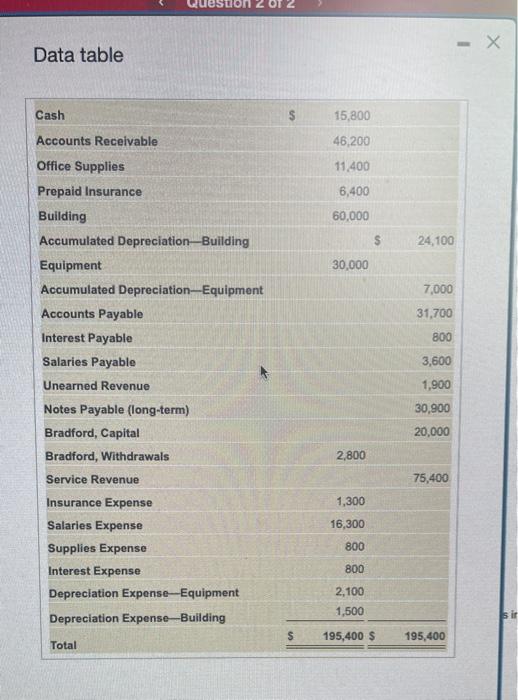

The adjusted trial balance of Bradford Irrigation System at December 31, 2024, follows: (Click the icon to view the adjusted trial balance.) Read the requirements. Requirement 1. Prepare the company's income statement for the year ended December 31, 2024. (If a box is not used in the statement, leave the box empty; do not select a label or enter a Bradford Irrigation System Income Statement Year Ended December 31, 2024 Net Income (Loss) Requirement 2. Prepare the company's statement of owner's equity for the year ended December 31, 2024. Assume that there were no contributions made by the owner during the year. Enter any increases in capital prior to the subtotal and any decreases to capital below the subtotal. (Exclude any zero-balance events for the period from the statement of owner's equity) Bradford invigation Syst Statement of Owner's Equity Year Ended December 31, 2024 Bradford, Capital, January 1, 2024 Requirement 2. Prepare the company's statement of owner's equity for the year ended December 31, 2024. Assume that there were no contributions made by the owner during the year. Enter any increases in capital prior to the subtotal and any decreases to capital below the subtotal (Exclude any zero-balance events for the period from the statement of owner's equity) Bradford Irrigation System Statement of Owner's Equity Year Ended December 31, 2024 Bradford, Capital, January 1, 2024 Bradfort Cantal Dacamber 31, 2024 Read the requirements Requirement 3. Prepare the company's classified balance sheet in report form at December 31, 2024 Start by preparing the sets section of the statement. In the next step, prepare the liabides and owner's equity sections to complete the Bradford irigation System Balance Shest December 31, 2024 Assets lance sheet leeve the box empty do not select a le K The adjusted trial balance of Bradford irrigation System at December 31, 2024, follows (Click the loon to view the adjusted trial balance) Read the requirements Libilities Dec 31 Cle() Owner's Equity Requirement 4. Jumalce the closing entries for Bradford ingaton System (Record debits bat, then credits Select the Start by closing revenues Dale Accounts and Explanation Debit Credit The adjusted trial balance of Bradford Irigation System at December 31, 2024, (Click the icon to view the adjusted v blanc) Read the murements Requirement 4. Joumalize the closing entries for Bradford Irrigation System. Record detits first, then credits. Delect the explanation on the last line of the journal entry Start by closing revenues Date Dec 31 Clos (1) Close expenses for the period Date Dec 31 Co (2) Close Income Summary Date Dec. 31 (3) Accounts and Explanation Accounts and Explanation Accounts and Explanation Debit Debit Question 2 of 2 Dail Credit Credi Credit This quizz z pomis) porside This questions pop L 2 Read the res Close income Surmay Dala Des, 21 ( WO Cse withdrawal Dele web) Dec 31 Cos (4) Aunds and Explanation Accounted Explanation D Credit Dett Credit Requirements Compute the company's cuentrat December 31, 2024. At December 31, 2023, e outra Select the labe's then enter the amounts and compute the current rato (Round your aw decal the cut was 2.2 one year ago frants ability to pay sumers has Data table Bradford Irrigation System Adjusted Trial Balance December 31, 2024 Account Title Cash Accounts Receivable Office Supplies Prepaid Insurance Building Accumulated Depreciation-Building Equipment Accumulated Depreciation-Equipment Accounts Payable Interest Payable Salaries Payable Unearned Revenue Notes Payable (long-term) Bradford, Capital Bradford, Withdrawals Service Revenue Insurance Expense Salaries Expense S Debit Balance 15,800 46,200 11,400 6,400 60,000 30,000 2,800 1,300 16,300 $ Credit 24,100 7,000 31,700 800 3,600 1,900 30,900 20,000 75,400 Data table Cash Accounts Receivable Office Supplies Prepaid Insurance Building Accumulated Depreciation-Building Equipment Accumulated Depreciation-Equipment Accounts Payable Interest Payable Salaries Payable Unearned Revenue Notes Payable (long-term) Bradford, Capital Bradford, Withdrawals Service Revenue Insurance Expense Salaries Expense Supplies Expense Interest Expense Depreciation Expense-Equipment Depreciation Expense-Building 201 2 Total 15,800 46,200 11,400 6,400 60,000 30,000 2,800 $ 1,300 16,300 800 800 2,100 1,500 S 195,400 $ 24,100 7,000 31,700 800 3,600 1,900 30,900 20,000 75,400 195,400 - X ir

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Step 1 Financial Statements Financial statements are the record of business transactions which are prepared to know about the financial performance an...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started