Question

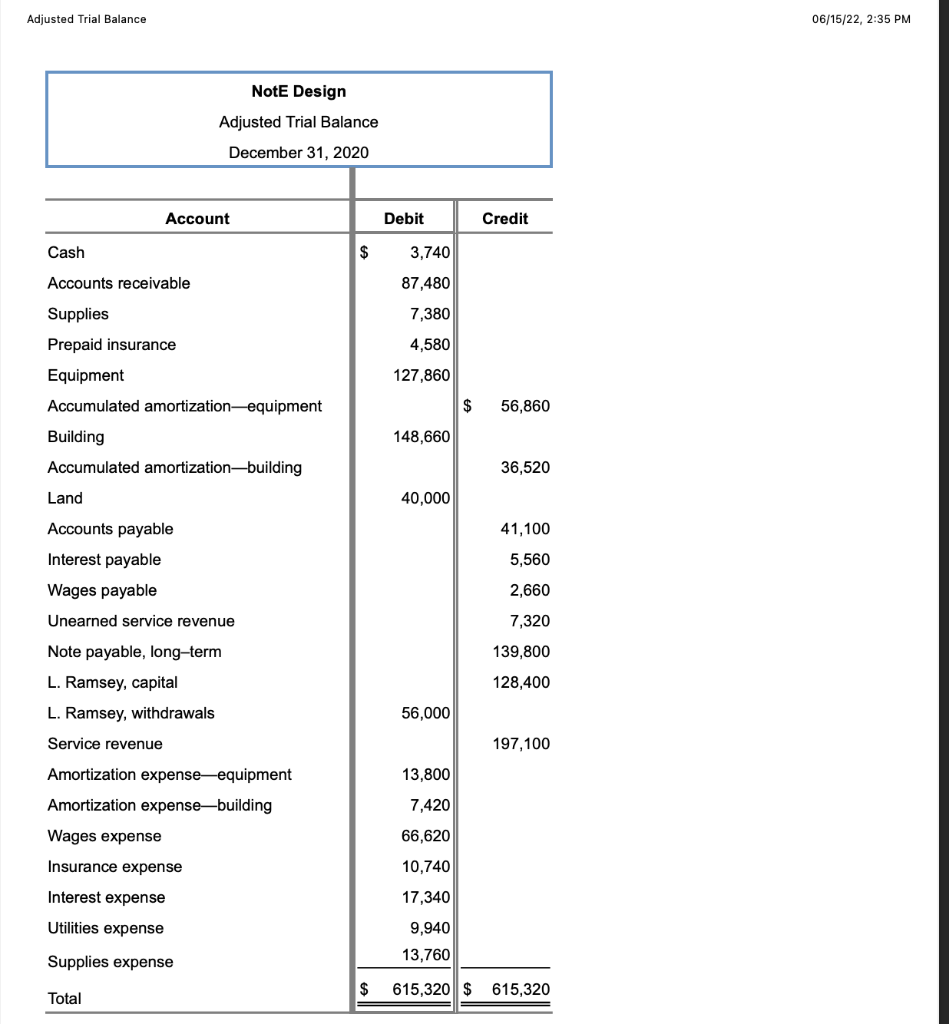

The adjusted trial balance of NotE Design at December 31, 2020, the end of the company's fiscal year, is provided. LOADING... (Click the icon to

The adjusted trial balance of

NotE

Design at

December

31,

2020,

the end of the company's fiscal year, is provided.

LOADING...

(Click the icon to view the adjusted trial balance.)

Required

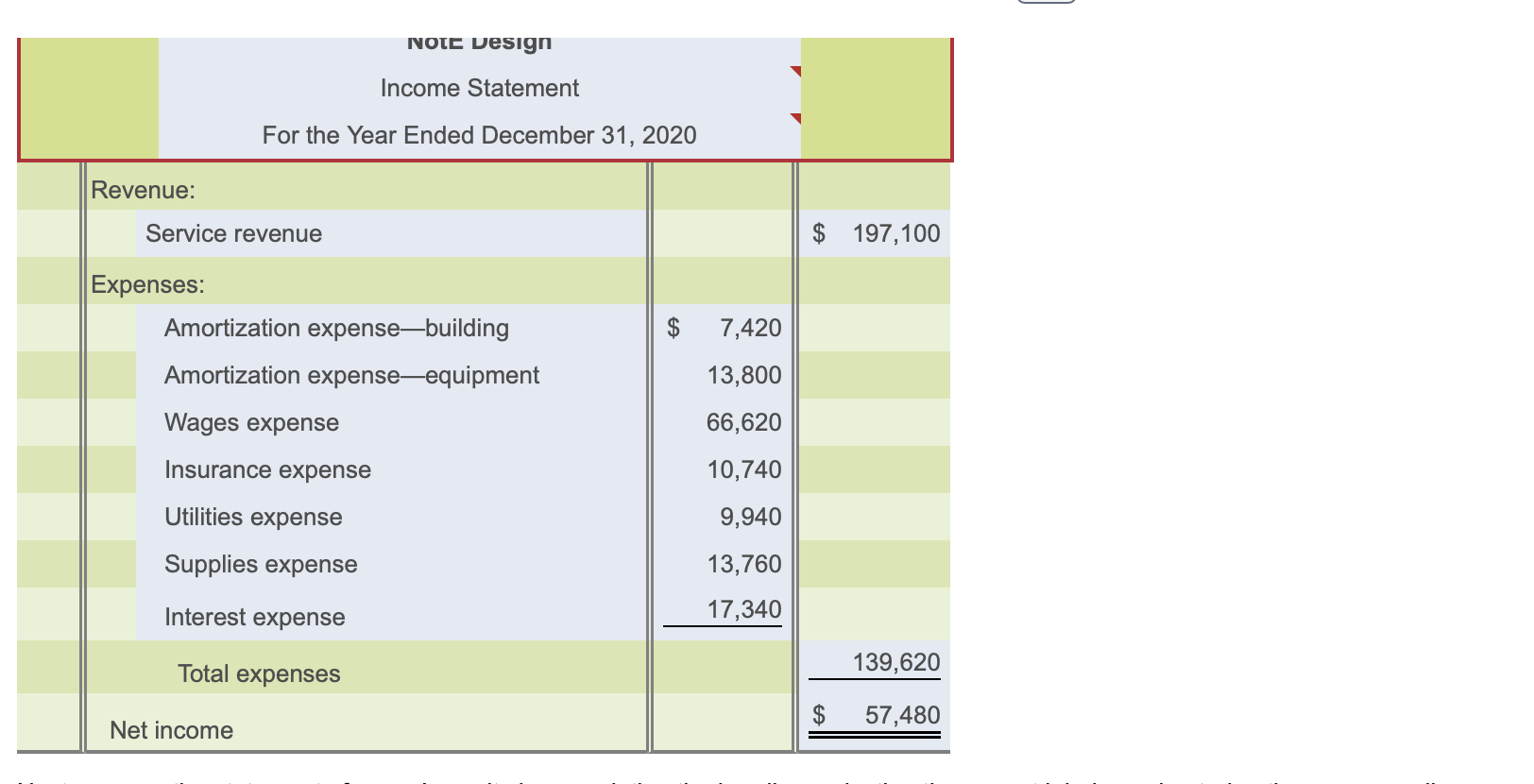

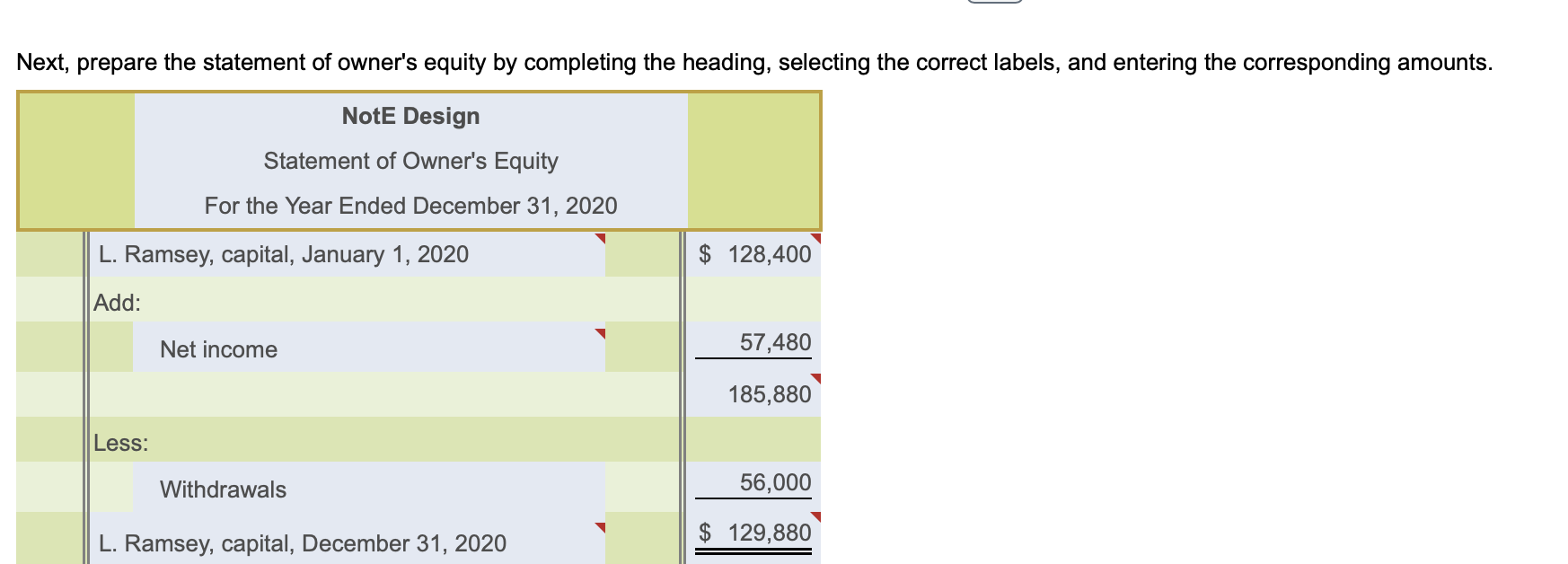

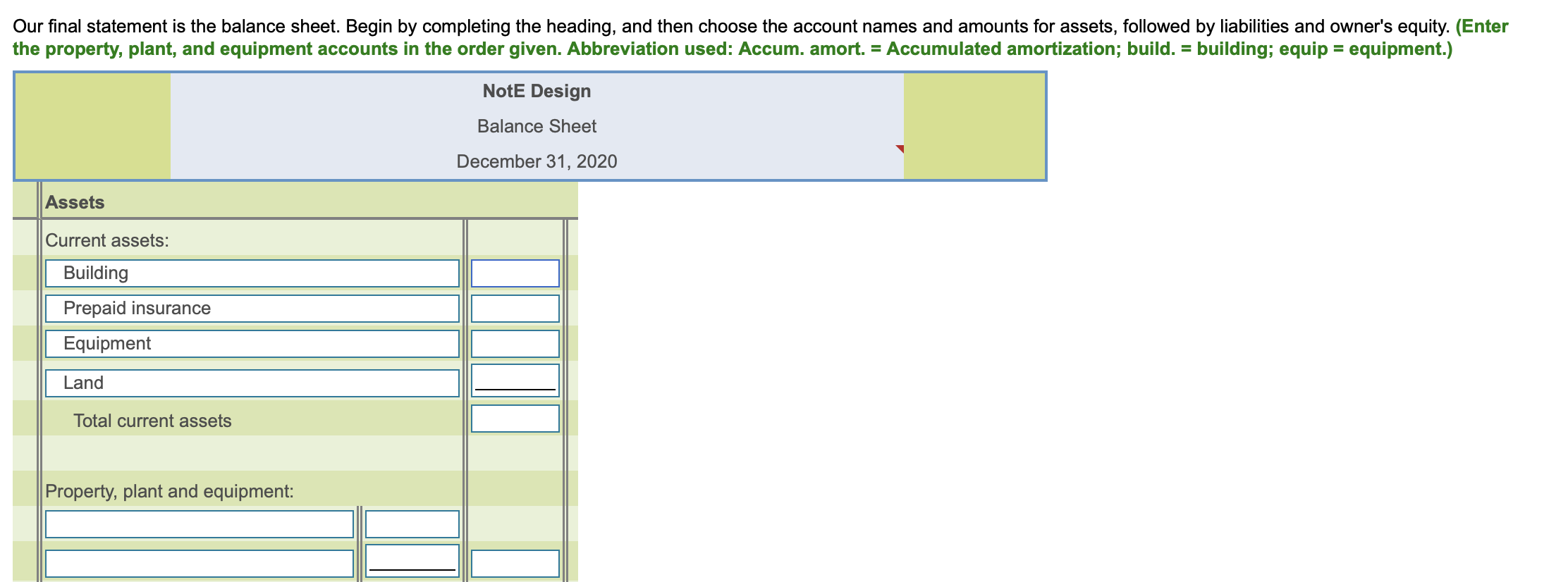

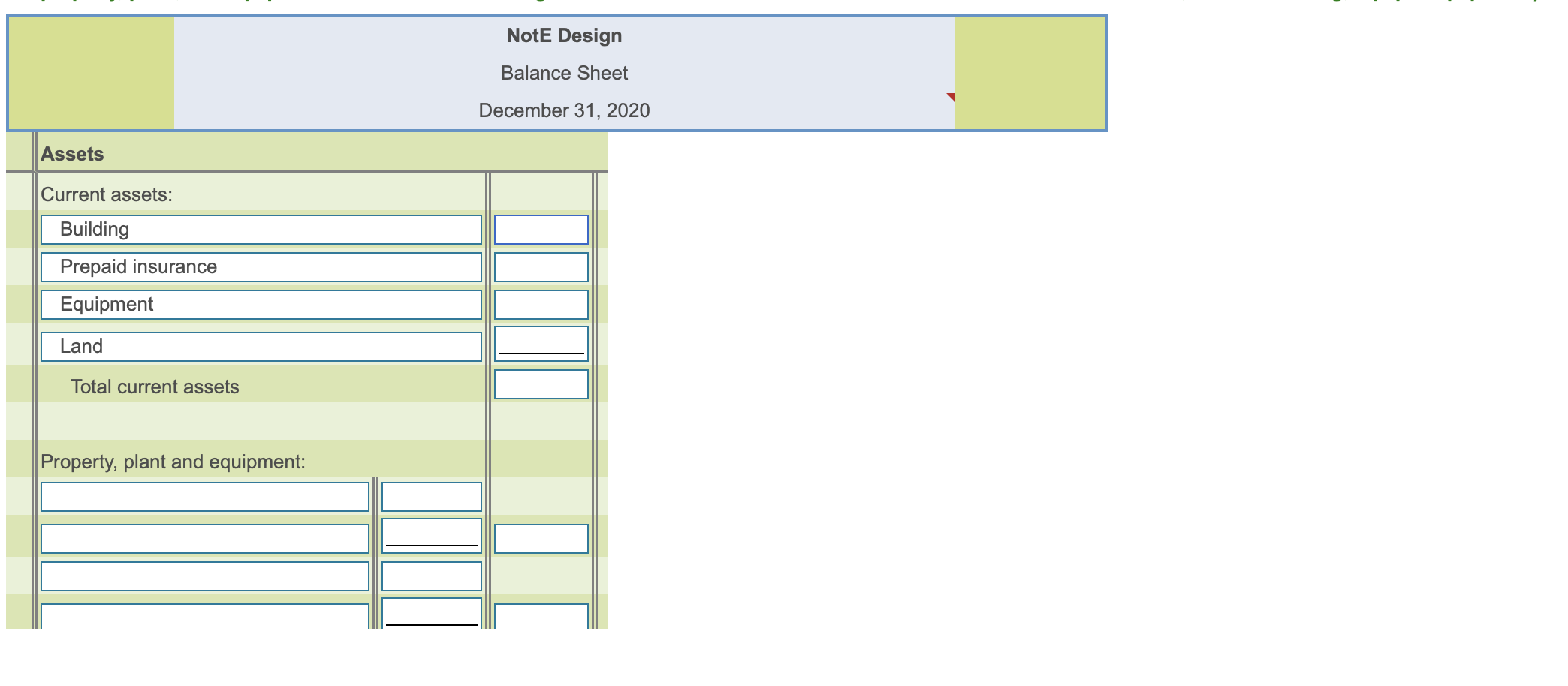

| 1. | Prepare NotE Design's income statement and statement of owner's equity for the year endedDecember 31, 2020, and the classified balance sheet on that date. Use the account format for the balance sheet. |

| 2. | Journalize the closing entries. Include explanations. |

| 3. | Compute NotE Design's current ratio and debt ratio atDecember 31, 2020. One year ago, the current ratio stood at1.21 and the debt ratio was0.55. DidNotE Design's ability to pay debts improve or deteriorate during fiscal2020? |

Question content area bottom

Part 1

Requirement 1. Prepare

NotE

Design's income statement and statement of owner's equity for the year ended

December

31,

2020,

and the classified balance sheet on that date. Use the account format for the balance sheet.

We will begin with the income statement. Start by completing the heading, then choose the accounts, and then enter the corresponding amounts.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started